Variable Annuity Jackson 2024 offers a unique investment opportunity with the potential for growth and income security. This guide will delve into the world of variable annuities, exploring the features of Jackson National Life Insurance Company’s offerings and how they might fit into your retirement planning strategy in 2024.

Dreaming of a $3 million annuity payout? It’s not as far-fetched as you might think. Learn more about the potential of a substantial annuity payout in our article, 3 Million Annuity Payout 2024. We explore the factors that influence payout amounts and provide insights on how to maximize your potential.

We’ll examine the basics of variable annuities, including their investment options, potential for growth, and associated risks. We’ll also discuss the current market trends and conditions affecting variable annuities in 2024, considering factors like interest rates, inflation, and economic uncertainty.

The interest earned on an annuity can be a significant part of your overall return. But is it taxable? Our article, Is Annuity Interest Taxable 2024 , clarifies the tax rules surrounding annuity interest, helping you understand your tax obligations and plan accordingly.

By analyzing these factors, we can gain a better understanding of the potential advantages and disadvantages of investing in variable annuities in the current market environment.

Annuity payments can be structured to last for a defined period or indefinitely. Our article, Annuity Is Indefinite Duration 2024 , explains the concept of indefinite duration annuities and their potential benefits, helping you understand your options for long-term income security.

Contents List

- 1 Variable Annuities: A Comprehensive Guide: Variable Annuity Jackson 2024

- 2 Final Thoughts

- 3 Frequently Asked Questions

Variable Annuities: A Comprehensive Guide: Variable Annuity Jackson 2024

Variable annuities are retirement savings products that offer the potential for growth, but also carry a degree of risk. Understanding the intricacies of these financial instruments is crucial for investors looking to maximize their retirement savings. This article delves into the world of variable annuities, focusing on Jackson National Life Insurance Company and the key considerations for investors in 2024.

Annuity payments can start at various ages, and 65 is a common starting point. Our article, Annuity 65 2024 , discusses the advantages and considerations of starting an annuity at age 65, helping you determine if it’s the right choice for you.

Variable Annuity Basics, Variable Annuity Jackson 2024

A variable annuity is a type of insurance contract that allows investors to accumulate funds for retirement. Unlike traditional fixed annuities, which guarantee a fixed rate of return, variable annuities offer investment options that fluctuate based on the performance of underlying mutual funds.

Looking for information about a $250,000 annuity? Our guide, Annuity 250k 2024 , explores the potential of a $250,000 annuity, including factors that influence payout amounts and the benefits it can offer.

The value of your variable annuity can increase or decrease depending on the market performance of the chosen investment options.

Many people wonder if annuity income is considered capital gains. Our guide, Is Annuity Income Capital Gains 2024 , explains the tax treatment of annuity income and distinguishes it from capital gains. This information is vital for accurate tax reporting and planning.

Key Features of Variable Annuities

- Investment Options:Variable annuities provide a wide range of investment options, including stocks, bonds, and mutual funds. Investors can choose from different asset classes and risk profiles to align with their financial goals and risk tolerance.

- Potential for Growth:The potential for growth in variable annuities is tied to the performance of the chosen investment options. If the market performs well, your annuity value can grow significantly.

- Potential Risks:Variable annuities carry investment risk. The value of your annuity can decline if the market performs poorly, and you may lose a portion of your investment. Furthermore, variable annuities typically have higher fees than traditional annuities, which can impact your overall returns.

Comparison with Other Retirement Savings Products

Variable annuities can be compared to other retirement savings products, such as traditional or Roth IRAs.

Understanding how annuities are taxed is crucial for financial planning. Our article, How Annuity Is Taxed 2024 , breaks down the tax implications of annuities, covering both the initial investment and the subsequent payouts. It’s essential information for making informed decisions about your retirement income.

- Traditional IRA:A traditional IRA allows pre-tax contributions, offering tax deductions in the present and taxable withdrawals in retirement.

- Roth IRA:A Roth IRA involves after-tax contributions, offering tax-free withdrawals in retirement.

- Variable Annuity:Variable annuities offer tax-deferred growth, meaning that you don’t pay taxes on your earnings until you withdraw them in retirement. They also provide additional features like death benefits and living benefits, which can provide protection for your beneficiaries or help ensure a steady stream of income in retirement.

Tax laws can vary significantly between countries. If you’re considering an annuity in India, it’s essential to understand the tax implications. Our article, Is Annuity Taxable In India 2024 , explains the tax treatment of annuities in India, providing valuable insights for Indian residents.

Jackson National Life Insurance Company

Jackson National Life Insurance Company is a leading provider of life insurance and annuity products in the United States. Founded in 1972, the company has a strong track record of financial stability and customer satisfaction.

Understanding the annuity formula is crucial for calculating your future income. Our article, How To Calculate Annuity Formula 2024 , breaks down the formula step-by-step, making it easy to understand and apply to your specific situation.

Financial Strength and Stability

Jackson National is known for its strong financial position and consistent ratings from reputable agencies like A.M. Best and Standard & Poor’s. These ratings reflect the company’s ability to meet its financial obligations and provide reliable insurance products.

Transamerica offers a variety of annuity products, including the B Share Variable Annuity. Learn more about this specific product in our article, Transamerica B Share Variable Annuity 2024. We delve into its features, benefits, and potential risks to help you make an informed decision.

Product Offerings

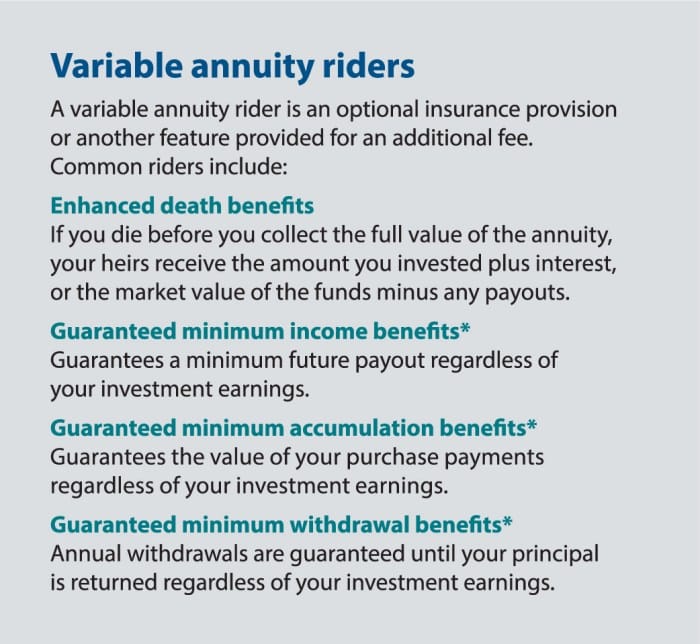

Jackson National offers a wide range of variable annuity products, catering to diverse investor needs and financial goals. These products often include features such as:

- Guaranteed Minimum Income Benefits (GMIBs):GMIBs provide a guaranteed minimum income stream in retirement, regardless of market performance.

- Guaranteed Lifetime Withdrawal Benefits (GLWBs):GLWBs allow investors to withdraw a specific amount of money each year for life, providing income security in retirement.

- Death Benefits:Variable annuities often include death benefits that can provide financial protection for beneficiaries in the event of the investor’s death.

Variable Annuities in 2024

The variable annuity market in 2024 is influenced by several factors, including interest rates, inflation, and economic uncertainty.

A deferred annuity allows you to delay receiving payments until a later date. Learn how to calculate the value of a deferred annuity in our article, Calculating A Deferred Annuity 2024. We provide clear explanations and practical examples to help you understand this type of annuity.

Current Trends and Market Conditions

- Rising Interest Rates:Rising interest rates can make fixed annuities more attractive, potentially leading to decreased demand for variable annuities.

- Inflation:High inflation can erode the purchasing power of retirement savings, making it crucial for investors to seek growth opportunities.

- Economic Uncertainty:Economic uncertainty can create volatility in the market, potentially impacting the performance of variable annuity investments.

Potential Impact on Variable Annuities

- Growth Potential:Variable annuities can offer potential for growth in a market environment characterized by inflation. The ability to invest in a variety of asset classes can help investors seek returns that outpace inflation.

- Risk Management:Variable annuities can provide a degree of risk management through features like guaranteed minimum income benefits and guaranteed lifetime withdrawal benefits.

- Fees and Expenses:Investors should carefully consider the fees and expenses associated with variable annuities, as these can impact their overall returns.

Key Considerations for Investors

Before investing in a variable annuity, it’s essential for investors to carefully consider their financial goals, risk tolerance, and time horizon.

A financial calculator can be a powerful tool for understanding annuity calculations. Learn how to use one effectively in our article, Financial Calculator Annuity 2024. We provide step-by-step instructions and practical examples to help you master this essential tool.

Factors to Consider

- Financial Goals:What are your retirement income goals? How much income do you need to generate in retirement?

- Risk Tolerance:How comfortable are you with the potential for investment losses?

- Time Horizon:How long do you plan to invest in the variable annuity?

Potential Risks and Rewards

- Risk:Variable annuities carry investment risk. The value of your annuity can decline if the market performs poorly, and you may lose a portion of your investment.

- Rewards:Variable annuities offer the potential for growth, and they can provide features like death benefits and living benefits that can help protect your beneficiaries or ensure a steady stream of income in retirement.

Choosing the Right Product and Investment Options

- Product Features:Compare the features of different variable annuity products, including investment options, fees, guarantees, and death benefits.

- Investment Options:Choose investment options that align with your risk tolerance and financial goals.

- Fees and Expenses:Be aware of the fees and expenses associated with variable annuities, as these can impact your overall returns.

Illustrative Example

Imagine a 55-year-old investor, Sarah, with a moderate risk tolerance and a goal of generating $50,000 in annual retirement income. She is considering a variable annuity from Jackson National with a guaranteed minimum income benefit (GMIB) and a guaranteed lifetime withdrawal benefit (GLWB).

Want to calculate the present value of your future annuity payments? Our guide, Calculate Annuity Of Present Value 2024 , provides the tools and formulas you need to determine the current value of your annuity, helping you make informed financial decisions.

| Investor Profile | Variable Annuity Features | Potential Outcomes |

|---|---|---|

| Age: 55 | Investment Options: Stocks, Bonds, and Mutual Funds | Projected Growth: 5-7% per year (assuming average market returns) |

| Risk Tolerance: Moderate | Fees: 1.5% annual expense ratio | Potential Losses: Market volatility could lead to temporary losses in the value of the annuity |

| Financial Goals: $50,000 annual retirement income | Guarantees: GMIB of $40,000 per year, GLWB of $50,000 per year | Projected Income: Guaranteed minimum income of $40,000 per year, with the potential to generate more income if the market performs well |

In this scenario, the variable annuity could provide Sarah with a guaranteed minimum income stream of $40,000 per year, while also offering the potential for growth. The GMIB and GLWB features can help mitigate some of the risk associated with market volatility, providing Sarah with greater peace of mind.

However, it’s important to note that the potential for growth is tied to the performance of the chosen investment options, and Sarah could experience losses in the value of her annuity if the market performs poorly.

Final Thoughts

Variable annuities can be a complex investment product, but understanding their features and risks is essential for making informed decisions. By considering your individual circumstances, financial goals, and risk tolerance, you can determine whether a variable annuity from Jackson National is the right fit for your retirement portfolio.

Planning for retirement in Nigeria? An annuity can be a valuable part of your strategy. Our guide, Annuity Calculator Nigeria 2024 , provides a calculator specifically designed for Nigerian residents, allowing you to estimate your potential annuity payments.

This guide has provided a comprehensive overview of variable annuities, covering key considerations for investors, market trends, and potential outcomes. With this information, you can make an informed decision about whether to include variable annuities in your investment strategy.

Frequently Asked Questions

What are the main benefits of a variable annuity?

Variable annuities offer the potential for growth through investments in the stock market. They also provide tax deferral on earnings and may include features like guaranteed death benefits or living benefits.

What are the risks associated with variable annuities?

Variable annuities carry market risk, meaning the value of your investment can fluctuate with market conditions. They also have fees and expenses that can impact returns.

How do I choose the right variable annuity for me?

Consider your risk tolerance, investment goals, and time horizon. Consult with a financial advisor to discuss your individual needs and find a variable annuity that aligns with your financial plan.

Figuring out the present value of an annuity can be a bit tricky, but Excel can make it a breeze. You can learn how to do it in our guide, Calculating Annuity Present Value In Excel 2024. It walks you through the steps and formulas needed for accurate calculations.

Are variable annuities right for everyone?

Variable annuities are not suitable for everyone. They are generally considered a more complex investment option and may not be appropriate for investors seeking guaranteed returns or low-risk investments.