Variable Annuity John Hancock 2024 presents a compelling investment opportunity, blending the security of a traditional annuity with the potential for growth through market-linked investments. This comprehensive guide delves into the intricacies of John Hancock’s variable annuities, exploring their features, benefits, and considerations.

Annuity is a word that can be unscrambled to form other words. You can try your hand at unscrambling this word and see what other words you can create. For more information on this topic, you can visit Annuity Unscramble 2024.

We’ll examine the various investment options available within these annuities, analyze their historical performance, and assess the associated fees and expenses. We’ll also delve into the death benefit and living benefit options offered by John Hancock, providing insights into their features and advantages.

When an annuity is inherited, the tax treatment of the payments can vary depending on the specific circumstances. You can find more information on How Is Inherited Annuity Taxed 2024.

Finally, we’ll address the tax implications of owning and withdrawing from these annuities, comparing them to other retirement savings options.

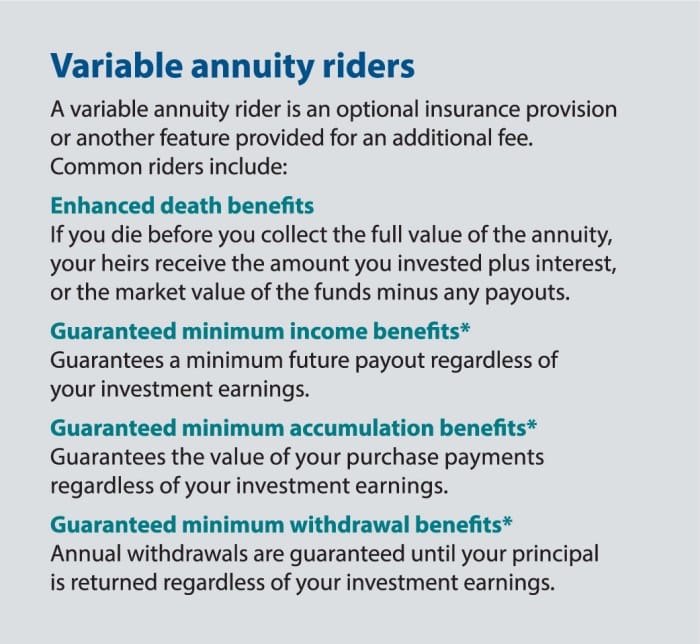

A GMIB rider is a feature that can be added to a variable annuity. This rider provides a guaranteed minimum income benefit, which can help protect your investment against market downturns. You can find more information on Variable Annuity Gmib Rider 2024.

Contents List

John Hancock Variable Annuities: An Overview

Variable annuities are a type of retirement savings product that offer the potential for growth, but also come with investment risk. Unlike traditional annuities, which guarantee a fixed stream of income payments, variable annuities link their payouts to the performance of underlying investment options.

John Hancock is a well-known provider of variable annuities, offering a range of products designed to meet different financial goals and risk tolerances.

The formula for calculating an annuity can vary depending on the type of annuity. There are various resources available online that can help you understand and apply the correct formula. You can find more information on How To Find Annuity Formula 2024.

What are Variable Annuities?

Variable annuities are a type of insurance contract that allows you to invest your money in a variety of sub-accounts, similar to mutual funds. The value of your annuity will fluctuate based on the performance of these sub-accounts. This means you have the potential to earn higher returns than a traditional annuity, but you also bear the risk of losing money if your investments perform poorly.

Whether or not an annuity is considered income depends on the specific type of annuity and the tax laws in your jurisdiction. It’s important to consult with a tax professional for personalized advice. You can find more information on Is Annuity Considered Income 2024.

Key Features and Benefits of John Hancock Variable Annuities

John Hancock variable annuities offer a variety of features and benefits, including:

- Growth potential:Variable annuities allow you to invest in a variety of sub-accounts, including stocks, bonds, and mutual funds, giving you the potential for higher returns than a traditional annuity.

- Tax deferral:Earnings on your investment grow tax-deferred, meaning you won’t pay taxes on them until you withdraw them in retirement.

- Death benefit:Many variable annuities offer a death benefit, which guarantees a minimum payout to your beneficiaries if you die before you withdraw all of your money.

- Living benefits:Some John Hancock variable annuities offer living benefits, such as guaranteed income riders, which can provide you with a guaranteed stream of income in retirement, regardless of how your investments perform.

Types of John Hancock Variable Annuities

John Hancock offers a variety of variable annuity products, each with its own features and benefits. Some of the most common types of John Hancock variable annuities include:

- Fixed-indexed annuities:These annuities offer a minimum guaranteed return, typically linked to the performance of a specific index, such as the S&P 500.

- Variable annuities with living benefits:These annuities offer guaranteed income riders that can provide you with a guaranteed stream of income in retirement, regardless of how your investments perform.

- Variable annuities with death benefits:These annuities offer a death benefit, which guarantees a minimum payout to your beneficiaries if you die before you withdraw all of your money.

Investment Options and Performance

John Hancock variable annuities offer a wide range of investment options, allowing you to tailor your portfolio to your specific risk tolerance and financial goals. These options include:

Investment Options Offered

- Mutual funds:John Hancock variable annuities offer access to a wide range of mutual funds, covering various asset classes, such as stocks, bonds, and real estate.

- Exchange-traded funds (ETFs):ETFs are similar to mutual funds but are traded on stock exchanges, offering greater flexibility and potentially lower costs.

- Separate accounts:Some John Hancock variable annuities offer separate accounts, which allow you to invest in individual stocks or bonds, giving you more control over your portfolio.

Historical Performance of Investment Options

The historical performance of investment options within John Hancock variable annuities can vary widely depending on the specific sub-accounts chosen. It’s important to note that past performance is not indicative of future results. When evaluating investment options, it’s crucial to consider factors such as:

- Risk tolerance:Different investment options carry varying levels of risk. Investors with a higher risk tolerance may be comfortable investing in sub-accounts with a higher potential for growth but also a greater risk of loss.

- Time horizon:Longer-term investors may be able to tolerate more volatility, while shorter-term investors may prefer more conservative investment options.

- Financial goals:Your financial goals should guide your investment choices. For example, if you are saving for retirement, you may choose to invest in a diversified portfolio of stocks and bonds.

Risk and Return Profiles

Different investment options within John Hancock variable annuities have different risk and return profiles. For example, stocks generally carry a higher risk than bonds but also have the potential for higher returns. It’s important to understand the risk and return profiles of the investment options you choose, as well as how they fit into your overall financial plan.

An annuity calculator can be used to determine your yearly payments based on the terms of the annuity. You can find a calculator online or use a financial software program. For more information on this topic, you can visit Annuity Calculator Yearly Payment 2024.

Fees and Expenses

John Hancock variable annuities, like most financial products, come with associated fees and expenses. These fees can impact your overall investment returns, so it’s important to understand them before investing. Here’s a breakdown of common fees:

Types of Fees

- Mortality and expense (M&E) charges:These fees cover the insurance component of the annuity and administrative expenses. They are typically expressed as a percentage of your account value and are deducted annually.

- Investment management fees:These fees cover the cost of managing the underlying investments in your sub-accounts. They are typically charged by the mutual fund or ETF provider and are expressed as an expense ratio.

- Surrender charges:These charges apply if you withdraw your money from the annuity before a certain period. They are typically designed to discourage early withdrawals and are usually highest in the early years of the contract.

- Administrative fees:These fees cover the cost of administering your annuity contract, such as account statements and customer service.

Fee Structures, Variable Annuity John Hancock 2024

The fee structures of John Hancock variable annuity products can vary. It’s essential to carefully compare the fee structures of different products before making a decision. Factors to consider include:

- Total annual expenses:The total annual expenses, including M&E charges, investment management fees, and administrative fees, should be carefully considered.

- Surrender charge schedule:The surrender charge schedule, including the duration of the surrender charge period and the amount of the charges, should be reviewed.

- Fee waivers:Some John Hancock variable annuity products may offer fee waivers for certain account balances or investment choices.

Impact of Fees on Investment Returns

Fees can significantly impact your investment returns over time. Even small fees can eat away at your investment gains. For example, if you have $100,000 invested in an annuity with a 1% annual fee, you would pay $1,000 in fees each year, which could reduce your overall returns.

Fidelity is a well-known financial institution that offers variable annuities. If you’re considering investing in a variable annuity through Fidelity, you can find more information on Variable Annuity Fidelity 2024.

Death Benefit and Living Benefits: Variable Annuity John Hancock 2024

John Hancock variable annuities offer various death benefit and living benefit options, providing additional security and flexibility. These features can be crucial in ensuring your financial well-being and protecting your loved ones.

If you’re using a TI-84 calculator, you can calculate annuity due with a few keystrokes. It’s a common financial calculation, and the TI-84 is a handy tool for it. For detailed instructions on how to do this, you can check out How To Calculate Annuity Due On Ti-84 2024.

Death Benefit Options

- Guaranteed death benefit:This option guarantees a minimum payout to your beneficiaries, regardless of the performance of your investments. The guaranteed amount is typically based on your initial investment or a specific percentage of your account value.

- Enhanced death benefit:This option provides a death benefit that can exceed the guaranteed amount, depending on the performance of your investments. It can offer a higher payout to your beneficiaries if your investments have performed well.

- Variable death benefit:This option provides a death benefit that fluctuates with the value of your investments. This option can offer a higher payout to your beneficiaries if your investments have performed well, but it also carries the risk of a lower payout if your investments perform poorly.

An annuity is a financial product that provides a series of regular payments over a period of time. You can learn more about what an annuity is, in simple terms, by visiting Annuity Meaning In English 2024.

Living Benefit Options

Living benefits are designed to provide you with income in retirement, even if your investments perform poorly. John Hancock variable annuities offer a variety of living benefit options, including:

- Guaranteed income rider:This option provides you with a guaranteed stream of income in retirement, regardless of how your investments perform. The guaranteed income amount is typically based on your initial investment or a specific percentage of your account value.

- Enhanced income rider:This option provides a higher guaranteed income amount, but it may come with higher fees or other restrictions.

- Income protection rider:This option protects your income stream against market downturns. If your investments decline in value, the rider can help to maintain your income level.

Comparing Death Benefit and Living Benefit Options

When choosing between death benefit and living benefit options, it’s important to consider your individual circumstances and financial goals. Factors to consider include:

- Your age and health:Younger and healthier individuals may prioritize growth potential, while older and less healthy individuals may prefer guaranteed income or death benefits.

- Your risk tolerance:Individuals with a higher risk tolerance may be comfortable with variable death benefits or enhanced income riders, while those with a lower risk tolerance may prefer guaranteed options.

- Your family situation:Individuals with dependents may prioritize death benefits to ensure their loved ones are financially protected.

Tax Considerations

Understanding the tax implications of owning and withdrawing from John Hancock variable annuities is crucial for maximizing your investment returns. Variable annuities offer tax advantages, but it’s important to be aware of the potential tax liabilities associated with these products.

The tax treatment of variable annuity death benefits can be complex. It’s important to understand the tax implications before making an investment decision. For more information on this topic, you can check out Variable Annuity Death Benefit Taxation 2024.

Tax Treatment of Investment Gains and Losses

Earnings on your investments within a variable annuity grow tax-deferred, meaning you won’t pay taxes on them until you withdraw them in retirement. This tax deferral can help to reduce your overall tax liability over time. However, when you withdraw money from the annuity, your withdrawals will be taxed as ordinary income, regardless of whether the gains are realized or unrealized.

If you’re in the UK and looking for a reliable annuity calculator, Money Saving Expert is a great resource. They offer a tool that can help you estimate your annuity payments. You can find more information on Annuity Calculator Uk Money Saving Expert 2024.

Tax Advantages and Disadvantages

Variable annuities offer several tax advantages, including:

- Tax-deferred growth:Earnings on your investments grow tax-deferred, allowing them to compound tax-free.

- Potential for tax-free withdrawals:If you withdraw your money from the annuity after age 59 1/2, you may be able to take advantage of tax-free withdrawals for qualified distributions.

However, variable annuities also have some tax disadvantages, including:

- Taxable withdrawals:When you withdraw money from the annuity, your withdrawals will be taxed as ordinary income.

- Potential for tax penalties:If you withdraw money from the annuity before age 59 1/2, you may be subject to a 10% early withdrawal penalty.

Tax Implications of Withdrawals

When you withdraw money from a variable annuity, you’ll need to consider the following tax implications:

- The amount of your withdrawal:The amount of your withdrawal will determine your tax liability.

- Your tax bracket:Your tax bracket will determine the tax rate applied to your withdrawal.

- The type of withdrawal:Different types of withdrawals may have different tax implications. For example, qualified distributions may be tax-free, while non-qualified distributions will be taxed as ordinary income.

Suitability and Considerations

John Hancock variable annuities can be a suitable retirement savings option for certain investors, but it’s important to carefully consider the risks and potential drawbacks before investing. It’s crucial to determine if a variable annuity aligns with your individual financial goals, risk tolerance, and investment horizon.

Whether or not an annuity is halal is a complex question that depends on the specific terms of the annuity and the Islamic legal framework. For more information on this topic, you can consult Is Annuity Halal 2024.

Suitable Investors

Variable annuities may be suitable for investors who:

- Have a long-term investment horizon:Variable annuities are designed for long-term savings, as their value can fluctuate in the short term.

- Are comfortable with investment risk:Variable annuities offer the potential for growth but also carry the risk of loss.

- Are seeking tax-deferred growth:Variable annuities allow your investments to grow tax-deferred, which can help to reduce your overall tax liability.

- Desire potential for guaranteed income:Some variable annuities offer living benefit riders that can provide you with a guaranteed stream of income in retirement.

Risks and Potential Drawbacks

Variable annuities also come with several risks and potential drawbacks, including:

- Investment risk:The value of your annuity can fluctuate based on the performance of your investments. This means you have the potential to lose money if your investments perform poorly.

- Fees and expenses:Variable annuities come with associated fees and expenses, which can impact your overall investment returns.

- Surrender charges:If you withdraw your money from the annuity before a certain period, you may be subject to surrender charges.

- Complexity:Variable annuities can be complex financial products, and it’s important to understand the terms and conditions of your contract before investing.

Comparison to Other Retirement Savings Options

When evaluating John Hancock variable annuities, it’s essential to compare them to other retirement savings options, such as:

- Traditional IRAs and 401(k)s:These accounts offer tax-deferred growth and may be more suitable for investors who are comfortable with a more hands-on approach to investing.

- Roth IRAs:Roth IRAs offer tax-free withdrawals in retirement, but contributions are made with after-tax dollars.

- Annuities:Traditional annuities offer a guaranteed stream of income payments, but they don’t provide the growth potential of variable annuities.

Final Wrap-Up

Understanding John Hancock’s variable annuities requires a careful examination of their multifaceted nature. By evaluating their investment options, fees, benefits, and tax implications, you can determine if these annuities align with your financial goals and risk tolerance. This guide provides the necessary information to make informed decisions about whether John Hancock’s variable annuities are the right fit for your retirement planning.

Helpful Answers

What are the minimum investment requirements for John Hancock variable annuities?

Minimum investment requirements vary depending on the specific John Hancock variable annuity product. It’s best to consult with a financial advisor or review the product’s prospectus for details.

How do I access my account information and make changes to my investment allocations?

The annuity discount factor is a key element in calculating the present value of an annuity. It’s a factor that considers the time value of money. You can learn more about calculating this factor by visiting Calculate Annuity Discount Factor 2024.

John Hancock typically provides online account access and mobile app functionality for managing your annuity. You can use these platforms to view account balances, transaction history, and adjust your investment allocations.

What are the surrender charges associated with withdrawing from a John Hancock variable annuity?

Variable annuities come with various charges, which can impact your returns. It’s important to understand these charges before making an investment decision. For a breakdown of these charges, you can check out Variable Annuity Charges 2024.

Surrender charges are fees assessed for withdrawing from an annuity before a specified period. The specific surrender charge structure varies by product and time period. Refer to the product prospectus for details.

Variable annuities are a type of investment that can provide guaranteed death benefits. These benefits ensure that your beneficiaries will receive a certain amount of money, even if the value of your investment decreases. You can find more information on Variable Annuity Guaranteed Death Benefit 2024.

Are there any guarantees associated with John Hancock variable annuities?

While variable annuities offer the potential for growth, they don’t typically guarantee a specific rate of return. However, some John Hancock variable annuities may include features like guaranteed income riders that provide a minimum level of income in retirement.