Variable Annuity Out Of Surrender 2024 takes center stage, presenting a critical financial decision for individuals seeking to access their retirement funds. This guide delves into the complexities of variable annuities, exploring the factors influencing surrender decisions, analyzing the potential consequences, and outlining alternative strategies.

Government-provided annuity calculators can be a helpful resource for planning your retirement income. Explore Annuity Calculator Gov 2024 to learn more about these tools.

Whether you’re considering surrendering your variable annuity due to financial constraints, market volatility, or a shift in your investment goals, understanding the implications is paramount.

Variable annuities offer potential for growth, but they also carry risks. Discover more about Variable Annuity Mutual Fund 2024 and its associated features.

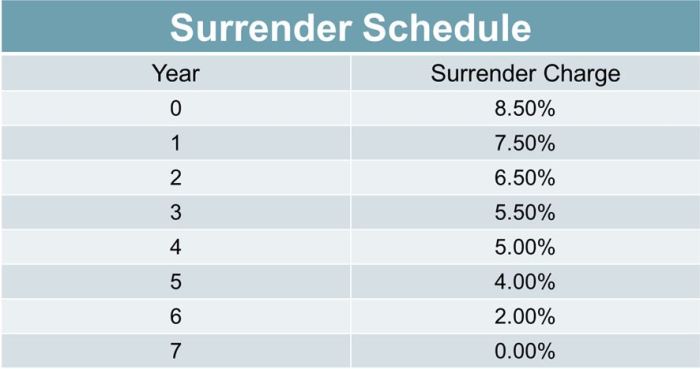

Variable annuities, with their potential for growth and tax-deferred accumulation, offer a compelling retirement savings option. However, the surrender charges associated with these annuities can significantly impact your returns, especially if you withdraw your funds before reaching a certain age.

If you’re seeking an annuity with a specific payout period, understanding the implications of a 5-year payout is essential. Learn more about Annuity 5 Year Payout 2024 and its potential benefits and drawbacks.

This guide aims to provide you with the knowledge and insights necessary to navigate the surrender process effectively, empowering you to make informed decisions that align with your financial objectives.

To accurately assess the value of an annuity, utilizing an NPV calculator is a valuable tool. Learn more about Annuity Npv Calculator 2024 and how it can help you make informed decisions.

Last Word

Surrendering a variable annuity is a complex decision that requires careful consideration. While it may offer immediate access to your funds, it can also result in substantial financial penalties. This guide has provided a comprehensive overview of the key factors to consider, including surrender charges, tax implications, and alternative strategies.

Understanding the different types of annuities is essential before making a decision. Explore Annuity Is Series 2024 to learn about the various series of annuities available.

By weighing the potential benefits and drawbacks, you can make an informed decision that best suits your individual circumstances and financial goals.

For those considering a substantial annuity payout, exploring the options for a $2 million annuity is crucial. Discover more about Annuity 2 Million 2024 and its associated features.

Popular Questions: Variable Annuity Out Of Surrender 2024

What is a variable annuity?

One of the primary concerns for individuals considering annuities is whether the payments are guaranteed. Explore Is Annuity Guaranteed 2024 to learn about the guarantees associated with different annuity types.

A variable annuity is a type of insurance contract that allows you to invest your money in a variety of sub-accounts, similar to mutual funds. The returns on your investment are based on the performance of the underlying investments.

Annuity payments can be affected by various factors, making it essential to understand the potential uncertainties involved. Check out Annuity Uncertain 2024 for a detailed explanation of these factors.

What are the benefits of a variable annuity?

To determine the future value of an annuity, you can utilize a compound value annuity factor table. Find out more about Compound Value Annuity Factor Table 2024 and its application.

Variable annuities offer tax-deferred growth, meaning that you don’t pay taxes on your earnings until you withdraw the money. They also provide death benefits and income guarantees, depending on the specific contract.

What are the drawbacks of a variable annuity?

Variable annuities can be complex, and they typically come with high fees and surrender charges. You also need to understand the risks associated with the underlying investments.

How long do surrender charges last?

Surrender charges can last for a period of time, typically between 5 to 10 years. The specific duration will depend on the terms of your annuity contract.

What are some alternative strategies to surrendering a variable annuity?

When considering an annuity, it’s crucial to understand the life expectancy used in its calculation. Learn more about When Annuity Is Written Whose Life Expectancy 2024 and how it impacts your payout.

Instead of surrendering, you could consider partial withdrawals, annuity exchanges, or taking a loan against your annuity. These strategies can help you access funds without incurring surrender charges.

Annuities serve various purposes, from retirement planning to income protection. Learn more about Annuity Is Used In 2024 and its diverse applications.

For those using a financial calculator like the BA II Plus, calculating annuity factors is essential. Explore Calculate Annuity Factor On Ba Ii Plus 2024 for detailed instructions.

Understanding how to calculate annuity due payments is crucial for accurate financial planning. Learn more about Calculating Annuity Due Payment 2024 and its significance.

SBI, a prominent financial institution, offers annuity calculators for retirement planning. Explore Annuity Calculator Sbi 2024 to learn more about its features and benefits.

There are various types of annuities available, each with its own unique characteristics. Explore 8 Annuities 2024 to learn about the different options available.