Variable Annuity Qualified Non Qualified 2024 presents a complex yet potentially rewarding investment landscape. This type of annuity offers growth potential tied to the performance of underlying investments, but it also carries risks associated with market fluctuations. Understanding the nuances of qualified and non-qualified variable annuities, including their tax implications and current market trends, is crucial for making informed investment decisions.

Annuity is a financial product that can be a good option for retirement planning. Annuity Is Which Account 2024 It involves making a lump sum payment or a series of payments in exchange for regular income payments for a set period of time.

This guide will explore the key features of variable annuities, delve into the differences between qualified and non-qualified options, and provide insights into the current market landscape. We will also examine the potential risks and considerations involved in choosing a variable annuity, equipping you with the knowledge needed to make informed decisions about your financial future.

Variable annuities come with various charges, including administrative fees, investment management fees, and mortality and expense charges. Variable Annuity Charges 2024 It’s important to understand these charges before investing in a variable annuity.

Wrap-Up

Navigating the world of variable annuities requires a careful consideration of your individual financial goals, risk tolerance, and investment horizon. By understanding the key aspects of variable annuities, including their tax treatment, market trends, and potential risks, you can make informed decisions that align with your financial objectives.

Variable annuities often have early withdrawal penalties, which can be substantial. Variable Annuity Early Withdrawal Penalty 2024 It’s important to consider these penalties before withdrawing money from your annuity.

Remember to consult with a qualified financial advisor to discuss your specific needs and explore options that best suit your unique circumstances.

Annuity and 401(k) are both retirement savings options, but they have different features and benefits. Is Annuity Better Than 401k 2024 The best option for you depends on your individual circumstances and financial goals.

FAQ: Variable Annuity Qualified Non Qualified 2024

What are the main differences between qualified and non-qualified variable annuities?

There are two main types of annuities: fixed and variable. Fixed Variable Annuity 2024 Fixed annuities offer a guaranteed rate of return, while variable annuities have a return that is tied to the performance of the underlying investments.

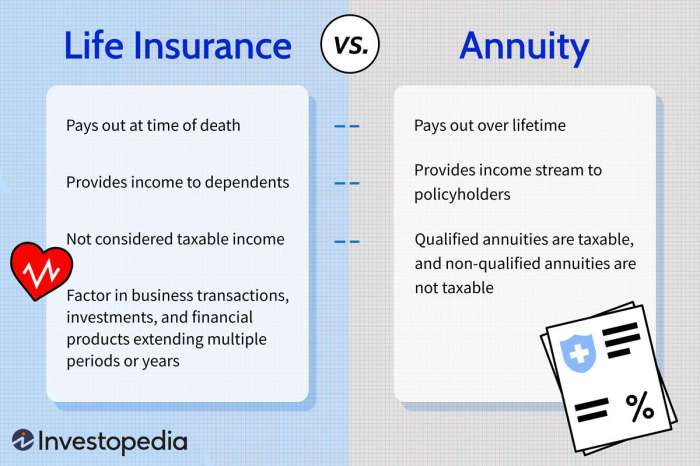

The primary difference lies in their tax treatment. Qualified variable annuities are held within tax-advantaged retirement accounts like 401(k)s and IRAs, offering tax deferral on earnings until retirement. Non-qualified variable annuities are held outside of retirement accounts, and earnings are typically taxed annually.

The question of whether annuities are halal is a complex one that depends on the specific terms of the annuity. Is Annuity Halal 2024 It’s important to consult with a qualified Islamic scholar to get guidance on this matter.

What are the potential risks associated with variable annuities?

A growing annuity calculator can help you determine the present value of an annuity that is expected to grow over time. Growing Annuity Calculator Present Value 2024 This can be a useful tool for planning your retirement income.

Variable annuities carry risks similar to those associated with any investment, including market volatility, potential for loss, and surrender charges. It’s important to diversify your investments within a variable annuity portfolio to mitigate these risks.

When calculating the present value of an annuity, you need to consider factors like the interest rate, the number of payments, and the payment amount. Calculating Annuity Due 2024 This can be done using a financial calculator or a spreadsheet program.

Are there any fees associated with variable annuities?

Annuity jackpots can be a big win, but it’s important to understand the terms and conditions of the annuity before making a decision. Annuity Jackpot 2024 You should also consult with a financial advisor to make sure it’s the right choice for you.

Yes, variable annuities typically involve fees, such as administrative fees, mortality and expense charges, and investment management fees. These fees can impact the overall return on your investment, so it’s crucial to carefully consider the fee structure before making a decision.

How do I choose the right variable annuity for my needs?

The best variable annuity for you depends on your individual financial goals, risk tolerance, and investment horizon. Consider factors such as investment options, fees, surrender charges, and death benefits when making your selection.

What are some common investment options available within variable annuities?

Variable annuities typically offer a range of investment options, including mutual funds, ETFs, and sub-accounts. You can choose investments that align with your risk tolerance and investment goals.

The present value of an annuity with growth is the value of the annuity today, taking into account the future growth of the payments. Pv Annuity With Growth 2024 This calculation can be complex, but there are online calculators and financial software programs that can help.

The best variable annuity for you will depend on your individual needs and investment goals. What Is The Best Variable Annuity 2024 It’s important to compare different annuities before making a decision.

Calculating annuity payments involves using a formula that takes into account the present value, the interest rate, and the number of payments. How Do You Calculate Annuity Payments 2024 There are also online calculators and financial software programs that can help you with this calculation.

An annuity is known for providing a steady stream of income for a set period of time. An Annuity Is Known 2024 This can be a valuable asset for retirees who want to ensure a predictable income stream.

Variable annuities can offer optional living benefits, which provide protection against outliving your savings. Variable Annuity Optional Living Benefits 2024 These benefits can be valuable for people who are concerned about running out of money in retirement.

When you win the lottery, you have the option of taking a lump sum payment or an annuity. Annuity Or Lump Sum Lottery 2024 The best choice for you depends on your financial goals and risk tolerance.