Variable Annuity Retirement Plan 2024 presents a compelling opportunity for individuals seeking to secure their financial future. This plan, offered by insurance companies, combines the stability of an annuity with the potential for growth through investment in various market sectors.

An annuity is a life insurance product that can provide a guaranteed income stream. Annuity Is A Life Insurance Product That 2024 can be a good option for those who want to ensure their income in retirement.

With its unique features, variable annuities offer a tailored approach to retirement planning, allowing individuals to customize their investment strategies based on their risk tolerance and financial goals.

This plan provides a blend of security and potential for growth, appealing to those seeking to diversify their retirement portfolio. Variable annuities offer tax-deferred growth, death benefit options, and guaranteed minimum income features, making them a viable option for individuals with varying risk appetites.

Calculating retirement annuity payments can be a complex process. Calculating Retirement Annuity Payments 2024 can help you understand how much income you can expect.

However, it is crucial to understand the associated risks and fees before investing in a variable annuity.

Contents List

- 1 Variable Annuity Retirement Plan Basics

- 2 Benefits and Drawbacks of Variable Annuities

- 3 Variable Annuities in 2024

- 4 Choosing a Variable Annuity

- 5 Managing a Variable Annuity

- 6 Variable Annuities and Taxes

- 7 Variable Annuities and Retirement Planning

- 8 Concluding Remarks

- 9 FAQ Corner: Variable Annuity Retirement Plan 2024

Variable Annuity Retirement Plan Basics

A variable annuity is a retirement savings plan that offers the potential for growth in your investment while also providing tax deferral and other benefits. Variable annuities are different from traditional annuities, which offer a guaranteed rate of return. Instead, the value of a variable annuity is tied to the performance of the underlying investments, which are typically mutual funds or other investment vehicles.

Key Features and Components

Variable annuities are structured with several key features:

- Sub-accounts: These are separate investment accounts within the variable annuity that allow you to allocate your funds among different investment options. Each sub-account has its own investment objective and risk profile.

- Investment options: You have the ability to choose from a variety of investment options within your sub-accounts, such as stocks, bonds, or money market funds. The specific options available will vary depending on the insurance company issuing the variable annuity.

- Insurance company: The insurance company plays a crucial role in a variable annuity by providing the underlying investment platform, managing the sub-accounts, and guaranteeing certain features like death benefits and minimum income guarantees.

- Investment growth potential: The value of your variable annuity can grow over time based on the performance of your chosen investments. However, it’s important to remember that there is also the potential for loss, as the value of your investments can fluctuate.

A present value calculator can be a handy tool for figuring out how much your annuity is worth today. Pv Calculator Annuity 2024 can be a great way to understand the potential growth of your investment.

How Variable Annuities Work

Variable annuities work by combining the elements of insurance and investment. Here’s a breakdown of the process:

- Initial investment: You make an initial investment into the variable annuity, which is then allocated to the sub-accounts of your choosing.

- Investment growth: The value of your investments in the sub-accounts will fluctuate based on market performance. You have the potential to earn higher returns with riskier investments, or lower returns with less risky investments.

- Tax deferral: The growth of your investments within the variable annuity is tax-deferred, meaning you won’t pay taxes on the gains until you withdraw them in retirement.

- Withdrawal options: You can withdraw funds from your variable annuity at any time, subject to certain rules and penalties. The specific withdrawal options and associated fees will vary depending on the annuity contract.

Benefits and Drawbacks of Variable Annuities

Variable annuities offer a mix of potential benefits and drawbacks. It’s crucial to carefully consider both sides before making a decision.

Potential Benefits

- Tax deferral: The growth of your investments is tax-deferred, allowing your money to compound tax-free until you withdraw it in retirement.

- Death benefit options: Many variable annuities offer death benefit options, which can provide a guaranteed payment to your beneficiaries upon your death.

- Guaranteed minimum income: Some variable annuities offer a guaranteed minimum income feature, which provides a guaranteed stream of income in retirement, regardless of the performance of your investments.

- Investment flexibility: You have the ability to choose from a variety of investment options within your sub-accounts, allowing you to tailor your portfolio to your risk tolerance and investment goals.

Potential Drawbacks

- Investment risk: The value of your investments in a variable annuity can fluctuate, meaning you could lose money. This risk is higher with investments that have the potential for higher returns, such as stocks.

- Fees: Variable annuities come with a variety of fees, including administrative fees, investment management fees, and surrender charges. These fees can eat into your returns over time.

- Surrender charges: If you withdraw funds from your variable annuity before a certain period, you may have to pay surrender charges, which can be substantial.

- Complexity: Variable annuities can be complex financial products, and it’s important to understand the risks and features before investing.

Comparison with Other Retirement Savings Options

Variable annuities offer a different set of features compared to other retirement savings options like traditional IRAs, Roth IRAs, and 401(k) plans. Here’s a brief comparison:

| Feature | Variable Annuity | Traditional IRA | Roth IRA | 401(k) |

|---|---|---|---|---|

| Tax Treatment | Tax-deferred growth, taxed at withdrawal | Tax-deductible contributions, taxed at withdrawal | Tax-free withdrawals in retirement | Tax-deferred growth, taxed at withdrawal |

| Investment Options | Wide range of investment options | Limited investment options | Limited investment options | Limited investment options (determined by employer) |

| Fees | Higher fees (administrative, investment management, surrender charges) | Lower fees | Lower fees | Lower fees (typically) |

| Guaranteed Income | May offer guaranteed minimum income | No guaranteed income | No guaranteed income | No guaranteed income |

| Death Benefit | May offer death benefit options | May offer death benefit options | May offer death benefit options | May offer death benefit options |

Variable Annuities in 2024

The variable annuity market is constantly evolving, influenced by factors such as market conditions, economic trends, and regulatory changes.

Market Conditions and Economic Factors

In 2024, the performance of variable annuities will be influenced by a number of factors, including interest rates, inflation, and global economic growth. For example, rising interest rates could impact the value of bond investments, while inflation could erode the purchasing power of your investment returns.

An annuity loan can be a good way to access funds from your annuity without having to withdraw the entire amount. Calculate Annuity Loan 2024 can help you understand the potential costs and benefits.

It’s crucial to stay informed about these factors and their potential impact on your variable annuity.

Recent Changes and Updates

The regulatory landscape for variable annuities can change, impacting investors. For instance, the Department of Labor (DOL) may introduce new rules related to retirement savings plans, including variable annuities. Staying informed about these changes is essential for making informed investment decisions.

Excel can be a powerful tool for calculating the present value of an annuity. Calculating Annuity Present Value In Excel 2024 can help you make informed financial decisions.

Emerging Trends and Innovations

The variable annuity market is constantly evolving with new investment options and features. For example, some insurance companies are offering variable annuities with target-date funds, which automatically adjust the investment allocation based on your retirement date. This innovation can simplify investment management and potentially improve returns.

If you’re considering an annuity, it’s important to understand the different types of annuities available. Annuity Number Lic 2024 can help you find the right option for your needs.

Choosing a Variable Annuity

Choosing the right variable annuity requires careful consideration of several factors. The goal is to find a product that aligns with your investment goals, risk tolerance, and financial situation.

The way your variable annuity payout is structured can have a big impact on your retirement income. Variable Annuity Payout 2024 is a good topic to research as you plan for the future.

Key Factors to Consider

- Investment options: Ensure the variable annuity offers a diverse range of investment options that meet your investment objectives and risk tolerance.

- Fees: Compare the fees charged by different insurance companies, including administrative fees, investment management fees, and surrender charges.

- Insurance company reputation: Research the financial strength and reputation of the insurance company issuing the variable annuity. Look for companies with a strong track record and solid financial ratings.

- Guaranteed features: Consider whether the variable annuity offers features like guaranteed minimum income, death benefit options, or other guarantees that align with your needs.

- Contract terms: Carefully review the terms of the annuity contract, including the withdrawal options, surrender charges, and other important details.

Comparing Variable Annuity Products

To make an informed decision, it’s helpful to compare the features and costs of different variable annuity products. Here’s a sample table comparing some major insurance providers:

| Insurance Company | Investment Options | Annual Fees | Surrender Charges | Guaranteed Minimum Income | Death Benefit Options |

|---|---|---|---|---|---|

| Company A | Stocks, bonds, money market funds | 1.5% | 7 years | Yes | Yes |

| Company B | Target-date funds, index funds, managed accounts | 1.25% | 5 years | No | Yes |

| Company C | Global equity funds, sector funds, real estate funds | 1.75% | 6 years | Yes | No |

Remember, this is just a sample table. The specific features and costs of variable annuity products will vary depending on the insurance company and the specific contract terms.

Determining Suitability

A variable annuity may not be suitable for everyone. It’s essential to consider your specific retirement goals, risk tolerance, and financial situation. If you’re unsure whether a variable annuity is right for you, consult with a qualified financial advisor.

Managing a Variable Annuity

Once you’ve invested in a variable annuity, it’s important to manage your investments effectively to maximize returns and minimize risk.

Investment Strategies

- Asset allocation: This involves determining the percentage of your portfolio that you want to allocate to different asset classes, such as stocks, bonds, and real estate. A well-balanced asset allocation can help reduce risk and potentially improve returns.

- Rebalancing: This involves adjusting your investment allocation periodically to ensure that your portfolio remains aligned with your risk tolerance and investment goals. Rebalancing can help you stay on track and avoid excessive risk.

- Dollar-cost averaging: This involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy can help you reduce the impact of market volatility and potentially improve your overall returns.

Monitoring Your Investments

It’s important to regularly monitor the performance of your variable annuity investments and make adjustments as needed. This involves reviewing your investment allocation, fees, and overall performance, and making changes to your strategy if necessary.

When you purchase an annuity, you’re essentially exchanging a lump sum for a stream of income. Annuity Is Purchased 2024 can be a good way to protect your savings in retirement.

Maximizing Returns and Minimizing Risk

- Diversify your investments: Spread your investments across different asset classes and investment options to reduce risk and potentially improve returns.

- Keep your fees low: Look for variable annuities with low fees to maximize your returns.

- Stay disciplined: Stick to your investment strategy and avoid making impulsive decisions based on market fluctuations.

- Seek professional advice: If you’re unsure about managing your variable annuity, consult with a qualified financial advisor.

Variable Annuities and Taxes

Variable annuities have specific tax implications that you need to understand. The tax treatment of your investments, withdrawals, and death benefits can significantly impact your overall returns.

The 59.5 rule can impact when you can withdraw from your annuity without penalty. Annuity 59.5 Rule 2024 is a good topic to research before making any withdrawals.

Tax Treatment

- Withdrawals: Withdrawals from a variable annuity are generally taxed as ordinary income. This means that you’ll pay taxes on the gains portion of your withdrawals at your current tax bracket.

- Death benefits: If you die before withdrawing funds from your variable annuity, the death benefit will typically be paid to your beneficiaries tax-free. However, if your beneficiaries choose to receive the death benefit as a lump sum, they may be subject to income tax on the gains portion.

When deciding between an annuity and an IRA, it’s important to consider your individual needs and goals. Annuity Or Ira 2024 can help you choose the right option for you.

- Rollovers: You can typically roll over funds from a variable annuity to another qualified retirement plan without incurring any tax penalties.

Tax Advantages and Disadvantages

Variable annuities offer some tax advantages, such as tax-deferred growth, but also come with potential tax disadvantages, such as ordinary income taxation on withdrawals. Here’s a brief comparison with other retirement savings options:

| Feature | Variable Annuity | Traditional IRA | Roth IRA | 401(k) |

|---|---|---|---|---|

| Tax Treatment of Contributions | Not tax-deductible | Tax-deductible | Not tax-deductible | Not tax-deductible |

| Tax Treatment of Growth | Tax-deferred | Tax-deferred | Tax-free | Tax-deferred |

| Tax Treatment of Withdrawals | Taxed as ordinary income | Taxed as ordinary income | Tax-free | Taxed as ordinary income |

Tax Planning Strategies

To minimize your tax burden, consider the following tax planning strategies for variable annuities:

- Withdraw funds strategically: Plan your withdrawals to minimize your tax liability. For example, you may want to withdraw funds during a year when your income is lower.

- Consider Roth conversions: If you have a traditional IRA or 401(k), you may consider converting some or all of your funds to a Roth IRA. This can help you avoid paying taxes on withdrawals in retirement.

- Consult with a tax advisor: Seek professional advice from a qualified tax advisor to develop a tax plan that aligns with your specific circumstances.

Variable Annuities and Retirement Planning

Variable annuities can play a significant role in a comprehensive retirement plan, providing a combination of investment growth potential, tax deferral, and income guarantees.

An annuity home loan can be a great way to finance your dream home. Annuity Home Loan 2024 can offer some unique advantages for borrowers.

Role in Retirement Planning

Variable annuities can be used to meet a variety of retirement goals, such as:

- Income generation: Variable annuities can provide a steady stream of income in retirement, particularly if they offer guaranteed minimum income features.

- Long-term growth: Variable annuities offer the potential for long-term growth, allowing your investments to compound over time.

- Legacy planning: Variable annuities can be used to provide for your beneficiaries after your death, particularly if they offer death benefit options.

Examples of Use

Here are some examples of how variable annuities can be used in retirement planning:

- Early retirement: A variable annuity can provide a source of income for those who retire early, before they are eligible for Social Security or other retirement benefits.

- Income protection: A variable annuity with a guaranteed minimum income feature can provide a safety net for those who are concerned about market volatility.

- Long-term care planning: A variable annuity can provide funds for long-term care expenses, such as assisted living or nursing home care.

Best Practices for Integration, Variable Annuity Retirement Plan 2024

Here are some best practices for integrating variable annuities into your overall retirement strategy:

- Diversify your investments: Don’t rely solely on variable annuities for your retirement savings. Diversify your investments across different asset classes and investment options.

- Review your strategy regularly: Periodically review your retirement plan and make adjustments as needed to ensure that your investments are still aligned with your goals.

- Seek professional advice: Consult with a qualified financial advisor to develop a comprehensive retirement plan that meets your individual needs.

Concluding Remarks

In conclusion, Variable Annuity Retirement Plan 2024 offers a multifaceted approach to retirement planning, providing both security and growth potential. While it presents certain advantages, it is essential to carefully evaluate the associated risks and fees before making an investment decision.

If you’re looking for a way to stretch your retirement savings, a variable annuity non-qualified stretch might be worth considering. Variable Annuity Non Qualified Stretch 2024 can help you manage your income stream throughout retirement.

By understanding the nuances of this plan and consulting with a financial advisor, individuals can determine if a variable annuity aligns with their specific retirement goals and risk tolerance.

If you’re planning to leave your annuity to a trust, it’s important to understand the rules and regulations. Annuity Beneficiary Is A Trust 2024 can help you ensure your wishes are carried out.

FAQ Corner: Variable Annuity Retirement Plan 2024

What are the different types of investment options available within a variable annuity?

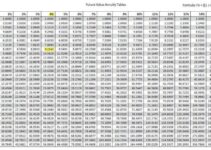

A future value calculator can help you estimate how much your annuity might be worth in the future. Fv Calculator Annuity 2024 can be helpful for long-term financial planning.

Variable annuities offer a range of investment options, including mutual funds, exchange-traded funds (ETFs), and sub-accounts. These options allow individuals to diversify their portfolio across various asset classes, such as stocks, bonds, and real estate.

How are variable annuities taxed?

Withdrawals from a variable annuity are taxed as ordinary income, similar to traditional IRAs. The earnings portion of withdrawals is subject to income tax, while the principal portion is typically tax-free. However, the tax treatment can vary depending on the specific annuity contract and the individual’s circumstances.

What are the surrender charges associated with variable annuities?

Surrender charges are fees imposed by insurance companies when an individual withdraws money from a variable annuity before a certain period. These charges are designed to discourage early withdrawals and can vary depending on the annuity contract and the length of time the money has been invested.

Are variable annuities right for everyone?

It’s always helpful to have a clear picture of what your annuity might pay out. How Much Will An Annuity Pay Calculator 2024 can help you make more informed decisions about your retirement savings.

Variable annuities are not suitable for everyone. They are best suited for individuals with a long-term investment horizon and a moderate to high risk tolerance. It is essential to consult with a financial advisor to determine if a variable annuity aligns with your specific financial goals and risk profile.