Variable Annuity Roth IRA 2024 presents a unique retirement savings strategy that combines the potential for tax-free growth with the flexibility of variable annuity investments. This approach offers a compelling alternative to traditional retirement accounts, allowing individuals to accumulate wealth for their golden years while potentially benefiting from tax-advantaged withdrawals.

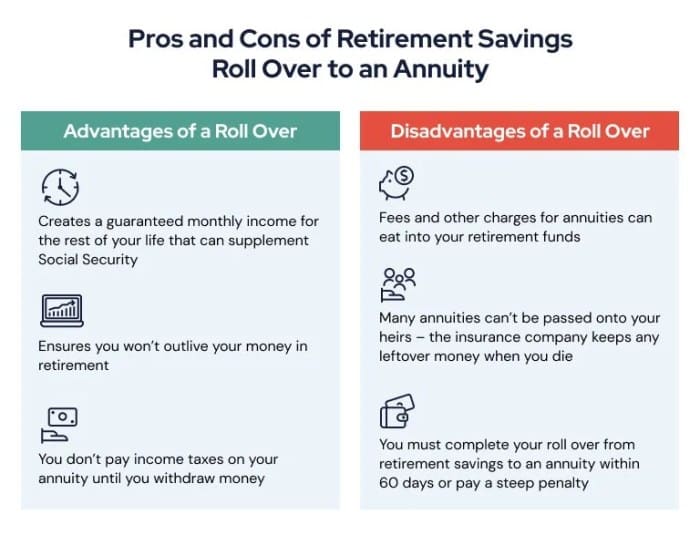

Thinking about retirement and if an annuity is right for you in 2024? Is Annuity Retirement 2024 explores the potential benefits and drawbacks of annuities as part of your retirement plan.

A variable annuity Roth IRA, as the name suggests, merges the features of both variable annuities and Roth IRAs. Variable annuities provide the opportunity to invest in a range of sub-accounts, often tied to mutual funds, offering potential for growth and income generation.

Need to calculate the annuity you can receive from your pension pot in 2024? Calculate Annuity From Pension Pot 2024 can help you understand how to determine your potential income stream.

The Roth IRA component, on the other hand, provides tax-free withdrawals in retirement, making it an attractive option for individuals seeking to minimize their tax burden in their later years.

It’s important to understand if your annuity is subject to RMDs in 2024. Check out Is Annuity Subject To Rmd 2024 for the latest information and how it might impact your financial strategy.

Outcome Summary: Variable Annuity Roth Ira 2024

Understanding the nuances of variable annuity Roth IRAs is crucial for individuals seeking to optimize their retirement savings strategies. While this approach offers potential benefits, it’s essential to consider the risks associated with variable annuities, including market volatility and investment losses.

Need help calculating your annuity? The Annuity Calculator Groww 2024 can help you estimate your potential income stream based on your specific circumstances.

Careful planning, including the selection of appropriate investment options and a thorough understanding of the tax implications, can help maximize the potential benefits of this strategy while mitigating potential risks.

Confused about what an annuity actually is? Annuity Is Meaning 2024 offers a clear explanation of this financial tool and its potential benefits.

Top FAQs

What are the potential risks associated with a variable annuity Roth IRA?

Learn about X Share Annuities and their potential role in your financial planning for 2024. X Share Annuity 2024 provides insights into this specific type of annuity.

Variable annuities carry investment risks, as the value of the underlying investments can fluctuate. Market downturns can lead to losses, potentially impacting your retirement savings. It’s essential to carefully consider your risk tolerance and investment goals before investing in a variable annuity.

How do I choose the right investment options within a variable annuity Roth IRA?

Wondering about the guaranteed return on a variable annuity in 2024? You can find out more about Variable Annuity Guaranteed Return 2024 and how it might affect your retirement planning.

Selecting the right investment options depends on your risk tolerance, time horizon, and investment goals. Consider factors like potential returns, fees, and the overall risk profile of each investment option. It’s advisable to consult with a financial advisor to develop a personalized investment strategy.

Are there any penalties for withdrawing funds from a variable annuity Roth IRA before retirement?

While withdrawals before age 59 1/2 are generally subject to a 10% penalty, Roth IRA withdrawals are tax-free and penalty-free if they meet certain conditions, such as being taken for qualified education expenses or a first-time home purchase.

Looking for a reliable annuity calculator? Calculator.Net Annuity 2024 provides a comprehensive tool for calculating your annuity payments.

Can’t figure out what that word is? Annuity Unscramble 2024 might help you unscramble the word “annuity” and better understand its meaning.

Wondering what an annuity with a starting amount of $600,000 might look like? Annuity 600k 2024 can help you explore the potential outcomes of such an annuity.

Need help calculating your annuity payments? Calculating Annuity Formula 2024 provides a detailed explanation of the formula used to calculate annuity payments.

Looking for information about annuities in the UK? Annuity Uk 2024 provides insights into annuities and their regulations in the UK.

Need to calculate your annuity payments on a quarterly basis? Annuity Formula Quarterly 2024 explains how to calculate your payments using a quarterly frequency.

Looking for a spreadsheet to help you calculate your annuity? Pv Annuity Sheet 2024 might be a helpful resource for your financial planning.

Curious about how a 3-year annuity works? How Does A 3 Year Annuity Work 2024 explains the basics of this type of annuity.