Variable Annuity S&P 500 2024 presents an intriguing investment opportunity, blending the potential for growth tied to the S&P 500 with the safety and income features of an annuity. This guide delves into the complexities of this financial instrument, exploring its benefits, risks, and strategic considerations for 2024 and beyond.

Variable annuities offer a unique combination of investment potential and guaranteed income streams. By linking the performance of the annuity to the S&P 500, investors can potentially participate in the growth of the stock market while also benefiting from guaranteed income payments in retirement.

Annuity calculators are online tools that can help you estimate how much income you can expect from an annuity. These calculators typically ask you to enter information about your age, the amount of money you want to invest, and the expected rate of return.

You can find a basic annuity calculator online to get a quick estimate of your potential annuity payments.

However, it’s crucial to understand the risks involved, including potential market fluctuations and surrender charges, before making an investment decision.

Contents List

Variable Annuities and the S&P 500: An Overview for 2024: Variable Annuity S&P 500 2024

Variable annuities have gained traction as a retirement investment strategy, particularly those linked to the S&P 500. This article delves into the intricacies of variable annuities, their connection to the S&P 500, and the factors influencing their performance in 2024.

Variable Annuity Basics

Variable annuities are insurance contracts that offer growth potential tied to the performance of underlying investments, often mutual funds or sub-accounts. The most common type of variable annuity is linked to the S&P 500, a broad market index representing 500 large-cap U.S.

companies. This connection allows investors to participate in the potential upside of the stock market while receiving certain guarantees and tax advantages.

Variable annuities are a type of annuity where the payments you receive can fluctuate based on the performance of underlying investments. This type of annuity can be a good option for people who are comfortable with risk and want the potential for higher returns.

You can learn more about variable annuities to see if it’s a good fit for your financial goals.

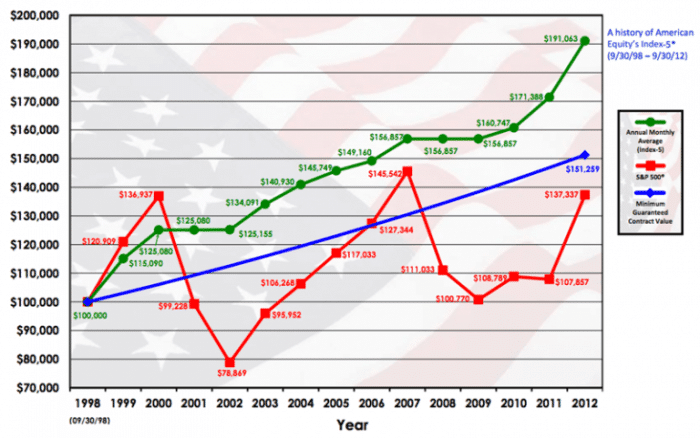

The primary benefit of a variable annuity linked to the S&P 500 is the potential for higher returns compared to fixed annuities. Since the value of the annuity is tied to the performance of the S&P 500, investors can benefit from market growth.

However, it’s important to note that the downside is also tied to the market. If the S&P 500 declines, the value of the annuity may decrease as well. Variable annuities also come with fees and charges that can impact returns.

Variable annuities are a type of annuity where the payments you receive can fluctuate based on the performance of underlying investments. While variable annuities offer the potential for higher returns, they also carry more risk. It’s important to understand that variable annuities do not provide guaranteed returns , and the value of your investment can go down as well as up.

Variable annuities can be suitable for investors with a long-term investment horizon who are comfortable with market volatility. They are often considered a good option for those seeking tax-deferred growth and potential downside protection. For instance, an individual nearing retirement who wants to grow their savings while mitigating some risk might find a variable annuity attractive.

Variable annuities are a type of annuity where the payments you receive can fluctuate based on the performance of underlying investments. If you’re considering a variable annuity, it’s important to understand the risks involved. You can learn more about variable annuity exchanges to see if this type of annuity is right for you.

Another scenario could involve an individual who desires tax-deferred growth and potential protection against market downturns.

S&P 500 Performance and Outlook

The S&P 500 has historically delivered strong returns over the long term. In the past five years, it has averaged a return of around 15%, while the ten-year average is closer to 12%. Over the past twenty years, the S&P 500 has generated an average annual return of approximately 8%.

Annuity is a popular topic in financial education, and you can find a lot of information online, including study guides and flashcards. If you’re looking for resources to help you learn about annuities, you can check out annuity quizzes and flashcards on Quizlet.

The S&P 500’s performance in 2024 will depend on several economic factors, including inflation, interest rates, and global economic growth. Rising interest rates could put pressure on stock valuations, while a slowdown in economic growth could dampen corporate earnings. Conversely, a decline in inflation and stable economic growth could support further stock market gains.

Calculating an annuity can be a bit complex, but there are calculators available to help you. The HP-10bii is a financial calculator that can be used to calculate annuity payments. If you’re interested in learning how to use the HP-10bii for annuity calculations, you can find resources online.

For example, you can learn more about calculating annuities on the HP-10bii to get started.

Investing in the S&P 500 in the current market environment presents both risks and opportunities. While the index has historically provided strong returns, it is not immune to market downturns. The ongoing economic uncertainties and potential for volatility create both challenges and opportunities for investors.

Annuities are often used as a retirement savings vehicle, and they can be a valuable tool for planning your financial future. While annuities can be a good option for some people, it’s important to understand how they work and the risks involved.

If you’re considering an annuity, you can learn more about annuities as a voluntary retirement vehicle to make an informed decision.

Variable Annuity Contract Features

Variable annuity contracts typically include various features that can impact the overall return on investment. These features can provide both benefits and drawbacks, so it’s crucial to understand them before making an investment decision.

Annuity is a financial product that provides a stream of payments over a set period of time. It’s often referred to as a retirement income stream , as it can provide a steady source of income during retirement.

- Death Benefits:Many variable annuities offer death benefits, guaranteeing a minimum payout to beneficiaries upon the death of the annuitant. This feature provides some downside protection and can be valuable for estate planning purposes.

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed minimum income or guaranteed minimum withdrawal benefits. These features provide income guarantees and can be helpful for those seeking income security in retirement.

- Surrender Charges:Variable annuity contracts often include surrender charges, which are fees assessed if the contract is withdrawn before a certain period. These charges can discourage short-term withdrawals and can impact the overall return on investment.

The specific features of a variable annuity contract can vary significantly between providers. It’s important to carefully review the contract terms and compare different options before making an investment decision.

Investment Strategies and Considerations

Developing an investment strategy for a variable annuity linked to the S&P 500 involves considering several factors, including risk tolerance, investment horizon, and financial goals.

Estimating how much income you can expect from an annuity can be helpful when making financial decisions. There are online calculators that can help you get an idea of what your annuity payments might be. You can find an annuity estimator to get a personalized estimate based on your circumstances.

For investors with a high risk tolerance and a long investment horizon, a strategy focused on maximizing growth might be appropriate. This could involve allocating a larger portion of the annuity to the S&P 500 sub-account and potentially taking on additional risk through other investments.

Conversely, investors with a lower risk tolerance and a shorter investment horizon might prefer a more conservative strategy, allocating a larger portion of the annuity to fixed income sub-accounts or other less volatile investments.

Asset allocation and diversification are crucial for managing risk within a variable annuity portfolio. By allocating assets across different asset classes, investors can reduce the overall risk of their portfolio. Diversification can also help to mitigate the impact of any single investment performing poorly.

Annuities can be a complex financial product, and there are many different types available. Some annuities are considered qualified plans, which means they offer certain tax advantages. If you’re considering an annuity, it’s important to understand whether it’s a qualified plan.

You can learn more about annuities and qualified plans to make sure you’re making the right choice for your situation.

Tax implications should also be considered when investing in a variable annuity linked to the S&P 500. The growth of the annuity is generally tax-deferred, meaning that taxes are not paid until the money is withdrawn. However, withdrawals from a variable annuity are typically taxed as ordinary income, which can result in a higher tax burden than withdrawals from other retirement accounts.

Variable annuities are a type of annuity that allows you to invest your money in a variety of sub-accounts. These sub-accounts can include stocks, bonds, and other investments, giving you more control over your investment strategy. If you’re considering a variable annuity, it’s important to understand the different investment options available.

You can learn more about variable annuity pension plans to see how they work.

Regulatory and Legal Considerations, Variable Annuity S&P 500 2024

Variable annuities are subject to various regulations and legal requirements in the United States. The Securities and Exchange Commission (SEC) oversees the sale and registration of variable annuities, while the Financial Industry Regulatory Authority (FINRA) regulates the conduct of brokers and dealers who sell variable annuities.

The SEC and FINRA have established rules and regulations to protect investors and ensure fair market practices. These regulations cover areas such as disclosure requirements, suitability standards, and anti-fraud provisions.

The variable annuity market is subject to ongoing regulatory scrutiny and potential changes. In recent years, there have been discussions about potential changes to regulations, including those related to fees and disclosure requirements. These potential changes could impact the variable annuity market in 2024.

Ending Remarks

Understanding the intricacies of Variable Annuity S&P 500 2024 requires a careful assessment of your individual financial goals, risk tolerance, and investment horizon. By considering the factors Artikeld in this guide, you can make an informed decision about whether this investment strategy aligns with your financial objectives.

Annuity is a financial product that provides a stream of payments over a set period of time. It’s often used as a retirement savings vehicle, and can be a valuable tool for planning your financial future. If you’re interested in learning more about annuities, check out this article on what an annuity is to get a better understanding of how they work.

Remember, seeking professional advice from a qualified financial advisor is essential before investing in any financial product, especially one as complex as a variable annuity.

Annuity is a common topic in finance courses, and you might encounter questions about it on exams or quizzes. To help you prepare, you can find practice questions and answers online. For example, check out this resource for annuity multiple-choice questions to test your knowledge.

Helpful Answers

What is the minimum investment required for a variable annuity linked to the S&P 500?

The minimum investment amount can vary significantly depending on the insurance company and specific contract. It’s best to consult with a financial advisor or review the contract details for specific requirements.

Life Insurance Corporation of India (LIC) offers various financial products, including annuities. If you’re considering an annuity from LIC, it’s important to understand the specific features and terms of the product. You can learn more about LIC annuities to see if it’s a good fit for your needs.

Are there any tax implications associated with withdrawals from a variable annuity?

Yes, withdrawals from a variable annuity are generally taxed as ordinary income. However, there may be exceptions depending on the type of withdrawal and the specific contract provisions. It’s important to consult with a tax professional for personalized advice.

How do I choose the right variable annuity contract for my needs?

If you’re planning for retirement, you might be considering an annuity as a way to supplement your pension. Calculating how much income you can expect from an annuity can be a bit complex, but there are tools available to help.

You can learn more about calculating an annuity from your pension to get a better idea of how it might fit into your retirement plans.

Selecting the right variable annuity contract requires careful consideration of your financial goals, risk tolerance, and investment horizon. Consulting with a financial advisor can help you assess your options and choose a contract that aligns with your individual circumstances.