Variable Annuity Tax Deferred 2024 offers a compelling investment strategy, allowing investors to potentially grow their wealth tax-deferred while managing risk through diversified investments. This type of annuity provides a unique blend of growth potential and tax advantages, making it an attractive option for those seeking to build a secure financial future.

Annuity payments can be subject to income tax. If you’re interested in understanding the tax implications of annuities under the Income Tax Act, you can find more information on Annuity Under Income Tax Act 2024.

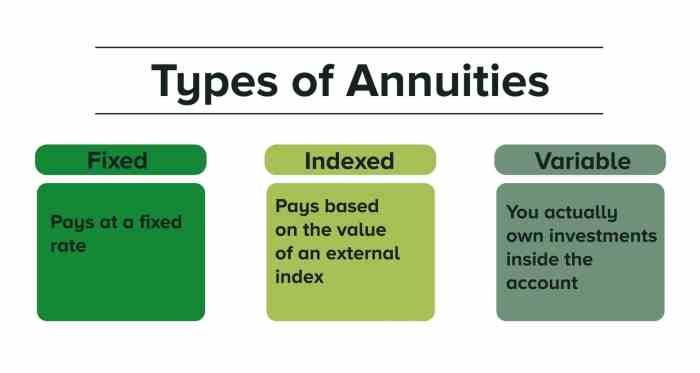

Unlike fixed annuities that offer guaranteed returns, variable annuities link your investment to the performance of underlying mutual funds or sub-accounts. This flexibility allows you to potentially achieve higher returns but also exposes you to market volatility. The tax-deferred growth feature means that any earnings from your investment are not taxed until you withdraw them, allowing your money to compound over time.

Contents List

Variable Annuities: An Overview

Variable annuities are a type of insurance contract that offers tax-deferred growth on your investments. They allow you to invest in a variety of sub-accounts, which are similar to mutual funds. The value of your investment will fluctuate based on the performance of the underlying investments.

An annuity calculator can help you determine the present value of future payments. If you’re interested in the mathematical calculations involved, you can learn more about Annuity Calculator Math 2024.

Key Features of Variable Annuities

Variable annuities offer a variety of features, including:

- Tax-deferred growth

- Death benefit

- Living benefit riders

- Investment flexibility

Variable Annuities vs. Fixed Annuities

Variable annuities differ from fixed annuities in a few key ways. Fixed annuities offer a guaranteed rate of return, while variable annuities offer the potential for higher returns but also carry the risk of losing money.

Variable annuities offer a potential for growth but also come with some risk. It’s important to weigh the advantages and disadvantages before making a decision. You can learn more about the benefits of this type of annuity on Variable Annuity Advantages 2024.

- Fixed Annuities: Guaranteed rate of return, lower potential returns, less risk.

- Variable Annuities: Potential for higher returns, higher risk, no guaranteed rate of return.

Advantages of Variable Annuities

- Tax-deferred growth: Earnings on your investments are not taxed until you withdraw them.

- Investment flexibility: You can choose from a variety of investment options to match your risk tolerance and investment goals.

- Death benefit: Your beneficiaries will receive a death benefit if you pass away.

- Living benefit riders: These optional riders can provide you with guaranteed income in retirement.

Disadvantages of Variable Annuities

- Fees and expenses: Variable annuities typically have higher fees and expenses than other types of investments.

- Market risk: The value of your investment can fluctuate based on the performance of the underlying investments.

- Complexity: Variable annuities can be complex and difficult to understand.

Tax-Deferred Growth

Variable annuities offer tax-deferred growth, which means that you won’t have to pay taxes on your investment earnings until you withdraw them. This can be a significant advantage for long-term investors.

An annuity is a financial product that provides a stream of payments over a period of time. It’s a way to ensure a steady income, particularly during retirement. If you’re curious about the basics of annuities, you can find more information on An Annuity Is 2024.

How Tax Deferral Works

When you invest in a variable annuity, your contributions are not taxed immediately. Instead, they grow tax-deferred, meaning that you will only pay taxes on your earnings when you withdraw them.

Prudential Premier Retirement B Variable Annuity is a specific type of retirement plan that allows you to invest your contributions in a variety of funds. To understand the details of this particular annuity, check out Prudential Premier Retirement B Variable Annuity 2024.

Benefits of Tax Deferral

Tax deferral can be a powerful tool for growing your wealth. It allows your investments to compound tax-free, which can significantly boost your returns over time.

Example of Tax Deferral

Let’s say you invest $10,000 in a variable annuity and it earns a 7% annual return. After 10 years, your investment would be worth approximately $19,671.51. If you had invested in a taxable account, you would have had to pay taxes on the annual earnings each year.

Annuity 95-1 is a specific type of annuity that offers guaranteed payments for life. You can find more information about this specific type of annuity on Annuity 95-1 2024.

This would have reduced your overall return.

The term “annuity” is used to describe a series of payments made over a period of time. If you’re looking for the Hindi meaning of “annuity,” you can find it on Annuity Ka Hindi Meaning 2024.

Investment Options within Variable Annuities

Variable annuities offer a variety of investment options, allowing you to tailor your portfolio to your risk tolerance and investment goals.

Types of Investment Options, Variable Annuity Tax Deferred 2024

Variable annuity sub-accounts typically invest in a variety of asset classes, including:

- Stocks: Equities represent ownership in publicly traded companies and offer the potential for high returns, but also carry higher risk.

- Bonds: Debt securities issued by governments or corporations, generally considered less risky than stocks, but offer lower potential returns.

- Mutual Funds: Pools of money invested in a variety of securities, offering diversification and professional management.

- Money Market Funds: Invest in short-term, low-risk debt securities, providing liquidity and stability.

- Real Estate Investment Trusts (REITs): Invest in real estate properties, offering exposure to the real estate market.

Risk and Return

The risk and potential return of each investment option vary depending on the underlying asset class and investment strategy.

To determine the amount of your annuity payments, you can use a calculator or consult a financial advisor. You can find more information about how to calculate annuity amounts on Calculate Annuity Amount 2024.

Investment Options Table

| Asset Class | Risk Level | Potential Returns |

|---|---|---|

| Stocks | High | High |

| Bonds | Moderate | Moderate |

| Mutual Funds | Variable | Variable |

| Money Market Funds | Low | Low |

| REITs | Moderate to High | Moderate to High |

Fees and Expenses

Variable annuities come with a variety of fees and expenses, which can impact your investment returns.

A single premium annuity is a type of annuity where you make one lump sum payment upfront. If you’re interested in learning more about this type of annuity, you can find information on G Purchased A $50 000 Single Premium 2024.

Types of Fees

- Mortality and expense (M&E) charges: These fees cover the insurance company’s costs of providing the death benefit and other features of the annuity.

- Administrative fees: These fees cover the costs of managing the annuity contract.

- Investment management fees: These fees are charged by the investment managers who oversee the sub-accounts.

- Surrender charges: These fees are charged if you withdraw your money from the annuity before a certain period.

Impact of Fees on Returns

Fees can significantly impact your investment returns. For example, if you pay a 1% annual fee on a $100,000 investment, you will lose $1,000 per year in fees.

The way a variable annuity pays out can vary depending on the investment performance of the underlying funds. To learn more about how variable annuities make payments, visit Variable Annuity Payout 2024.

Comparing Fee Structures

It’s important to compare the fee structures of different variable annuity products before making a decision. Look for products with low fees and expenses.

A PV annuity chart can help you visualize the present value of future payments. If you’re interested in learning more about how to use this type of chart, visit Pv Annuity Chart 2024.

Variable Annuities and Retirement Planning

Variable annuities can be a valuable tool for retirement planning, offering tax-deferred growth and potential for income generation.

The taxability of annuity payments can vary depending on the type of annuity and the terms of the contract. If you’re curious about the tax implications of annuities, you can learn more on Is Annuity From Lic Taxable 2024.

Strategies for Retirement Planning

- Accumulate wealth: Variable annuities can be used to accumulate wealth for retirement. The tax-deferred growth feature allows your investments to grow tax-free.

- Generate income: Variable annuities can provide a source of income in retirement. You can withdraw your investment earnings tax-free.

- Protect your principal: Some variable annuities offer living benefit riders that can help protect your principal from market downturns.

Income Generation in Retirement

You can generate income from your variable annuity in several ways:

- Withdrawals: You can withdraw your investment earnings tax-free.

- Annuities: You can annuitize your variable annuity, which will provide you with a guaranteed stream of income for life.

- Living benefit riders: Some variable annuities offer living benefit riders that can provide you with guaranteed income in retirement.

Comparing Variable Annuities to Other Retirement Savings Options

Variable annuities are just one of many retirement savings options available. Other options include:

- 401(k) plans: Employer-sponsored retirement savings plans.

- IRAs: Individual retirement accounts.

- Roth IRAs: Retirement accounts that allow you to withdraw your earnings tax-free in retirement.

Variable Annuities in 2024: Variable Annuity Tax Deferred 2024

The variable annuity market is constantly evolving, and it’s important to stay up-to-date on the latest trends.

Market Conditions

The performance of variable annuities is closely tied to the overall market conditions. In a bull market, variable annuities can perform well, but they can also lose value in a bear market.

An annuity loan calculator can help you determine the monthly payments for a loan. If you’re interested in using a calculator to estimate loan payments, you can find one on Annuity Loan Calculator 2024.

Recent Changes and Trends

- Increased competition: The variable annuity market is becoming increasingly competitive, with new products and features being introduced regularly.

- Focus on transparency: Insurance companies are being more transparent about the fees and expenses associated with their variable annuity products.

- Growing popularity of living benefit riders: Living benefit riders are becoming increasingly popular, as they offer guaranteed income in retirement.

Key Factors to Consider

- Fees and expenses: Carefully compare the fees and expenses of different variable annuity products.

- Investment options: Choose a product that offers a variety of investment options to match your risk tolerance and investment goals.

- Living benefit riders: Consider whether a living benefit rider is right for you.

- Financial strength of the insurance company: Choose a variable annuity from a financially sound insurance company.

Conclusion

Variable Annuities Tax Deferred 2024 presents a complex investment landscape, requiring careful consideration of your risk tolerance, financial goals, and long-term investment strategy. Understanding the intricacies of variable annuities, including their advantages, disadvantages, and potential risks, is crucial before making any investment decisions.

Consulting with a financial advisor can provide personalized guidance and help you determine if this type of annuity aligns with your financial objectives.

Question Bank

What are the main risks associated with variable annuities?

Variable annuities are subject to market risk, meaning the value of your investment can fluctuate based on the performance of the underlying investments. Additionally, there are fees associated with variable annuities that can impact your returns. It’s essential to carefully evaluate the fees and risks before investing.

Annuity is a financial product that provides a stream of payments for a set period of time. It’s a popular way to ensure a steady income during retirement. If you’re curious about the different types of annuities available, you can learn more about Annuity Kinds 2024.

How do variable annuities compare to other retirement savings options?

Variable annuities offer tax-deferred growth and potential for higher returns compared to traditional IRAs or 401(k)s. However, they also carry higher fees and risks. It’s important to compare the different options based on your individual needs and risk tolerance.

What are the tax implications of withdrawing money from a variable annuity?

Withdrawals from a variable annuity are taxed as ordinary income, and any earnings are subject to taxes. You may also face early withdrawal penalties if you withdraw funds before age 59 1/2.