Variable Annuity Taxable Income 2024 takes center stage as a crucial aspect of retirement planning. This type of annuity, unlike its fixed counterpart, allows for investment growth based on market performance, potentially leading to higher returns. However, this flexibility also comes with complex tax implications.

If you’re using a TI-84 calculator, this article can help you understand how to calculate annuities on this popular device: How To Calculate Annuities On Ti 84 2024.

Understanding how variable annuities are taxed in 2024 is essential for maximizing your retirement savings and minimizing your tax liability.

Annuity King Sarasota is a local company that specializes in annuities. This article provides information about Annuity King Sarasota in 2024: Annuity King Sarasota 2024.

This guide will delve into the intricacies of variable annuity taxation in 2024, providing insights into the tax treatment of premiums, investment growth, withdrawals, and strategies for minimizing your taxable income. We’ll also explore how recent tax changes may affect your variable annuity investment strategy and the importance of seeking professional financial advice.

The BA II Plus calculator is a popular tool for financial calculations. This article explains how to calculate annuities using the BA II Plus calculator in 2024: Calculate Annuity With Ba Ii Plus 2024.

Contents List

Variable Annuities: A Comprehensive Overview

Variable annuities are a type of annuity contract that offers investment growth potential, unlike traditional fixed annuities. These contracts allow you to invest your premium payments in a variety of sub-accounts, each representing a different investment option. The value of your annuity fluctuates based on the performance of the underlying investments.

Understanding how annuities are taxed can be crucial when planning for retirement. You can learn more about the specific tax implications of annuities in 2024 by reading this comprehensive article: How Annuity Is Taxed 2024.

Fundamental Characteristics of Variable Annuities

Variable annuities are characterized by their investment flexibility and potential for growth. They differ from traditional fixed annuities in that they do not guarantee a fixed rate of return. Instead, the value of your annuity is tied to the performance of the sub-accounts you choose.

Calculating the present value (PV) factor for an annuity can be a helpful tool for financial planning. This article provides guidance on how to calculate the annuity PV factor in 2024: How To Calculate Annuity Pv Factor 2024.

Key Features of Variable Annuities

- Investment Options:Variable annuities offer a wide range of investment options, such as stocks, bonds, and mutual funds, allowing you to tailor your portfolio to your risk tolerance and investment goals.

- Growth Potential:The potential for growth in a variable annuity is tied to the performance of the underlying investments. If your investments perform well, the value of your annuity will increase.

- Tax Deferral:Investment earnings within a variable annuity are tax-deferred, meaning you won’t have to pay taxes on them until you withdraw the money. This can be a significant advantage, especially for long-term investments.

- Guaranteed Minimum Death Benefit:Many variable annuities offer a guaranteed minimum death benefit, which ensures that your beneficiaries will receive at least a certain amount, even if the value of your annuity has declined.

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed income payments or protection against market losses. These benefits can provide additional security and peace of mind.

Investment Options in Variable Annuities

Variable annuities typically offer a variety of investment options, including:

- Mutual Funds:These funds pool money from multiple investors to invest in a diversified portfolio of securities. They offer a convenient way to diversify your investments and gain exposure to different asset classes.

- Exchange-Traded Funds (ETFs):ETFs are similar to mutual funds but are traded on stock exchanges. They offer a more liquid and transparent investment option.

- Separate Accounts:These accounts offer access to a wider range of investment options, including individual stocks, bonds, and other securities. They provide more control over your investment strategy but may require a higher minimum investment.

Examples of Variable Annuities in Retirement Planning

Variable annuities can be used in various retirement planning scenarios:

- Retirement Income:You can use a variable annuity to generate a stream of retirement income. You can choose to receive payments for life or for a specific period.

- Long-Term Growth:Variable annuities can be used to accumulate wealth over the long term. Their tax-deferred growth potential can help you reach your financial goals.

- Estate Planning:Variable annuities can be used to provide for your beneficiaries after your death. They can help ensure that your loved ones are financially secure.

Tax Implications of Variable Annuities: Variable Annuity Taxable Income 2024

Variable annuities have unique tax implications that you should understand before investing.

Transamerica offers a variable annuity called the O Share Variable Annuity. This article provides information about the Transamerica O Share Variable Annuity in 2024: Transamerica O Share Variable Annuity 2024.

Tax Treatment of Variable Annuity Premiums

Premiums you pay into a variable annuity are not tax-deductible. However, investment earnings within the annuity are tax-deferred, meaning you won’t have to pay taxes on them until you withdraw the money.

Variable annuities may come with surrender charges. It’s essential to understand these charges before investing. This article explains variable annuity surrender charges in 2024: Variable Annuity Surrender Charges 2024.

Taxation of Investment Growth

Investment growth within a variable annuity is tax-deferred, meaning you won’t have to pay taxes on it until you withdraw the money. When you withdraw funds from the annuity, the withdrawals are taxed as ordinary income.

Annuities can be a valuable tool for retirement planning. This article explores the role of annuities in retirement planning in 2024: Is Annuity Retirement 2024.

Tax Implications of Withdrawals

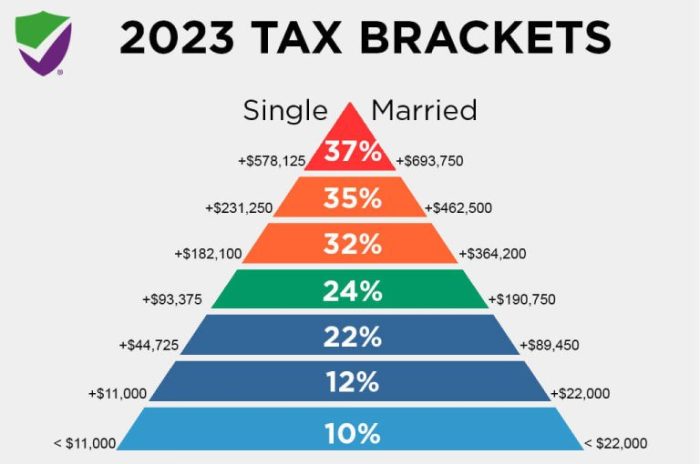

When you withdraw funds from a variable annuity, the withdrawals are taxed as ordinary income. This means that the withdrawals will be taxed at your ordinary income tax rate.

Variable annuities offer the potential for growth, but it’s important to understand their complexities. Check out this article for an overview of variable annuities in 2024: Variable Annuity 2024.

Comparison with Other Retirement Savings Vehicles

Variable annuities offer tax advantages compared to other retirement savings vehicles, such as traditional IRAs and 401(k)s. The tax-deferred growth potential can help you accumulate wealth more quickly. However, it’s important to consider the tax implications of withdrawals when comparing variable annuities to other options.

Taxable Income in 2024: A Focus on Variable Annuities

The tax landscape is constantly evolving, and it’s essential to stay informed about any changes that could affect your variable annuity investments.

Khan Academy offers valuable resources for learning about annuities. This article explores the annuity content available on Khan Academy in 2024: Annuity Khan Academy 2024.

Key Tax Changes in 2024

As of now, there are no significant tax changes specifically affecting variable annuities in 2024. However, it’s crucial to stay updated on any new tax legislation that could impact your investments.

Impact on Taxability of Variable Annuity Income

Any potential changes in tax laws could affect the taxability of variable annuity income. For example, changes to the tax rates or the treatment of withdrawals could impact your overall tax liability.

Annuity and IRA are often compared as retirement savings options. This article helps you understand the key differences between annuities and IRAs in 2024: Annuity Vs Ira 2024.

Impact on Investment Strategies

Tax legislation can influence your investment strategies within variable annuities. For example, if tax rates on withdrawals are increased, you might consider adjusting your withdrawal strategy to minimize your tax liability.

Annuity and IRA are often compared, but they have distinct features. This article will help you understand the key differences between annuities and IRAs in 2024: Is Annuity The Same As Ira 2024.

Practical Examples of Tax Changes

For example, if the tax rate on withdrawals from variable annuities is increased, you might consider withdrawing funds more frequently to take advantage of lower tax brackets. Alternatively, you might consider delaying withdrawals until you reach a lower tax bracket in retirement.

There are different types of annuities, including fixed and variable annuities. This article provides an overview of fixed and variable annuities in 2024: Fixed Variable Annuity 2024.

Strategies for Minimizing Taxable Income

Understanding the tax implications of variable annuities is crucial for minimizing your tax liability.

Annuity 95-1 is a specific type of annuity. This article provides information about Annuity 95-1 in 2024: Annuity 95-1 2024.

Structuring Investments to Minimize Taxes, Variable Annuity Taxable Income 2024

You can structure your variable annuity investments to minimize taxes by:

- Investing in tax-efficient funds:Choosing funds with low turnover rates can help minimize capital gains taxes.

- Using tax-loss harvesting:Selling losing investments to offset capital gains can reduce your overall tax liability.

- Taking advantage of tax-advantaged withdrawals:You can withdraw funds from a variable annuity using tax-advantaged strategies, such as the “death benefit” option, to minimize your tax liability.

Tax-Advantaged Withdrawals

Variable annuities offer various tax-advantaged withdrawal strategies, including:

- Death Benefit:You can withdraw funds from your annuity tax-free if you die before taking any distributions. This can be a valuable strategy for estate planning purposes.

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed income payments or protection against market losses. These benefits can provide additional security and peace of mind.

Role of Roth Conversions

Roth conversions can be a useful strategy for minimizing taxable income from variable annuities. By converting traditional IRA or 401(k) funds to a Roth IRA, you can avoid paying taxes on withdrawals in retirement.

Understanding the cash flows associated with an annuity is crucial for making informed financial decisions. This article explains how to calculate annuity cash flows in 2024: Calculating Annuity Cash Flows 2024.

Withdrawal Strategies and Tax Implications

| Withdrawal Strategy | Tax Implications |

|---|---|

| Withdrawals before age 59 1/2 | Taxed as ordinary income, plus a 10% penalty |

| Withdrawals after age 59 1/2 | Taxed as ordinary income |

| Death Benefit | Tax-free |

| Living Benefits | Tax implications vary depending on the specific benefit |

The Importance of Professional Advice

Variable annuities are complex financial products with significant tax implications. Seeking professional financial advice is crucial to make informed decisions.

Benefits of Professional Advice

Consulting with a tax advisor or financial planner can help you:

- Understand the tax implications of variable annuities:A professional can explain the tax rules and regulations that apply to variable annuities and help you understand the potential tax consequences of your investment decisions.

- Develop a tax-efficient investment strategy:A professional can help you develop a strategy that minimizes your tax liability while meeting your investment goals.

- Optimize your withdrawal strategy:A professional can help you determine the most tax-efficient way to withdraw funds from your variable annuity.

Key Questions to Ask a Financial Professional

When seeking professional advice about variable annuities, be sure to ask these questions:

- What are the tax implications of this particular variable annuity?

- What are the best withdrawal strategies for my situation?

- How can I minimize my tax liability on my variable annuity investments?

- What are the potential risks and benefits of investing in a variable annuity?

Conclusive Thoughts

Navigating the tax landscape of variable annuities in 2024 requires careful consideration. By understanding the tax implications, exploring strategies for minimizing taxable income, and seeking professional guidance, you can optimize your retirement savings and ensure a smoother tax experience. Remember, the key is to be informed and proactive in managing your variable annuity investments.

FAQ Resource

What is the difference between a variable annuity and a fixed annuity?

A variable annuity offers investment growth based on the performance of underlying investment options, while a fixed annuity provides a guaranteed rate of return.

How is investment growth within a variable annuity taxed?

Investment growth within a variable annuity is generally taxed as ordinary income when withdrawn, but there are exceptions for qualified withdrawals.

What are some strategies for minimizing taxable income from a variable annuity?

Strategies include tax-advantaged withdrawals, Roth conversions, and careful investment selection.

When should I seek professional financial advice regarding variable annuities?

It’s always advisable to consult with a financial professional to understand your individual tax situation and optimize your investment strategy.