Variable Annuity Units 2024 are a type of investment that allows individuals to participate in the growth potential of the stock market while also providing some protection against market downturns. These units are linked to the performance of underlying investments, such as mutual funds or exchange-traded funds, and their value fluctuates based on the market performance of those investments.

This

Variable annuities can involve charges. Read about A Variable Annuity Charges 2024 to understand the potential costs associated with them.

For those seeking information on annuities with a specific principal amount, explore the article on Annuity 300k 2024 to learn about its implications.

Annuity payments represent a structured stream of income. Explore the concept of Annuity Is Sequence Of Mode Of Payment 2024 to understand its fundamental nature.

approach offers a balance between potential growth and downside protection, making it an attractive option for investors seeking to diversify their portfolios and achieve long-term financial goals.

Variable annuity units are typically purchased through insurance companies and are often included as part of a larger retirement savings plan. They offer a number of potential benefits, including tax-deferred growth, guaranteed minimum death benefits, and the potential for higher returns compared to traditional fixed annuities.

For those who prefer using R for calculations, you can leverage its capabilities to determine annuity values. Learn more about this approach in the article on R Calculate Annuity 2024.

However, it is important to understand the risks associated with variable annuity units before investing, as their value can fluctuate significantly based on market conditions.

Contents List

- 1 Variable Annuity Units: An Overview

- 2 How Variable Annuity Units Work

- 3 Benefits of Variable Annuity Units

- 4 Risks Associated with Variable Annuity Units

- 5 Variable Annuity Units in 2024: Current Market Trends

- 6 Choosing the Right Variable Annuity Units

- 7 Variable Annuity Units and Tax Implications

- 8 Variable Annuity Units: Case Studies and Examples

- 9 Final Conclusion

- 10 FAQ Guide: Variable Annuity Units 2024

Variable Annuity Units: An Overview

Variable annuity units are a type of investment product that allows you to participate in the growth potential of the stock market while also providing some protection against market downturns. They are essentially shares in a mutual fund or other investment portfolio that is designed to grow over time.

Key Features of Variable Annuity Units

- Variable annuity units are linked to the performance of a specific underlying investment portfolio.

- The value of the units fluctuates based on the performance of the underlying investments.

- Variable annuity units offer the potential for growth, but they also carry the risk of losing money.

Types of Variable Annuity Units

- Index-Linked Variable Annuity Units:These units are linked to the performance of a specific stock market index, such as the S&P 500.

- Target-Date Variable Annuity Units:These units are designed for retirement planning and adjust their asset allocation over time to become more conservative as you approach retirement.

- Managed Variable Annuity Units:These units are managed by professional investment managers who select and allocate investments in the underlying portfolio.

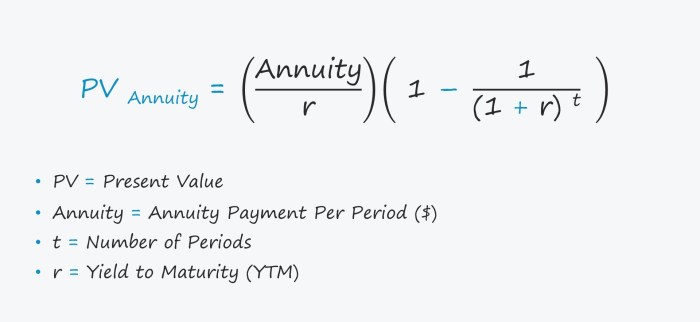

If you’re looking to understand the present value of an annuity, you can utilize Excel for calculations. Check out this guide on Pv Annuity Excel 2024 for a detailed breakdown of the process.

How Variable Annuity Units Work

The tax implications of annuity income can be complex. Explore the article on Is Immediate Annuity Income Taxable 2024 to understand the relevant tax rules.

Valuation and Pricing

Variable annuity units are valued based on the performance of the underlying investments. The price of a unit is determined by dividing the total value of the underlying portfolio by the number of units outstanding.

Impact of Underlying Investments

The performance of the underlying investments directly impacts the value of variable annuity units. If the investments in the underlying portfolio perform well, the value of the units will increase. Conversely, if the investments perform poorly, the value of the units will decrease.

Fees and Expenses

Variable annuity units come with a variety of fees and expenses, including management fees, administrative fees, and mortality and expense charges. These fees can impact the overall return on your investment.

Benefits of Variable Annuity Units

Growth Potential

Variable annuity units offer the potential for growth that is linked to the performance of the underlying investments. If the investments perform well, your units will increase in value.

If you’re considering annuities in the UK, obtaining quotes is a crucial step. Explore the article on Annuity Quotes Uk 2024 to learn about the process.

Income Generation

Some variable annuity units offer the option to receive income payments, either through a guaranteed minimum income benefit or through a withdrawal feature.

Variable annuities offer flexibility and potential growth. Learn about the characteristics and potential benefits of these instruments in the article on Variable Annuities Have 2024.

Retirement Planning

Variable annuity units can be a valuable tool for retirement planning. They offer the potential for growth and income generation, which can help you accumulate a nest egg for your retirement years.

Risks Associated with Variable Annuity Units

Loss of Principal

One of the biggest risks associated with variable annuity units is the potential for loss of principal. If the underlying investments perform poorly, the value of your units could decline, and you could lose some or all of your initial investment.

Fees and Expenses

Fees and expenses can significantly impact the overall return on your investment in variable annuity units. It is important to carefully consider the fees associated with any variable annuity unit before investing.

Market Volatility

Variable annuity units are subject to market volatility. This means that the value of your units can fluctuate significantly in response to changes in the market.

Variable annuities can offer diverse payout options. Read about Variable Annuity Payout 2024 to understand how these payouts can be structured.

Variable Annuity Units in 2024: Current Market Trends

Market Conditions

The current market conditions are uncertain, with inflation, rising interest rates, and geopolitical tensions impacting investment performance.

Investment Performance

The performance of variable annuity units in 2024 will likely be influenced by a number of factors, including the overall health of the economy, interest rate movements, and the performance of the underlying investments.

Future Trends

It is difficult to predict future trends in the variable annuity market. However, it is likely that investors will continue to seek out products that offer the potential for growth and income generation while also providing some protection against market downturns.

An annuity is a financial product that provides a series of payments over time. Discover more about An Annuity Is Known 2024 to understand its key features.

Choosing the Right Variable Annuity Units

Calculating annuity payouts is a key step in financial planning. Learn about the methods involved in Calculating An Annuity Payout 2024.

Factors to Consider

- Investment Goals:What are your investment goals? Are you looking for growth, income, or a combination of both?

- Risk Tolerance:How much risk are you willing to take? Variable annuity units can be risky investments, so it is important to choose a product that aligns with your risk tolerance.

- Fees and Expenses:Carefully consider the fees and expenses associated with any variable annuity unit before investing.

- Underlying Investments:What are the underlying investments in the variable annuity unit? Do they align with your investment goals?

Research and Comparison

It is important to thoroughly research and compare different variable annuity unit options before investing. You can consult with a financial advisor or use online resources to gather information.

Variable Annuity Units and Tax Implications

Excel can be a valuable tool for calculating annuities. Learn how to calculate annuities due in Excel with the guide on Calculating Annuity Due In Excel 2024.

Tax Treatment, Variable Annuity Units 2024

The tax treatment of variable annuity units can be complex. Distributions from variable annuity units are generally taxed as ordinary income. However, there may be tax-deferred growth opportunities depending on the specific features of the product.

Tax Strategies

It is important to consult with a tax advisor to understand the tax implications of investing in variable annuity units and to develop a tax strategy that meets your individual needs.

Variable Annuity Units: Case Studies and Examples

Deferred annuities provide income at a future date. If you’re interested in understanding how these annuities work, check out the guide on How To Calculate A Deferred Annuity 2024.

Real-World Examples

Variable annuity units have been used in a variety of investment portfolios. For example, they can be used as part of a retirement savings plan, as a way to generate income in retirement, or as a tool for long-term growth.

Annuity interest rates can vary. Learn about the characteristics of annuities with an 8% interest rate in the article on Annuity 8 Percent 2024.

Investment Strategies

There are a number of different investment strategies that can be used with variable annuity units. Some investors may choose to invest in a diversified portfolio of stocks and bonds, while others may focus on a specific sector or asset class.

Advantages and Disadvantages

Variable annuity units offer a number of potential advantages, including the potential for growth, income generation, and tax-deferred growth. However, they also come with risks, such as the potential for loss of principal and the impact of fees and expenses.

It is important to carefully consider the advantages and disadvantages of variable annuity units before investing.

Final Conclusion

Variable Annuity Units 2024 offer a unique blend of potential growth and downside protection, making them a valuable tool for investors seeking to diversify their portfolios and achieve their long-term financial goals. While there are risks associated with these units, understanding their intricacies and carefully considering your investment goals can help you make informed decisions.

By exploring the features, benefits, and risks of variable annuity units, you can determine if they are the right investment choice for your individual circumstances and financial aspirations.

FAQ Guide: Variable Annuity Units 2024

What are the tax implications of investing in Variable Annuity Units?

The tax implications of variable annuity units can vary depending on the specific type of unit and the investment strategy used. Generally, the growth of the investment is tax-deferred until withdrawals are made, and withdrawals are taxed as ordinary income.

However, certain withdrawals may be subject to early withdrawal penalties. It is important to consult with a tax professional to understand the specific tax implications of your variable annuity unit investment.

What are the fees associated with Variable Annuity Units?

Determining monthly annuity payments is crucial for financial planning. A comprehensive guide on Calculating Monthly Annuity 2024 can help you understand the factors involved.

Variable annuity units typically come with a range of fees, including administrative fees, mortality and expense charges, and investment management fees. These fees can impact the overall return on your investment, so it is important to carefully review the fee structure before investing.

Consider comparing the fees of different variable annuity unit options to find the most cost-effective choice for your needs.

How do I choose the right Variable Annuity Units for my investment goals?

Choosing the right variable annuity units depends on your individual investment goals, risk tolerance, and time horizon. Consider factors such as the underlying investments, fees, and potential for growth when making your decision. It is advisable to consult with a financial advisor to discuss your specific needs and receive personalized recommendations.