Variable Annuity Upon Death 2024: Planning for Your Legacy, this guide explores the complexities of variable annuities and their implications for your loved ones after your passing. It’s a topic that often gets overlooked, but understanding how these financial products work upon death can be crucial for ensuring your legacy is protected and your beneficiaries receive the intended benefits.

Annuity health insurance is a type of coverage that can protect your retirement income. Annuity Health Insurance 2024 provides information on the different types of health insurance available for annuities.

Variable annuities are financial products designed to provide a stream of income during retirement. However, they also offer a unique set of death benefit options that can provide financial security for your beneficiaries in the event of your passing. This guide will delve into the intricacies of these death benefit options, exploring their features, tax implications, and how they can be tailored to your specific needs and financial goals.

Contents List

Variable Annuity Basics

A variable annuity is a type of retirement savings product that offers the potential for growth in your investment portfolio, while also providing some protection against market downturns. It’s important to understand the core features of a variable annuity to make informed decisions about your retirement planning.

Core Features of a Variable Annuity

Variable annuities are known for their flexibility and potential for growth, but they also come with some complexities. Here are the key features:

- Investment Options:Variable annuities allow you to invest your contributions in a variety of sub-accounts, similar to mutual funds. These sub-accounts can include stocks, bonds, and other investment options. This provides you with the opportunity to tailor your investment strategy to your risk tolerance and investment goals.

To accurately calculate annuity payments, you need to understand the formula used. Annuity Formula Quarterly 2024 provides insights into the specific formula for quarterly payments.

- Growth Potential:The value of your variable annuity is directly tied to the performance of the sub-accounts you choose. If your investments perform well, the value of your annuity will grow. However, if your investments decline, the value of your annuity will also decrease.

An annuity with a principal of $30,000 can provide a stream of income for retirement. Annuity 30k 2024 offers insights into how this type of annuity works.

- Death Benefit:Variable annuities typically include a death benefit provision that guarantees a minimum payout to your beneficiary upon your death. The specific amount of the death benefit will depend on the type of death benefit option you choose and the value of your annuity at the time of your death.

A variable annuity license is required for professionals who want to sell these financial products. You can find more information on Variable Annuity License 2024 to learn about the licensing process.

- Tax Deferral:Contributions to a variable annuity grow tax-deferred, meaning you won’t have to pay taxes on the earnings until you withdraw them in retirement. This can help you accumulate more wealth over time.

- Guaranteed Minimum Income:Some variable annuities offer a guaranteed minimum income rider. This rider guarantees a minimum payout for life, regardless of how your investments perform. This can provide you with some peace of mind, knowing that you’ll have a steady stream of income in retirement.

When considering retirement savings, it’s important to weigh the pros and cons of different options. Variable Annuity Or Roth Ira 2024 provides a comparison to help you decide what’s best for you.

Investment Options within a Variable Annuity

The investment options available within a variable annuity are typically designed to provide a range of risk and return profiles. These options can include:

- Stock Sub-Accounts:These sub-accounts invest in a diversified portfolio of stocks, offering the potential for higher returns but also higher risk.

- Bond Sub-Accounts:These sub-accounts invest in bonds, which are typically considered less risky than stocks. They offer a lower potential for returns but also a lower risk of losing money.

- Money Market Sub-Accounts:These sub-accounts invest in short-term debt securities, providing a low level of risk and a relatively stable return.

- Target-Date Funds:These sub-accounts automatically adjust their asset allocation over time, becoming more conservative as you approach retirement. They can be a good option for investors who want a hands-off approach to managing their investments.

Variable Annuity Payouts vs. Fixed Annuities

The payout structure of a variable annuity differs significantly from that of a fixed annuity. In a fixed annuity, you receive a guaranteed fixed income stream for life. The amount of your payments is predetermined and doesn’t fluctuate based on market performance.

With a variable annuity, your payouts are not guaranteed and will depend on the performance of your investments. You have the potential for higher returns, but also the risk of lower returns or even losses.

To determine the required annuity payments over a specific period, you can use online calculators or consult with a financial advisor. What Annuity Is Required Over 12 Years 2024 offers insights into calculating these payments.

Here’s a table summarizing the key differences between variable and fixed annuities:

| Feature | Variable Annuity | Fixed Annuity |

|---|---|---|

| Investment Options | Wide range of investment options, including stocks, bonds, and money market funds | Guaranteed fixed interest rate |

| Payout | Not guaranteed, depends on investment performance | Guaranteed fixed income stream for life |

| Risk | Higher risk, potential for higher returns | Lower risk, lower potential for returns |

| Taxation | Tax-deferred growth, taxes paid upon withdrawal | Tax-deferred growth, taxes paid upon withdrawal |

Death Benefit Provisions

A key feature of variable annuities is the death benefit provision, which ensures a minimum payout to your beneficiary upon your death. This benefit can provide financial security for your loved ones and help them meet their needs after you’re gone.

Excel is a powerful tool for financial calculations, including annuity present value. Calculating Annuity Present Value In Excel 2024 offers a guide on how to use Excel for these calculations.

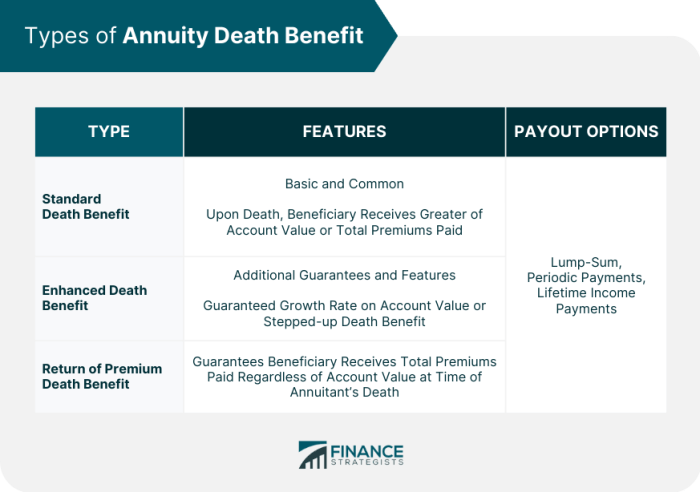

Types of Death Benefit Options

Variable annuity providers offer various death benefit options, each with its own characteristics and potential benefits. The most common types include:

- Return of Premium:This option guarantees the return of your premium payments to your beneficiary. It provides a basic level of protection and ensures that your beneficiary will receive at least what you paid into the annuity.

- Maximum Death Benefit:This option guarantees a minimum death benefit that is typically equal to the highest value your annuity reached during its lifetime. This option provides a higher level of protection than the return of premium option, but it also carries a higher cost.

Variable annuities invest in a variety of funds, offering diversification. Variable Annuity Funds 2024 provides insights into the different types of funds available within these annuities.

- Guaranteed Minimum Income:Some variable annuities offer a death benefit that provides a guaranteed minimum income stream to your beneficiary for life. This option can provide a steady stream of income for your beneficiary and help them meet their long-term financial needs.

- Lump-Sum Death Benefit:This option allows your beneficiary to receive the full value of your annuity as a lump sum payment. This option can be beneficial if your beneficiary needs a large amount of cash immediately.

Death Benefit Calculations

The amount of the death benefit you receive will depend on the specific type of death benefit option you choose and the value of your annuity at the time of your death. For example, if you choose the return of premium option, your beneficiary will receive the total amount of premiums you paid into the annuity, regardless of how your investments performed.

An annuity is a financial product that provides regular payments over a specific period. Annuity Meaning With Example 2024 explains the concept of annuities with real-world examples.

If you choose the maximum death benefit option, your beneficiary will receive the highest value your annuity reached during its lifetime, even if the value has decreased since then.

Jackson National is a well-known provider of variable annuities. Variable Annuity Jackson National Review 2024 offers an overview of their offerings and reviews.

Advantages and Disadvantages of Death Benefit Choices, Variable Annuity Upon Death 2024

The choice of death benefit option is a personal one that should be based on your individual circumstances and goals. Here’s a breakdown of the advantages and disadvantages of each option:

| Death Benefit Option | Advantages | Disadvantages |

|---|---|---|

| Return of Premium | Provides a guaranteed minimum payout to your beneficiary. | May not provide adequate protection if your investments perform poorly. |

| Maximum Death Benefit | Provides a higher level of protection than the return of premium option. | Can be more expensive than the return of premium option. |

| Guaranteed Minimum Income | Provides a guaranteed income stream for your beneficiary for life. | Can be more expensive than other death benefit options. |

| Lump-Sum Death Benefit | Provides a large amount of cash to your beneficiary immediately. | May not provide adequate protection if your investments perform poorly. |

Tax Implications Upon Death

The tax implications of a variable annuity death benefit can vary depending on the beneficiary’s relationship to the deceased and the type of death benefit received. Understanding these tax implications is crucial for making informed decisions about your variable annuity and ensuring your beneficiary receives the maximum benefit.

Receiving the Death Benefit

When you pass away, your beneficiary will receive the death benefit from your variable annuity. The way they receive it depends on the death benefit option you selected. For example, if you chose a lump-sum death benefit, they will receive the full value of your annuity in a single payment.

If you chose a guaranteed minimum income option, they will receive regular payments for life.

Variable annuities come in various forms, including non-proprietary options. Variable Annuity Non Prop 2024 provides information on these non-proprietary annuities.

Potential Tax Consequences

The beneficiary’s tax situation upon receiving the death benefit depends on how the annuity was structured and the beneficiary’s relationship to the deceased. Here are some potential tax scenarios:

- Taxable Income:If the annuity was held in a non-qualified account, the death benefit will be taxed as ordinary income to the beneficiary. This means the beneficiary will need to pay taxes on the entire amount of the death benefit.

- Tax-Free Inheritance:If the annuity was held in a qualified account, such as an IRA or 401(k), the death benefit may be tax-free to the beneficiary, depending on the beneficiary’s relationship to the deceased and other factors.

- Step-Up in Basis:If the annuity was held in a non-qualified account, the beneficiary will receive a step-up in basis for the annuity. This means that the beneficiary’s cost basis for the annuity will be equal to the fair market value of the annuity at the time of your death.

Variable annuities come with various charges, including administrative fees and investment expenses. Variable Annuity Charges 2024 provides information on these charges to help you understand the costs involved.

This can reduce the amount of capital gains tax the beneficiary will have to pay if they sell the annuity in the future.

Tax-Efficient Strategies

There are several strategies that can help minimize the tax implications of a variable annuity death benefit. Here are a few key considerations:

- Consult with a Tax Advisor:It’s always advisable to consult with a qualified tax advisor to discuss the specific tax implications of your variable annuity and determine the most tax-efficient strategy for your beneficiary.

- Consider Beneficiary Designation:Carefully consider the beneficiary designation for your variable annuity. You can choose a spouse, child, or other individual as your beneficiary. The beneficiary’s tax status can impact the tax implications of the death benefit.

- Maximize Tax-Advantaged Accounts:If you’re still accumulating wealth, consider maximizing your contributions to tax-advantaged accounts, such as IRAs and 401(k)s. These accounts can provide tax-free growth and potentially reduce the tax burden on your beneficiary.

Considerations for 2024: Variable Annuity Upon Death 2024

The variable annuity landscape is constantly evolving, with new regulations, market trends, and product innovations emerging. It’s essential to stay informed about the latest developments to make informed decisions about your variable annuity in 2024.

Regulatory Changes and Tax Laws

Keep an eye on any changes to variable annuity regulations or tax laws that may be enacted in 2024. These changes could affect the tax treatment of your annuity, the investment options available, or the death benefit provisions. Consult with a financial advisor or tax professional to understand the implications of any new regulations.

Emerging Trends and Innovations

The variable annuity market is dynamic, with new product innovations emerging regularly. In 2024, look for trends like:

- Increased Focus on Guaranteed Income Riders:As people seek greater financial security in retirement, variable annuities with guaranteed income riders are likely to gain popularity. These riders provide a guaranteed minimum income stream, regardless of market performance, which can be a valuable feature for retirees.

Understanding the contribution limits for variable annuities is crucial for planning your retirement savings. You can find the latest information on Variable Annuity Contribution Limits 2024 to make informed decisions about your investments.

- Personalized Investment Options:Variable annuities are increasingly offering personalized investment options tailored to individual risk profiles and investment goals. This allows investors to customize their portfolios to meet their specific needs.

- Digital Platforms and Technology:The use of digital platforms and technology is becoming more prevalent in the variable annuity market. This can make it easier for investors to manage their accounts, access information, and make investment decisions.

Economic Conditions and Variable Annuities

Economic conditions can significantly impact the performance of variable annuities. In 2024, it’s essential to consider the potential impact of factors such as:

- Interest Rate Changes:Rising interest rates can affect the performance of bonds, which are a significant component of many variable annuity portfolios. Investors should consider the potential impact of interest rate changes on their investments.

- Inflation:High inflation can erode the purchasing power of your investment returns. It’s essential to consider the impact of inflation on your investment strategy and ensure your portfolio can keep pace with rising prices.

- Market Volatility:Market volatility can impact the value of your investments. Consider your risk tolerance and adjust your investment strategy accordingly. You may want to consider more conservative investment options if you’re concerned about market volatility.

Examples of Variable Annuity Death Benefit Scenarios

Here are some examples of variable annuity death benefit scenarios that illustrate the potential impact of different death benefit choices:

| Scenario | Death Benefit Type | Investment Performance | Beneficiary’s Tax Situation | Outcome |

|---|---|---|---|---|

| John, 65, dies with a variable annuity worth $100,000. He chose the return of premium option. He paid $80,000 in premiums. | Return of Premium | N/A | Taxable as ordinary income | John’s beneficiary receives $80,000, the total amount of premiums paid. They will pay taxes on this amount. |

| Mary, 70, dies with a variable annuity worth $120,000. She chose the maximum death benefit option. The highest value her annuity reached was $150,000. | Maximum Death Benefit | N/A | Taxable as ordinary income | Mary’s beneficiary receives $150,000, the highest value her annuity reached. They will pay taxes on this amount. |

| David, 75, dies with a variable annuity worth $90,000. He chose the guaranteed minimum income option, which guarantees a monthly payout of $1,000 for life. | Guaranteed Minimum Income | N/A | Taxable as ordinary income | David’s beneficiary receives a monthly payment of $1,000 for life. They will pay taxes on each payment. |

| Sarah, 68, dies with a variable annuity worth $110,000. She chose the lump-sum death benefit option. | Lump-Sum Death Benefit | N/A | Taxable as ordinary income | Sarah’s beneficiary receives $110,000 as a lump-sum payment. They will pay taxes on this amount. |

Epilogue

Variable annuities, with their diverse death benefit options, offer a valuable tool for estate planning and legacy building. By understanding the intricacies of these products, you can ensure your loved ones are financially protected after your passing. This guide has provided an overview of the key considerations, including the types of death benefits, tax implications, and emerging trends in the variable annuity market.

It’s essential to consult with a financial advisor to determine the most suitable death benefit options for your individual circumstances and to navigate the complex landscape of variable annuities effectively.

There are various annuity options available, each with its own features and benefits. Exploring Annuity Options 2024 can help you find the right one for your retirement goals.

FAQ Insights

What is the difference between a variable annuity and a fixed annuity?

A variable annuity’s payout depends on the performance of the underlying investments, while a fixed annuity provides a guaranteed rate of return.

Can I change the beneficiary of my variable annuity?

Yes, you can typically change the beneficiary of your variable annuity by contacting your insurance company.

What happens if I die before my variable annuity has accumulated enough value to cover the death benefit?

If you’re using a TI-84 calculator, learning how to calculate annuities can be a valuable skill. Check out How To Calculate Annuities On Ti 84 2024 for a step-by-step guide.

The insurance company will typically pay out the death benefit based on the accumulated value of the annuity at the time of death, even if it’s less than the guaranteed minimum death benefit.