Variable Annuity Vs Indexed Annuity 2024: Navigating the world of retirement savings can be a daunting task, especially when faced with complex financial instruments like annuities. Understanding the nuances of variable annuities and indexed annuities is crucial for making informed decisions about your long-term financial well-being.

These two types of annuities offer distinct approaches to wealth accumulation, each with its own set of advantages and disadvantages. Variable annuities, known for their market-linked growth potential, allow investors to participate in the ups and downs of the stock market.

Annuities are commonly used to provide a steady income stream. Annuity Is Primarily Used To Provide 2024 explores the various ways annuities can be used to meet your financial needs, offering a comprehensive overview of their potential applications.

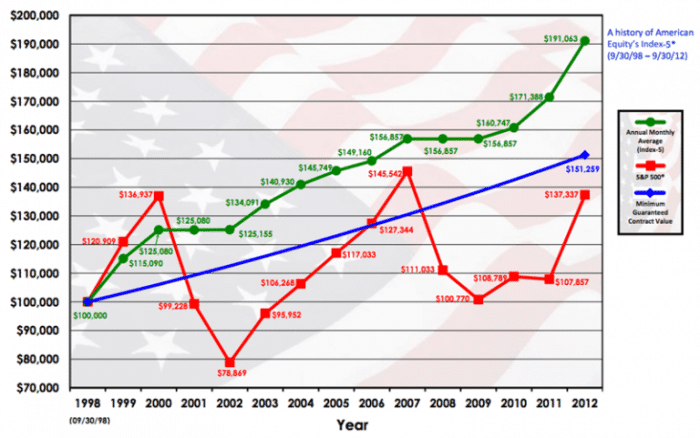

Indexed annuities, on the other hand, provide a balance between potential growth and downside protection by linking returns to a specific market index, such as the S&P 500.

Variable annuities are often linked to underlying investments. Variable Annuity Units 2024 explains how these units work and how their value can fluctuate based on market performance.

Contents List

Variable Annuities vs. Indexed Annuities: Which Is Right for You in 2024?

Choosing the right investment strategy is crucial, especially in today’s dynamic market. Two popular options that often come up in conversations about retirement planning are variable annuities and indexed annuities. Both offer potential for growth, but they come with distinct features and risk profiles.

This article will delve into the key characteristics of each, exploring their strengths, weaknesses, and suitability in the context of 2024’s economic landscape.

Are annuities the right investment for you? Is Annuity Good Investment 2024 explores the pros and cons of annuities, helping you determine if they align with your financial goals.

Variable Annuities, Variable Annuity Vs Indexed Annuity 2024

Variable annuities are investment-driven contracts that allow you to invest in a variety of sub-accounts, typically mutual funds. These sub-accounts are designed to grow in value over time, mirroring the performance of the underlying investments. This means your returns are tied to the performance of the stock market, bonds, or other assets you choose.

Looking for a way to ensure a steady stream of income in retirement? 4 Annuity 2024 can be a great option. They offer a guaranteed payout for a set period of time, providing peace of mind during your golden years.

The primary advantage of variable annuities lies in their potential for significant growth. As the market rises, your annuity’s value can increase accordingly. However, this potential for growth comes with a significant caveat: risk. Because your investment is directly linked to market fluctuations, the value of your annuity can also decline during periods of market downturns.

If you’re considering annuities for your retirement planning, 7 Annuities 2024 is a helpful resource to explore. It provides insights into different types of annuities and how they can be tailored to your specific needs.

Indexed Annuities

Indexed annuities, on the other hand, offer a different approach to market participation. These contracts link their returns to the performance of a specific market index, such as the S&P 500. While your returns may not mirror the index’s performance exactly, they typically provide a percentage of the index’s growth.

Looking for information about a specific type of annuity? Annuity 5 2024 delves into the details of this particular annuity, helping you understand its features and potential benefits.

The key advantage of indexed annuities is their downside protection. Unlike variable annuities, your investment is shielded from losses if the market declines. This protection is usually provided through a guaranteed minimum return, which ensures you’ll receive a specific interest rate regardless of the index’s performance.

Planning for retirement often involves calculating your annuity payments. Calculating Retirement Annuity 2024 provides a guide to estimating your future income stream, helping you plan for a comfortable retirement.

While this downside protection limits potential gains, it offers peace of mind for investors who prioritize safety over maximum growth.

Understanding the interest earned on your annuity is crucial for making informed decisions. Interest Calculator Annuity 2024 allows you to estimate your potential returns, helping you plan for your financial future.

Key Differences: Variable vs. Indexed Annuities

| Feature | Variable Annuity | Indexed Annuity |

|---|---|---|

| Investment Strategy | Direct investment in sub-accounts (mutual funds) | Linked to a market index (e.g., S&P 500) |

| Growth Potential | Higher potential for growth, but also higher risk | Limited growth potential, but with downside protection |

| Risk Level | High risk, as returns are tied to market performance | Lower risk due to downside protection and guaranteed minimum return |

| Guarantees | Typically offer death benefit guarantees | Guaranteed minimum return and downside protection |

| Fees | Higher fees due to complex investment structure | Lower fees compared to variable annuities |

The suitability of each annuity type depends heavily on your individual risk tolerance and financial goals. If you have a higher risk tolerance and are seeking the potential for significant growth, a variable annuity might be a suitable option. However, if you prioritize safety and downside protection, an indexed annuity might be a better choice.

Schwab offers a user-friendly annuity calculator to help you estimate your potential payments. Annuity Calculator Schwab 2024 provides a valuable tool for exploring different annuity options and understanding their financial implications.

Factors to Consider in 2024

The current economic climate plays a significant role in determining the performance and suitability of both variable and indexed annuities. Interest rates and inflation are key factors to consider. Rising interest rates can negatively impact the value of fixed income investments, potentially affecting variable annuities.

If you’re comfortable with Excel, Calculate Annuity On Excel 2024 provides guidance on using Excel formulas to calculate annuity payments, allowing you to take control of your financial planning.

Inflation, on the other hand, can erode the purchasing power of your returns, impacting both annuity types.

Wondering about the tax implications of annuities? Is Annuity Subject To Rmd 2024 provides insights into how Required Minimum Distributions (RMDs) apply to annuities, helping you plan for your tax obligations.

Market trends also play a crucial role. If the market is expected to experience significant volatility, indexed annuities with downside protection might be more attractive. However, if the market is expected to rise steadily, variable annuities could offer greater potential for growth.

Annuities are often described as a series of equal payments. Annuity Is A Series Of Equal Payments 2024 explores this concept in more detail, helping you understand the fundamentals of annuities.

It’s essential to stay informed about market conditions and seek professional advice to make an informed decision.

Seeking Professional Advice

Choosing between variable and indexed annuities is a complex decision that should not be taken lightly. It’s highly recommended to consult with a qualified financial advisor who can assess your individual circumstances, risk tolerance, and financial goals. An advisor can help you understand the nuances of each annuity type, compare their features, and determine the most suitable option for your specific needs.

Want to calculate the future value of your annuity? Fv Calculator Annuity 2024 can help you project how much your annuity will be worth in the future, giving you a clearer picture of your financial security.

Final Review

Choosing between a variable annuity and an indexed annuity requires careful consideration of your individual risk tolerance, investment goals, and financial situation. While variable annuities offer the potential for higher returns, they also carry a greater level of risk.

Indexed annuities, with their downside protection, may be a more suitable option for investors seeking a more conservative approach. Ultimately, consulting with a qualified financial advisor can help you determine the most appropriate annuity type for your specific circumstances.

General Inquiries: Variable Annuity Vs Indexed Annuity 2024

What are the tax implications of variable annuities and indexed annuities?

Understanding the difference between fixed and variable annuities is key to making an informed choice. Fixed Variable Annuity Definition 2024 breaks down the key characteristics of each type, allowing you to make the best decision for your situation.

Both variable and indexed annuities offer tax-deferred growth, meaning that you won’t pay taxes on the earnings until you withdraw them in retirement. However, withdrawals from annuities are generally taxed as ordinary income.

How do I choose the right annuity for my needs?

Need to calculate annuity payments but don’t have a financial calculator handy? Calculate Annuity Hp10bii 2024 can guide you through the process using your HP10bii calculator, making it easier to understand your future income potential.

The best annuity for you depends on your individual circumstances, including your risk tolerance, time horizon, and financial goals. It’s essential to consult with a financial advisor to determine the most appropriate annuity option for your situation.

Are there any fees associated with annuities?

Yes, annuities typically come with fees, including administrative fees, mortality and expense charges, and surrender charges. It’s important to carefully review the fees associated with any annuity before making a decision.

Can I withdraw money from my annuity before retirement?

You may be able to withdraw money from your annuity before retirement, but you may be subject to penalties. The specific rules governing withdrawals vary depending on the type of annuity and the terms of your contract.