W9 Form October 2024 changes and updates are here, bringing new requirements and adjustments for individuals and businesses alike. The W9 Form, a crucial document for tax reporting, has undergone revisions, impacting how you provide your tax information. This guide explores the key changes, their implications, and how to navigate the updated form effectively.

The changes aim to enhance tax compliance and streamline the reporting process. This update is essential for ensuring accurate tax reporting and minimizing potential penalties. This guide provides a comprehensive overview of the W9 Form changes, covering everything from understanding the updates to completing and filing the form correctly.

Contents List

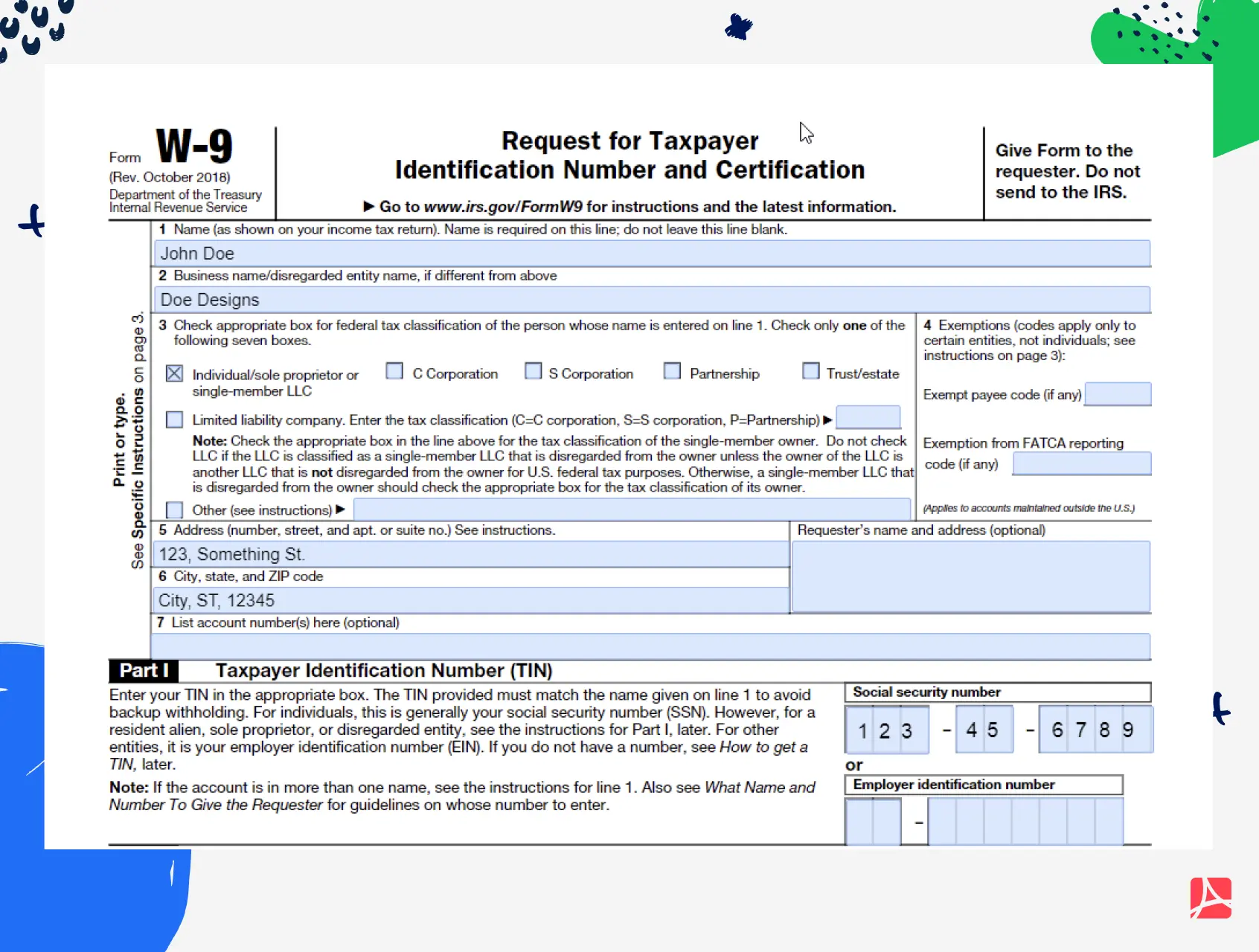

W9 Form: An Overview

The W9 Form is a crucial document used in the United States for tax reporting purposes. It serves as a request for taxpayer identification numbers (TINs) and is essential for individuals and businesses engaging in various financial transactions.

The mileage rate for October 2024 is an important factor for those using their vehicles for business purposes. This article provides the current mileage rate and explains how to use it for tax deductions.

Purpose of the W9 Form, W9 Form October 2024 changes and updates

The primary purpose of the W9 Form is to provide the Internal Revenue Service (IRS) with accurate taxpayer information, enabling them to properly track and report income and withhold taxes. It is used by businesses and organizations to collect the necessary information from individuals and other entities for tax reporting and compliance.

With the October 2024 deadline approaching, it’s crucial to understand the tax deadline for businesses. This article outlines the specific requirements and potential consequences of missing the deadline.

Significance of the W9 Form

The W9 Form plays a significant role in financial transactions by:* Ensuring accurate tax reporting:The form provides the IRS with the necessary information to correctly track income and withhold taxes, preventing errors and potential penalties.

Facilitating tax compliance

By providing the required taxpayer information, individuals and businesses can comply with tax regulations and avoid legal issues.

If you’re a small business owner, you might be interested in the IRA contribution limits for 2024. This article discusses the specific rules and regulations for small business owners, helping you make informed decisions about your retirement savings.

Streamlining financial transactions

Wondering if the mileage rate is changing in October 2024? This article addresses this common question, providing clarity on any potential changes to the mileage rate for business and work-related travel.

The W9 Form helps simplify the process of collecting and reporting tax-related information, making financial transactions more efficient.

It’s important to stay informed about tax bracket changes for 2024. This article provides a clear overview of the new tax brackets, explaining how they might affect your tax liability and financial planning.

Key Sections of the W9 Form

The W9 Form, a vital document for tax purposes, requires specific information to facilitate accurate reporting of income and tax withholding. Understanding the form’s sections and their purpose is crucial for accurate completion.

The October 2024 tax deadline applies to retirees as well. This article provides specific information for retirees, outlining the important deadlines and requirements they need to be aware of.

Requestor’s Name, Address, and Taxpayer Identification Number (TIN)

This section captures information about the entity requesting the W9 form. The information is crucial for proper identification and communication.

Understanding the tax brackets for 2024 is crucial for accurate tax planning. This article breaks down the different tax brackets, explaining how they work and how they might impact your tax liability.

- Requestor’s Name:The legal name of the organization or individual requesting the W9 form. For example, “ABC Corporation” or “John Doe”.

- Requestor’s Address:The complete address of the requestor, including street address, city, state, and ZIP code. This allows for accurate communication and ensures the form is sent to the correct location.

- Requestor’s TIN:This is the requestor’s Employer Identification Number (EIN) if they are a business or their Social Security Number (SSN) if they are an individual. This information is essential for tax reporting and withholding purposes.

Payer’s Name, Address, and TIN

This section gathers information about the entity paying the income. This information is crucial for accurate tax reporting and withholding.

- Payer’s Name:The legal name of the entity making the payment. This can be a business, an individual, or a government agency. For example, “XYZ Company” or “Jane Smith”.

- Payer’s Address:The complete address of the payer, including street address, city, state, and ZIP code. This ensures that the payer’s information is accurate and can be used for communication and tax reporting purposes.

- Payer’s TIN:This is the payer’s Employer Identification Number (EIN) if they are a business or their Social Security Number (SSN) if they are an individual. This information is essential for accurate tax reporting and withholding purposes.

Payee’s Name, Address, and TIN

This section captures information about the recipient of the income, also known as the payee. This information is crucial for accurate tax reporting and withholding.

- Payee’s Name:The legal name of the individual or entity receiving the income. For example, “John Smith” or “ABC Corporation”.

- Payee’s Address:The complete address of the payee, including street address, city, state, and ZIP code. This information ensures that the payee receives communication and tax forms correctly.

- Payee’s TIN:This is the payee’s Social Security Number (SSN) if they are an individual or their Employer Identification Number (EIN) if they are a business. This information is vital for tax reporting and withholding purposes.

Exemption from Backup Withholding

This section allows the payee to claim an exemption from backup withholding. Backup withholding is a tax withholding measure that applies to certain situations where the IRS has reason to believe that the payee might not be reporting their income correctly.

- Exemption from Backup Withholding:This section allows the payee to claim an exemption from backup withholding if they meet certain criteria. This might include providing a valid TIN or indicating that they are exempt due to being a foreign person or a U.S.

citizen or resident who is exempt from backup withholding.

- Certification:The payee must certify that they are not subject to backup withholding by signing and dating the form.

Other Information

This section allows the payee to provide additional information, such as their business activity code, the name of their business, and their state identification number.

The tax bracket calculator for 2024 is a valuable tool for estimating your tax liability. This article explains how to use the calculator effectively and provides insights into tax bracket implications.

- Business Activity Code:This code categorizes the payee’s business activity. This information is used by the IRS for statistical purposes and for identifying the payee’s industry.

- Business Name:This section allows the payee to provide the name of their business if they are a sole proprietor or a partnership. This information helps to distinguish the payee from other entities with similar names.

- State Identification Number:Some states require businesses to have a state identification number. This section allows the payee to provide this information if applicable.

Completing the W9 Form

The W9 form is a crucial document for individuals and businesses who are paid by others for services rendered or goods sold. It’s essential to complete the form accurately and provide all necessary information to ensure proper tax reporting.

The October 2024 tax deadline also applies to foreign nationals residing in the US. This article clarifies the specific requirements and deadlines for foreign nationals filing their taxes.

Completing the W9 form correctly is critical for several reasons. It ensures that the payer reports your income accurately, avoids penalties for incorrect reporting, and helps you receive the appropriate tax forms at the end of the year.

Are you planning to contribute to a SEP IRA in 2024? This article explains the contribution limits for SEP IRAs in 2024, helping you make informed decisions about your retirement savings.

Providing Accurate Information

Providing accurate information on the W9 form is vital for smooth tax reporting and prevents complications with the IRS.

- Double-check all details, including your name, address, Social Security Number (SSN) or Taxpayer Identification Number (TIN), and business structure.

- If you’re unsure about a specific section, refer to the IRS instructions provided on the W9 form or visit the IRS website for guidance.

- Use a black or blue pen to fill out the form neatly and legibly.

- Avoid using white-out or erasing mistakes. If you make an error, start over with a new form.

Understanding Common Errors

Here are some common mistakes to avoid when completing the W9 form:

- Incorrect Name:Ensure you provide your legal name as it appears on your tax records.

- Incorrect Address:Provide your current mailing address where you want to receive tax-related documents.

- Missing or Incorrect TIN:Use your SSN if you are an individual or your TIN if you are a business.

- Incorrect Business Structure:Accurately identify your business structure, such as sole proprietorship, partnership, corporation, or LLC.

- Incorrect Exemption Status:Choose the appropriate exemption status if applicable. For example, if you are a tax-exempt organization, mark the relevant box.

- Missing Signature:Ensure you sign and date the form in the designated space.

Tips for Avoiding Errors

- Use the IRS Website:Refer to the IRS website for detailed instructions, FAQs, and examples of completed forms.

- Review Before Submitting:Carefully review the completed form for any errors before submitting it to the payer.

- Keep a Copy:Keep a copy of the completed W9 form for your records.

Filing the W9 Form

The W9 Form is crucial for individuals and businesses to provide their tax information to payers, enabling accurate reporting of income and withholding taxes. Filing the form correctly and on time is essential to avoid penalties and ensure smooth financial transactions.

Are you a freelancer working towards the October 2024 tax deadline? This article provides a detailed breakdown of the deadline, including important factors to consider, such as income thresholds and specific requirements for freelancers.

Methods for Filing the W9 Form

The IRS offers various methods for filing the W9 Form, providing flexibility and convenience for taxpayers.

- By Mail:The most traditional method involves printing the W9 Form from the IRS website, completing it, and mailing it to the payer. This method is suitable for individuals and businesses who prefer a physical copy or have limited access to online services.

- Online:Many online platforms and software solutions allow taxpayers to electronically complete and submit the W9 Form. This method is often faster and more convenient, especially for individuals and businesses who frequently file the form.

- Fax:Some payers may accept the W9 Form via fax. However, this method is becoming less common as electronic filing options become more prevalent.

Deadlines for Filing the W9 Form

The deadline for filing the W9 Form is generally determined by the payer and their specific requirements.

For those seeking tax credits, this article outlines the available tax credits and how to claim them before the October 2024 deadline.

- Initial Filing:When establishing a new business relationship with a payer, the W9 Form should be filed as soon as possible.

- Updates:If any information on the W9 Form changes, such as your name, address, or tax identification number, you should update the form and submit it to the payer promptly.

Consequences of Late Filing

Failing to file the W9 Form on time can result in various consequences, including:

- Incorrect Withholding:Without accurate tax information, payers may withhold taxes incorrectly, potentially leading to underpayment or overpayment of taxes.

- Penalties:The IRS may impose penalties for late filing, particularly if the delay is deemed intentional or due to negligence.

- Delayed Payments:Payers may delay payments until they receive a valid W9 Form, impacting your cash flow and financial planning.

Understanding the W9 Form Requirements: W9 Form October 2024 Changes And Updates

The W9 Form is not just a simple form; it carries significant legal weight and compliance requirements. Understanding these requirements is crucial to avoid penalties and ensure smooth financial transactions.

Stay organized and efficient with your tax preparation by following these tax preparation tips for the October 2024 deadline. This article provides practical advice for a smoother tax filing experience.

Legal Requirements

The Internal Revenue Service (IRS) mandates the use of the W9 Form for various purposes, including:

- Reporting your taxpayer identification number (TIN) to the IRS.

- Providing your name, address, and other essential information.

- Confirming your status as an individual, corporation, partnership, or other entity.

The W9 Form plays a vital role in ensuring accurate tax reporting and preventing tax fraud. It helps the IRS track payments made to individuals and entities, facilitating proper tax collection and administration.

Penalties for Non-Compliance

Failure to comply with W9 Form requirements can lead to serious consequences, including:

- Withholding:The payer may withhold a higher percentage of your payment, often at the highest rate, as a backup withholding measure. This significantly reduces your income.

- Penalties:The IRS can impose penalties for failing to provide a valid W9 Form, including fines and interest charges.

- Audits:Non-compliance can trigger an IRS audit, leading to scrutiny of your financial records and potential adjustments to your tax liability.

- Legal Issues:In extreme cases, non-compliance can result in legal action, including lawsuits or criminal charges.

Resources for Obtaining Further Information

For comprehensive information on the W9 Form, its requirements, and potential penalties, you can refer to the following resources:

- IRS Website:The official IRS website provides detailed guidance, FAQs, and downloadable forms. You can find specific information about the W9 Form, its requirements, and compliance procedures. (https://www.irs.gov)

- Tax Professionals:Consulting a qualified tax professional can provide personalized advice and guidance on completing the W9 Form accurately and avoiding potential issues.

- Legal Counsel:If you face complex legal issues related to the W9 Form, seeking legal counsel from a tax attorney can ensure proper compliance and protect your interests.

Impact on Tax Reporting

The W9 Form plays a crucial role in ensuring accurate tax reporting for both individuals and businesses. It provides the Internal Revenue Service (IRS) with the necessary information to correctly withhold taxes and report income. This information is essential for accurate tax filings and prevents discrepancies between reported income and actual earnings.

Withholding Taxes

The W9 Form helps determine the correct amount of taxes to be withheld from payments made to individuals and businesses. It provides the payer with the payee’s tax identification number (TIN), which is used to determine the applicable tax rates and withholding requirements.

For example, if an individual provides their Social Security number on the W9 Form, the payer will withhold taxes at the appropriate rate based on the individual’s tax bracket.

If a business provides its Employer Identification Number (EIN) on the W9 Form, the payer will withhold taxes based on the business’s tax structure.

For instance, a corporation may be subject to different withholding rates than a partnership or a sole proprietorship.

If you’re driving for work, you’ll want to know about the mileage rate for driving to work in October 2024. This article provides the latest information on the mileage rate and how it applies to your tax deductions.

The W9 Form also allows the payee to claim certain tax exemptions, such as claiming exemption from backup withholding if they are a non-resident alien.

Examples and Scenarios

The W9 Form is a critical document for ensuring accurate tax reporting and compliance. Understanding how the W9 Form is used in real-world situations can provide valuable insights into its importance and implications.This section will explore various examples and scenarios involving the W9 Form, demonstrating its common applications and potential impact.

It will also address situations where the W9 Form is required, providing practical examples to illustrate its use.

Real-World Examples of W9 Form Usage

The W9 Form is used in various situations where an individual or entity needs to provide their taxpayer identification number (TIN) to a payer. Here are some common examples:

- Freelance Work:When a freelancer or independent contractor is hired for a project, the payer (client) typically requires a W9 Form to report the income paid to the contractor on their tax return.

- Rental Income:Landlords often require a W9 Form from their tenants if they are paying rent to an individual or entity. This allows the landlord to report the rental income received on their tax return.

- Selling Goods or Services:Businesses selling goods or services to individuals or other businesses may require a W9 Form to accurately report payments made.

- Investment Income:Investors receiving dividends or interest payments from companies may need to provide a W9 Form to the payer to ensure accurate reporting of the income.

- Royalties:Authors, musicians, or inventors receiving royalty payments may need to provide a W9 Form to the payer for tax reporting purposes.

Hypothetical Scenarios Involving the W9 Form

Consider these hypothetical scenarios to understand the potential implications of using or not using a W9 Form:

- Scenario 1:A freelance writer is hired to write articles for a website. The website owner does not request a W9 Form before making payments. The writer may not be able to claim the income earned on their tax return, potentially leading to penalties.

For those over 50, it’s essential to know about the IRA contribution limits for 2024. This article provides a comprehensive overview of the limits and explains how they can benefit your retirement planning.

- Scenario 2:A small business owner sells products online. They do not require a W9 Form from customers making purchases. This could result in inaccurate tax reporting for both the business owner and the customers, potentially leading to audits and penalties.

- Scenario 3:An individual receives rental income from a property. They fail to provide a W9 Form to the tenant. The tenant may not be able to claim the rent paid as a deduction on their tax return, potentially leading to a higher tax burden.

Common Situations Where the W9 Form is Required

The W9 Form is generally required in the following situations:

- Payments exceeding $600:If a payer makes payments to an individual or entity exceeding $600 in a calendar year, they are required to file a Form 1099-MISC and request a W9 Form.

- Direct payments to individuals:Payments made directly to individuals for services or goods, such as freelance work or rental income, typically require a W9 Form.

- Payments to entities:Payments made to businesses, corporations, partnerships, or trusts generally require a W9 Form.

- Certain tax-exempt organizations:Even tax-exempt organizations may be required to provide a W9 Form if they receive payments for goods or services.

Last Recap

The updated W9 Form signifies a shift in tax reporting, emphasizing accuracy and compliance. Understanding these changes is crucial for individuals and businesses to navigate the evolving tax landscape. By familiarizing yourself with the new requirements and procedures, you can ensure smooth tax reporting and avoid potential complications.

This guide serves as a valuable resource for navigating the W9 Form changes, empowering you to stay informed and compliant.

FAQ Overview

What are the main changes to the W9 Form in October 2024?

The October 2024 W9 Form update includes revised sections for reporting tax information, particularly for businesses. These changes aim to improve accuracy and streamline the reporting process.

How do these changes impact businesses?

Businesses will need to adjust their W9 forms to reflect the new requirements, ensuring they provide accurate and complete information. These changes may affect how businesses report their tax information to clients or partners.

Where can I find the updated W9 Form?

You can find the updated W9 Form on the IRS website. It is essential to download and use the latest version for accurate tax reporting.