The W9 Form October 2024 deadline for filing is approaching, and understanding the requirements is crucial for individuals and businesses alike. This form serves as a vital tool for reporting your taxpayer identification number (TIN) and other essential information to the IRS.

The W9 form is necessary for various transactions, including receiving payments from clients, opening bank accounts, and investing in securities. Knowing the filing deadline and adhering to the necessary procedures ensures smooth financial operations and avoids potential penalties.

This article delves into the intricacies of the W9 form, covering its purpose, filing deadlines, methods of submission, common errors, and essential tips for successful filing. We’ll also explore the consequences of missing the deadline and provide valuable resources to guide you through the process.

Contents List

Understanding the W9 Form

The W9 form is a crucial document for anyone who is being paid for services or goods by a business or organization. This form provides the payer with your tax identification number (TIN), which is used to report your income to the Internal Revenue Service (IRS).

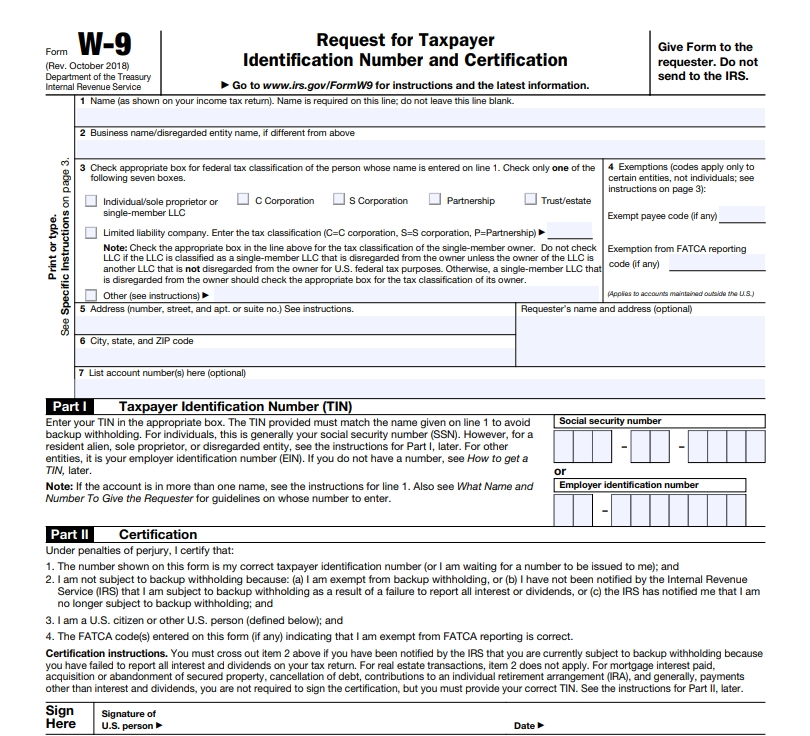

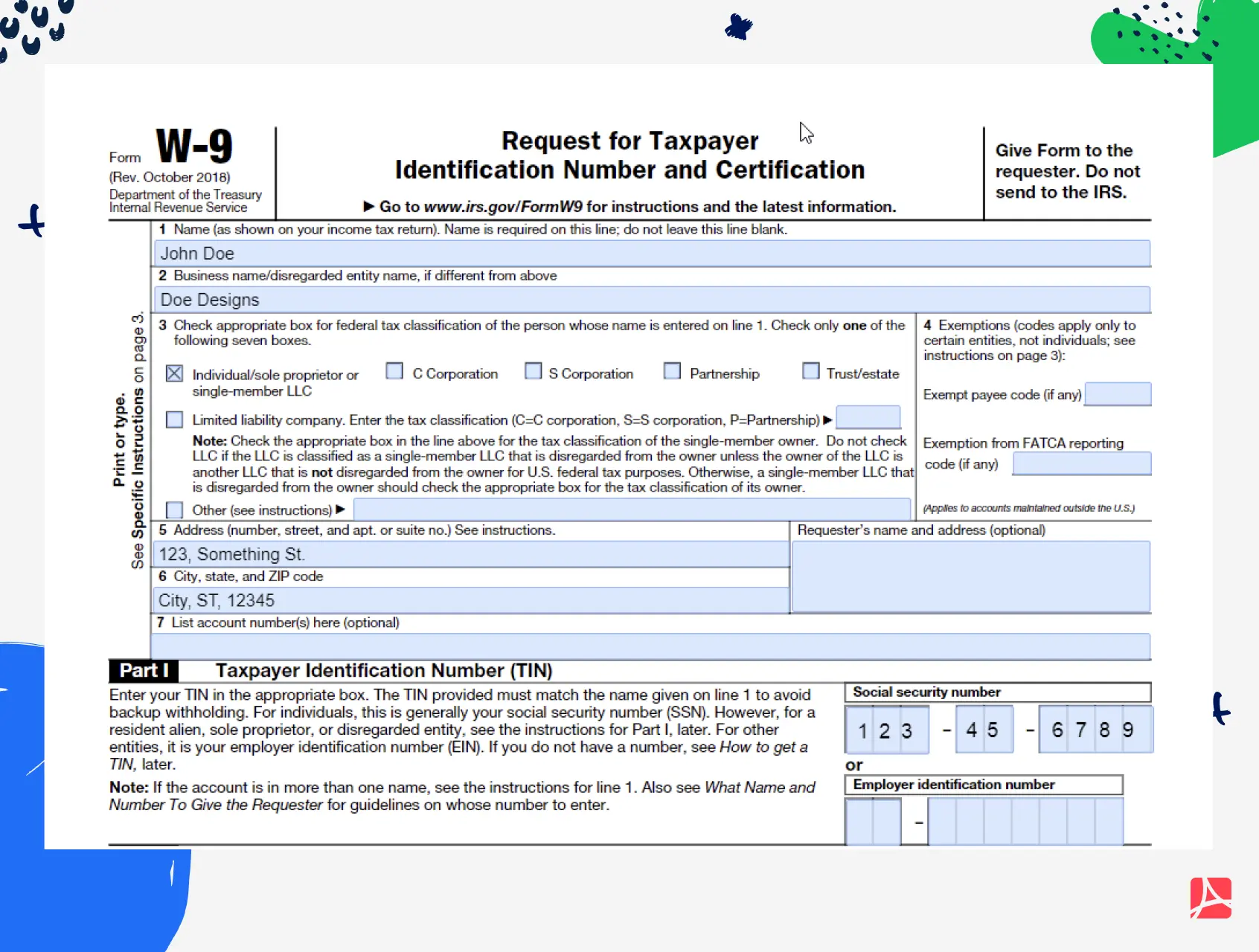

Information Required on the W9 Form, W9 Form October 2024 deadline for filing

The W9 form requests specific information about the payee, including:

- Name:This is the legal name of the payee, as it appears on their tax records.

- Business Name (if different from Name):This field is used if the payee is operating under a business name that is different from their legal name.

- Taxpayer Identification Number (TIN):This is either your Social Security number (SSN) or Employer Identification Number (EIN).

- Address:This is the current mailing address of the payee.

- Exemption from Backup Withholding:This section allows the payee to claim an exemption from backup withholding if they meet specific requirements.

- Certification:The payee must sign and date the form to certify that the information provided is accurate.

Scenarios Where the W9 Form is Needed

The W9 form is used in various situations, including:

- Independent Contractors:Businesses often require independent contractors to complete a W9 form to ensure proper tax reporting of payments made.

- Freelancers:Freelancers working for businesses or organizations are typically required to provide a W9 form for tax reporting purposes.

- Vendors:Businesses may request a W9 form from vendors to report payments for goods or services purchased.

- Rental Property:Landlords may require tenants to complete a W9 form for tax reporting purposes.

- Non-Profit Organizations:Non-profit organizations may need a W9 form from individuals or businesses who receive payments from them.

Filing Deadline for October 2024: W9 Form October 2024 Deadline For Filing

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document for individuals and businesses who receive payments from others. It provides the payee’s tax identification number (TIN), which is necessary for the payer to report income correctly on their tax return.

The deadline for filing W9 forms can vary depending on the specific circumstances.The deadline for filing W9 forms in October 2024 will depend on the specific situation. If you are filing a W9 form for the first time, you should submit it as soon as possible.

If you have already filed a W9 form and your information has not changed, you do not need to file a new one.

The IRS offers a variety of resources to help taxpayers navigate the tax filing process. You can find helpful guides, publications, and other information on the IRS website, which is linked here: IRS resources for the October 2024 tax deadline.

Don’t hesitate to utilize these resources if you have any questions or need assistance.

Consequences of Missing the Deadline

Missing the deadline for filing a W9 form can have several consequences, including:* Delayed payments:The payer may delay your payment until they receive a valid W9 form.

Filing your taxes can be a daunting task, but it doesn’t have to be stressful. You can find helpful tips and strategies for preparing your taxes for the October 2024 deadline on this website: Tax preparation tips for the October 2024 deadline.

By being organized and informed, you can make the process smoother and more efficient.

Incorrect reporting

The payer may report your income incorrectly on their tax return, leading to potential penalties.

Tax credits can be a valuable way to reduce your tax liability. If you’re looking for information about the available tax credits for the October 2024 deadline, you can find a comprehensive list here: Tax credits for the October 2024 deadline.

Make sure to explore these credits to see if you qualify for any potential savings.

Potential IRS audits

Missing the tax deadline can result in penalties. If you’re concerned about potential penalties for not meeting the October 2024 deadline, you can find more information on the IRS website: Tax penalties for missing the October 2024 deadline.

It’s best to avoid penalties by filing on time or seeking an extension if needed.

The IRS may audit the payer if they are unable to provide accurate information about the payee’s TIN.

The IRS has specific guidelines for determining which tax bracket you fall into. You can find a clear outline of the tax brackets for 2024 in the United States by following this link: Tax brackets for 2024 in the United States.

Knowing your tax bracket can help you plan your finances and make informed decisions about your income and expenses.

Resources for Finding Accurate and Updated Information

To find accurate and updated information on W9 form filing deadlines, you can consult the following resources:* Internal Revenue Service (IRS):The IRS website provides comprehensive information on tax forms and filing deadlines.

Moving expenses can be deducted on your taxes, but you’ll need to know the current mileage rate. The mileage rate for moving expenses in October 2024 is available on this website: October 2024 mileage rate for moving expenses. Keep track of your mileage and use this rate to calculate your potential deduction.

Tax professionals

If you’re contributing to an IRA, it’s essential to know the contribution limits for each year. You can find the IRA contribution limits for 2024 and 2025 on this website: Ira contribution limits for 2024 and 2025. Understanding these limits will help you plan your contributions and maximize your retirement savings.

Certified public accountants (CPAs) and enrolled agents (EAs) can provide expert guidance on W9 form filing requirements.

Financial institutions

Banks and other financial institutions may provide information on W9 form filing deadlines.

Methods of Filing

There are two primary ways to file a W9 form: electronically and by mail. Each method has its own set of advantages and disadvantages, which you should consider before deciding which method is right for you.

Electronic Filing

Electronic filing offers convenience and speed. You can submit your W9 form online through the IRS website or a third-party service provider. This eliminates the need for printing, signing, and mailing the form, saving you time and effort. Additionally, electronic filing often allows for faster processing times, potentially speeding up your tax refund or payment.

Understanding how the tax brackets work is crucial when filing your taxes. You can find a detailed breakdown of each tax bracket and its corresponding rate for 2024 by visiting this link: Tax rates for each tax bracket in 2024.

This information will help you accurately calculate your tax liability.

Here’s a step-by-step guide for filing a W9 form electronically:

1. Visit the IRS website or a third-party service provider

The Seahawks had a tough loss in Week 5, but their comeback effort was impressive. You can read a full recap of the game and see what fans are saying about the team’s performance here: Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss.

It’s always exciting to see a team fight back, even if they don’t get the win.

Begin by navigating to the IRS website or a reputable third-party service provider that allows electronic W9 form filing.

2. Download the W9 form

Once on the website, locate and download the W9 form in electronic format. This will likely be a PDF file that you can open and fill out digitally.

If you’re planning on deducting business mileage for the October 2024 tax deadline, you’ll want to know the standard mileage rate. You can find out more about the rate and how it’s calculated by visiting this link: How is the mileage rate calculated for October 2024?

. This will help you determine the exact amount you can deduct for your business travel.

3. Fill out the form

Life happens, and sometimes you need a little extra time to file your taxes. If you need an extension for the October 2024 deadline, you can find all the necessary information and instructions on how to apply for one here: Tax filing extensions for October 2024.

It’s important to note that an extension only gives you more time to file, not to pay.

Complete all required fields accurately and thoroughly. Double-check your information before submitting the form.

4. Sign the form electronically

Most electronic filing platforms allow you to sign the form electronically. Ensure that the platform you use provides a secure and legally compliant way to sign documents.

5. Submit the form

Once you’ve filled out and signed the form, submit it electronically through the platform you’re using.

It’s important to be aware of any tax changes that might affect your filing for the October 2024 deadline. The IRS website is a great resource for staying up-to-date, and you can also find information about recent changes impacting the deadline here: Tax changes impacting the October 2024 deadline.

Note:Ensure that the third-party service provider you choose is reputable and complies with IRS regulations.

Mailing

The traditional method of filing a W9 form involves printing the form, filling it out, signing it, and mailing it to the requester. While this method is straightforward, it can be time-consuming, especially if you need to print, sign, and mail the form.

Additionally, it might take longer for the requester to receive and process your form compared to electronic filing.

The tax brackets for qualifying widow(er)s in 2024 may differ from those for single filers or married couples. You can find a breakdown of these specific tax brackets and their corresponding rates here: Tax brackets for qualifying widow(er)s in 2024.

It’s important to understand these differences to ensure you’re filing accurately.

Note:When mailing your W9 form, ensure you send it to the correct address and include a self-addressed stamped envelope if you need a confirmation copy.

Common Filing Errors

The W9 form is a crucial document for tax purposes, and errors can lead to delays in payments and even penalties. Understanding common mistakes can help you avoid them and ensure accurate and timely processing.

Incorrect TIN or Name

Providing an incorrect Taxpayer Identification Number (TIN) or legal name is a common error. This can result in your payments being misdirected or delayed. Double-check your TIN and legal name against your official documents before submitting the form.

It is crucial to ensure that the TIN and legal name on the W9 form match your official documents.

- Ensure the TIN is accurate and matches the TIN provided on your Social Security card or Employer Identification Number (EIN) document.

- Double-check your legal name, including any middle names or suffixes, to ensure accuracy.

Missing or Incomplete Information

Failing to complete all required fields on the W9 form is another common mistake. This can lead to rejection of the form, delaying your payments. Carefully review the form and ensure all necessary information is provided accurately.

If you’re using your vehicle for business purposes, you can deduct the mileage you drive. The standard mileage rate for business use in October 2024 can be found here: October 2024 mileage rate for business use. Make sure to track your mileage accurately for a successful deduction.

- Ensure that all required fields, including name, address, TIN, and signature, are completed.

- If you are a business, include your business structure (sole proprietorship, partnership, corporation, etc.).

- Review the form for any missing or incomplete information before submission.

Incorrect Address or Contact Information

Providing an incorrect address or contact information can lead to important tax documents being misdirected. It’s essential to verify and update your address and contact information on the W9 form regularly.

- Ensure that your current address is accurate and up-to-date.

- Provide a valid phone number and email address for communication purposes.

Incorrect Signature

Failing to sign the W9 form or signing it incorrectly can invalidate the form. Always sign the form legibly and ensure that the signature matches the name provided.

- Sign the form legibly and ensure the signature matches the name provided on the form.

- If you are signing on behalf of a business, ensure you have the authority to do so.

Submitting the Form Late

Filing the W9 form after the deadline can result in penalties and delays in payments. It’s crucial to submit the form on time or before the deadline to avoid any complications.

The W9 form deadline is usually October 2024, but it’s essential to check the specific deadline for your situation.

- Check the specific deadline for filing the W9 form and submit it on time.

- Keep a record of the date you submitted the form.

Tips for Successful Filing

Filing your W9 form correctly and on time is crucial to ensure you receive the appropriate tax treatment for payments you receive. Here are some tips to help you navigate the process smoothly.

Essential Documents for Filing

Before you start filling out your W9 form, make sure you have the following documents ready. These documents will provide the necessary information to complete the form accurately.

- Taxpayer Identification Number (TIN):This is either your Social Security Number (SSN) or Employer Identification Number (EIN). You will need this number to identify yourself on the form.

- Name and Address:Ensure the name and address you provide on the form match the information on file with the IRS. Any discrepancies can cause delays in processing.

- Business Name (if applicable):If you are filing as a business, you will need to include the legal name of your business.

- Exemption Status (if applicable):If you are exempt from backup withholding, you will need to provide documentation to support your exemption. This might include a completed Form W-7 or a copy of your IRS exemption certificate.

Tracking the Status of a Filed W9 Form

After submitting your W9 form, you might want to keep track of its status. Here are some ways to do this.

- Confirmation of Receipt:Some payers may provide a confirmation of receipt when they receive your W9 form. Keep this confirmation for your records.

- Follow Up with the Payer:If you haven’t received payment after a reasonable time, you can follow up with the payer to inquire about the status of your W9 form.

Ending Remarks

Filing the W9 form correctly and on time is essential for maintaining financial compliance. By understanding the requirements, utilizing available resources, and following our provided tips, you can navigate the W9 filing process with ease. Remember, accuracy and timely submission are key to avoiding penalties and ensuring a smooth financial journey.

Question & Answer Hub

What happens if I miss the W9 Form deadline?

Missing the W9 deadline can result in penalties and delays in receiving payments. The IRS may also issue a notice requesting the missing information.

Can I file my W9 form online?

Yes, you can file your W9 form electronically through the IRS website or through third-party tax preparation software.

Where can I find the latest W9 form?

You can download the latest W9 form directly from the IRS website.

What if I don’t have a Social Security number?

If you don’t have a Social Security number, you’ll need to provide your Employer Identification Number (EIN) on the W9 form.

What if I need to update my W9 information?

If your information changes, you must file a new W9 form with the updated information. This includes changes to your name, address, or TIN.