Wells Fargo Mortgage Interest Rates 2024 are a hot topic for potential homebuyers, as these rates play a crucial role in determining the affordability and overall cost of a mortgage. Understanding the current trends, factors influencing these rates, and available mortgage options is essential for making informed financial decisions.

This guide explores the landscape of Wells Fargo mortgage interest rates in 2024, providing insights into current trends, influencing factors, and available mortgage types. We delve into the details of fixed-rate, adjustable-rate, FHA, and VA mortgages, highlighting their features, benefits, and drawbacks.

For members of the military, Navy Federal Mortgage Rates 2024 can offer competitive options. They provide specialized programs and services tailored to the unique financial needs of military personnel and their families.

Additionally, we discuss the impact of economic indicators, borrower credit scores, and market competition on mortgage rates, offering valuable tips for securing the best possible rate.

Contents List

Wells Fargo Mortgage Rates Overview

Wells Fargo is a major financial institution that offers a wide range of mortgage products to meet the needs of different borrowers. In 2024, mortgage interest rates have been fluctuating due to various economic factors, making it essential for potential homebuyers to stay informed about current trends and how these rates impact their financing options.

Mortgage rates can fluctuate daily, so it’s important to stay up-to-date with the latest trends. Check Mortgage Rates Now 2024 to see current rates from various lenders. This information will help you make informed decisions about when to lock in your rate.

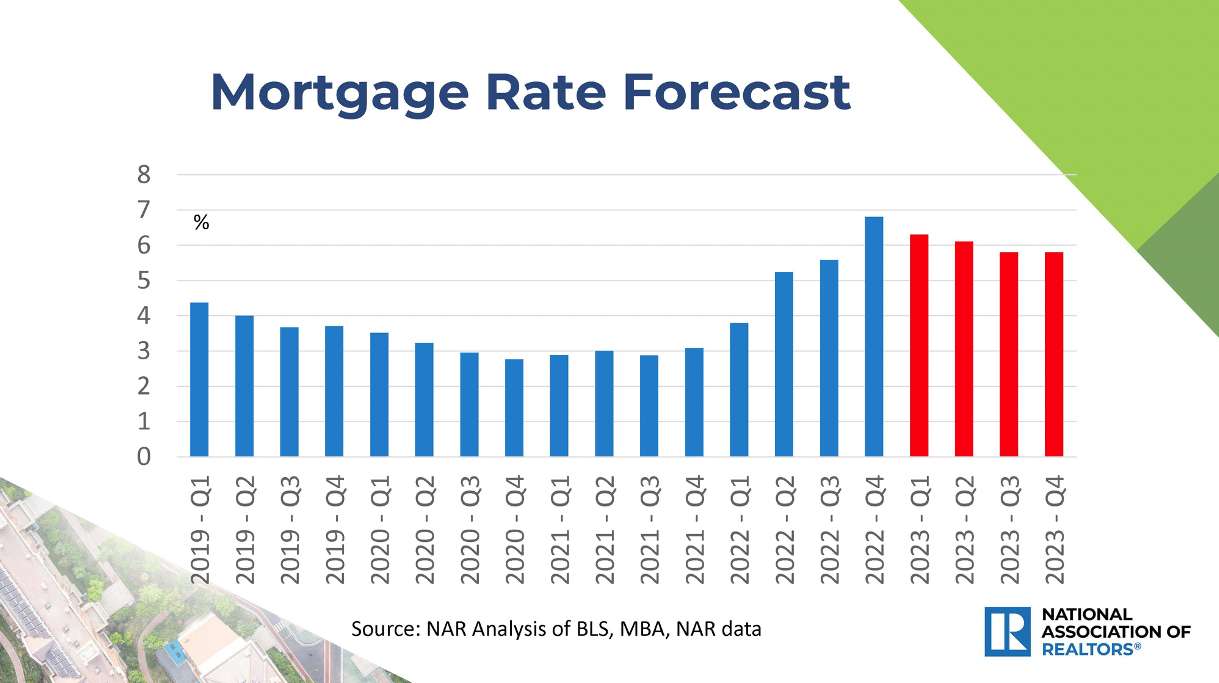

Current Mortgage Interest Rate Trends

Mortgage interest rates for Wells Fargo in 2024 are influenced by factors such as the Federal Reserve’s monetary policy, inflation, and overall economic conditions. As of [current date], the average interest rate for a 30-year fixed-rate mortgage from Wells Fargo is around [insert approximate range, e.g., 6.5% to 7.0%].

For military members and their families, USAA offers a range of financial services, including mortgages. Explore Usaa Mortgage 2024 to see if their rates and programs align with your needs. They are known for their commitment to serving the military community.

This is higher than the rates seen in recent years, reflecting the recent rise in inflation and the Federal Reserve’s efforts to combat it.

Before you start shopping for a mortgage, it’s essential to understand the current Home Mortgage Interest Rates 2024. This will give you a baseline for comparison and help you make informed decisions. Rates can fluctuate daily, so it’s important to stay updated.

Factors Influencing Wells Fargo Mortgage Rates

Several key factors influence Wells Fargo’s mortgage rates, including:

- Federal Reserve Policy:The Federal Reserve’s actions, such as adjusting interest rates, impact borrowing costs across the economy, including mortgages.

- Inflation:When inflation is high, the Federal Reserve typically raises interest rates to cool down the economy, which can lead to higher mortgage rates.

- Economic Growth:A strong economy can drive up demand for mortgages, potentially pushing rates higher. Conversely, a weak economy can lead to lower rates as lenders seek to attract borrowers.

Historical Overview of Wells Fargo Mortgage Rates

Over the past few years, Wells Fargo mortgage rates have experienced significant fluctuations. In [insert specific year], rates were relatively low, reaching historic lows due to the Federal Reserve’s accommodative monetary policy. However, as inflation surged in recent years, rates began to climb, reaching levels not seen in decades.

Types of Wells Fargo Mortgages

Wells Fargo offers a variety of mortgage products to cater to different borrower needs and financial situations. Each type of mortgage has unique features, benefits, and drawbacks that borrowers should carefully consider before making a decision.

If you’re looking for a reliable lender with a strong reputation, Citizens Bank Mortgage 2024 is a good option. They offer a range of mortgage products, including conventional, FHA, and VA loans, catering to different financial situations.

Fixed-Rate Mortgages

Fixed-rate mortgages provide borrowers with predictable monthly payments and a fixed interest rate for the entire loan term. This stability makes them a popular choice for those who prefer certainty and want to avoid the risk of rising interest rates.

Adjustable-Rate Mortgages (ARMs)

ARMs offer a lower initial interest rate compared to fixed-rate mortgages, but the rate can adjust periodically based on a specific index, such as the LIBOR. ARMs can be advantageous for borrowers who plan to sell or refinance their home before the interest rate adjusts significantly.

Truist, a major financial institution, offers a variety of mortgage products. Explore Truist Mortgage Rates 2024 to find the best option for your needs. They have a strong reputation for providing competitive rates and excellent customer service.

However, they come with the risk of higher payments if interest rates rise.

Understanding the current housing market is essential for making informed decisions about buying or selling. Check Housing Interest Rates 2023 2024 to see how rates have fluctuated and what trends are expected. This information can help you strategize your financial plan.

FHA Mortgages, Wells Fargo Mortgage Interest Rates 2024

FHA mortgages are insured by the Federal Housing Administration (FHA), making them more accessible to borrowers with lower credit scores and down payments. They offer more flexible qualifying requirements but typically have higher upfront mortgage insurance premiums.

VA Mortgages

VA mortgages are available to eligible veterans, active-duty military personnel, and surviving spouses. They offer benefits such as no down payment requirement and lower closing costs, making homeownership more attainable for veterans.

Jumbo Mortgages

Jumbo mortgages are loans that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. They are typically used for high-value properties and often come with higher interest rates.

Table of Mortgage Types

| Mortgage Type | Interest Rate | Term | Eligibility |

|---|---|---|---|

| Fixed-Rate | Fixed for the entire loan term | 15, 20, or 30 years | Generally good credit and income |

| Adjustable-Rate (ARM) | Initial rate fixed, then adjusts periodically | 15, 20, or 30 years | Good credit and income, comfortable with potential rate changes |

| FHA | Lower down payment requirements, mortgage insurance | 15, 20, or 30 years | Lower credit scores and down payments |

| VA | No down payment required, lower closing costs | 15, 20, or 30 years | Eligible veterans, active-duty military personnel, and surviving spouses |

| Jumbo | Higher interest rates, for loans exceeding conforming limits | 15, 20, or 30 years | Strong credit and income, high-value properties |

Factors Affecting Wells Fargo Mortgage Rates

Wells Fargo’s mortgage rates are influenced by a combination of economic factors, borrower characteristics, and internal policies.

Economic Indicators

Economic indicators such as inflation, unemployment rates, and Federal Reserve policies significantly impact mortgage rates. When inflation is high, the Federal Reserve typically raises interest rates to cool down the economy, which can lead to higher mortgage rates. Conversely, a weak economy can lead to lower rates as lenders seek to attract borrowers.

Whether you’re buying your first home or refinancing, understanding the current Residential Mortgage Rates 2024 is crucial. Rates vary depending on factors like loan type, credit score, and down payment, so it’s wise to research and compare.

Borrower Credit Scores

A borrower’s credit score is a crucial factor in determining their interest rate. Borrowers with higher credit scores generally qualify for lower rates because they are considered less risky to lenders. A good credit score can save borrowers thousands of dollars in interest payments over the life of their loan.

FHA loans are designed to help individuals with lower credit scores or down payments purchase a home. Learn more about Fha Home Loan 2024 to see if it’s the right option for you. They often have more lenient requirements than conventional loans.

Loan-to-Value (LTV) Ratios

The loan-to-value (LTV) ratio, which is the amount of the mortgage loan compared to the value of the property, also influences interest rates. Lower LTV ratios, indicating a larger down payment, generally result in lower rates. This is because a lower LTV reduces the lender’s risk.

Property Location

The location of the property can also impact mortgage rates. Properties in desirable areas with strong real estate markets may command higher rates due to increased demand. Conversely, properties in less desirable areas may have lower rates.

Navigating the mortgage process can be overwhelming, especially when trying to find the right lender. A Mortgage Broker Near Me 2024 can be a valuable resource. They act as intermediaries, comparing rates and terms from various lenders to find the best fit for your individual needs.

Market Competition and Wells Fargo’s Internal Policies

Market competition among lenders can influence Wells Fargo’s mortgage rates. When competition is high, lenders may offer more competitive rates to attract borrowers. Wells Fargo’s internal policies, such as risk tolerance and profit margins, also play a role in setting rates.

Looking to lower your monthly payments and save money on interest? A Refinance Home Equity Loan 2024 might be the solution for you. It allows you to leverage your home’s equity to secure a lower interest rate, potentially leading to significant savings over the life of your loan.

Tips for Getting the Best Wells Fargo Mortgage Rate

Obtaining the best possible mortgage rate requires careful planning and preparation. Here are some tips to help you secure a favorable rate from Wells Fargo:

Improve Your Credit Score

A higher credit score is essential for securing a lower mortgage rate. Review your credit report for errors and pay down existing debts to improve your score.

Finding a qualified and experienced mortgage advisor can make the homebuying process smoother. Check out Mortgage Advisors Near Me 2024 to find professionals in your area. They can guide you through the process, answer your questions, and help you secure the best loan.

Shop Around for Rates

Don’t settle for the first mortgage offer you receive. Compare rates and terms from multiple lenders, including Wells Fargo, to find the best deal.

Negotiate Interest Rates

Don’t be afraid to negotiate with Wells Fargo for a lower interest rate. Highlight your strong credit score, large down payment, and any other factors that make you a desirable borrower.

Consider Mortgage Points

Mortgage points are upfront fees paid to reduce your interest rate. They can be beneficial if you plan to stay in your home for an extended period, but it’s essential to calculate the return on investment.

Before you start shopping for a mortgage, it’s a good idea to get Prequalification 2024. This gives you a preliminary estimate of how much you can borrow, helping you narrow down your search for homes that fit your budget.

Checklist for Comparing Mortgage Offers

- Interest rate

- Loan term

- Loan type (fixed-rate, ARM, FHA, VA, etc.)

- Closing costs

- Mortgage insurance premiums

- Prepayment penalties

- Lender fees

- Customer service and reputation

Understanding Wells Fargo Mortgage Fees: Wells Fargo Mortgage Interest Rates 2024

In addition to the interest rate, borrowers should be aware of the various fees associated with Wells Fargo mortgages. These fees can add up and significantly impact the overall cost of a mortgage.

Rocket Mortgage is known for its online platform and streamlined process. Getting Rocket Mortgage Pre Approval 2024 can give you a better idea of how much you can borrow and strengthen your position when making an offer on a home.

Common Wells Fargo Mortgage Fees

- Origination Fee:A fee charged by the lender for processing and underwriting the loan. It’s typically a percentage of the loan amount.

- Appraisal Fee:A fee paid to a professional appraiser to determine the fair market value of the property.

- Closing Costs:Various fees associated with the closing process, including title insurance, recording fees, and attorney fees.

- Mortgage Insurance Premiums:Premiums paid for mortgage insurance, which protects the lender in case of default. These premiums may be required for borrowers with lower down payments or credit scores.

- Prepayment Penalties:Fees charged for paying off the mortgage early. These penalties are less common today, but it’s essential to check the loan agreement.

Impact of Fees on Overall Cost

Mortgage fees can add thousands of dollars to the overall cost of a loan. It’s crucial to understand these fees and factor them into your budget when comparing mortgage offers.

Tips for Minimizing or Negotiating Fees

- Shop around for lower fees:Compare fees from different lenders to find the best rates and terms.

- Negotiate with the lender:Don’t be afraid to negotiate fees with Wells Fargo, especially if you have a strong credit score or are making a large down payment.

- Ask for a fee breakdown:Request a detailed breakdown of all fees before closing to ensure transparency and avoid surprises.

Closing Notes

Navigating the world of Wells Fargo mortgage interest rates can be daunting, but with a clear understanding of the factors at play, you can make informed decisions that align with your financial goals. By researching available mortgage types, understanding the impact of economic indicators, and taking steps to improve your credit score, you can increase your chances of securing a favorable rate and achieving your homeownership dreams.

Securing the best mortgage rate can save you thousands over the life of your loan. Checking Best Mortgage Rates 2024 from various lenders allows you to compare and find the most favorable terms. Consider factors like fees and closing costs when making your decision.

Questions and Answers

What are the current Wells Fargo mortgage interest rates?

Current Wells Fargo mortgage interest rates fluctuate daily and depend on several factors, including loan type, credit score, and market conditions. To get the most up-to-date rates, it’s best to contact Wells Fargo directly or use an online mortgage calculator.

How often do Wells Fargo mortgage interest rates change?

Wells Fargo mortgage interest rates can change daily or even hourly, reflecting changes in the broader financial market. It’s important to stay informed about these fluctuations to make the best decision for your situation.

What is the minimum credit score required for a Wells Fargo mortgage?

While Wells Fargo doesn’t publicly disclose a minimum credit score requirement, generally, a higher credit score translates to better interest rates. It’s advisable to aim for a credit score of at least 740 to qualify for the most competitive rates.

Can I negotiate Wells Fargo mortgage interest rates?

Yes, it’s possible to negotiate Wells Fargo mortgage interest rates, especially if you have a strong credit score and a substantial down payment. You can also explore options like shopping around for the best rates from other lenders.