What Happens After You Submit a Capital One Claim? sets the stage for a comprehensive exploration of the process, guiding you through each step from initial submission to final resolution. This guide delves into the intricacies of claim types, processing timelines, communication channels, and dispute resolution, offering valuable insights for navigating the journey of seeking compensation from Capital One.

Understanding the process of submitting a claim to Capital One can be overwhelming. This guide aims to provide clarity and reassurance, empowering you to navigate the process with confidence. Whether you’re dealing with a credit card dispute, a fraud claim, or an insurance claim, this guide offers a comprehensive overview of what to expect and how to effectively engage with Capital One throughout the process.

Contents List

Understanding Capital One Claims

Navigating the process of filing a claim with Capital One can be a bit overwhelming, especially if you’re unfamiliar with the procedures. This guide will provide you with a comprehensive overview of the entire process, from submitting your claim to receiving payment.

We’ll delve into the different types of claims Capital One handles, the necessary documentation, claim processing, communication updates, resolution, and even the appeals process.

Types of Claims Capital One Handles

Capital One handles a wide range of claims, including:

- Credit Card Claims:These claims are typically for unauthorized charges, fraudulent transactions, or errors on your statement.

- Auto Insurance Claims:If you have a Capital One auto insurance policy, you can file a claim for accidents, theft, or damage to your vehicle.

- Bank Account Claims:This category includes claims related to unauthorized withdrawals, errors in account balances, or issues with debit card transactions.

- Mortgage Claims:Claims related to your mortgage could include issues with loan payments, property damage, or foreclosure prevention.

- Other Claims:Capital One may also handle other types of claims depending on the specific products and services you have with them.

Submitting a Claim to Capital One

The process of submitting a claim to Capital One generally involves the following steps:

- Gather Necessary Documentation:This step is crucial as it provides evidence to support your claim. The required documentation varies depending on the type of claim, but typically includes things like:

- Proof of identity (e.g., driver’s license, passport)

- Copy of the relevant account statement or policy documents

- Police report (in case of theft or fraud)

- Supporting documentation for the claim (e.g., receipts, invoices, medical bills)

- Contact Capital One:You can submit your claim through various channels, including:

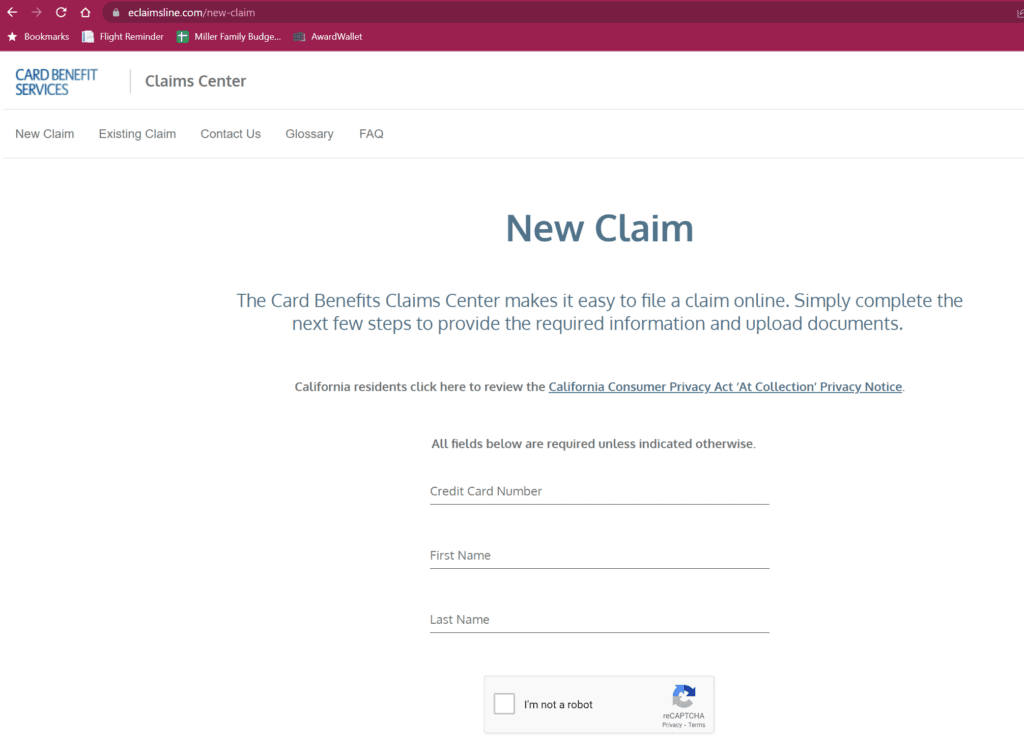

- Online:Capital One often has an online claim portal on their website, where you can submit your claim electronically.

- Phone:You can call their customer service line to speak with a representative who can guide you through the process.

- Mail:In some cases, you may need to send your claim by mail using the address provided on their website or in your account documents.

- Provide Detailed Information:When submitting your claim, provide clear and accurate details about the incident or issue. This includes dates, times, locations, and any other relevant information.

- Review and Submit:Before submitting your claim, carefully review all the information you’ve provided to ensure accuracy. Once you’re satisfied, submit your claim.

Claim Processing and Review

Once you’ve submitted your claim, Capital One will begin the processing and review phase. This typically involves the following stages:

Claim Processing Timeline

The timeframe for processing a claim can vary depending on the complexity of the claim and the type of documentation required. However, Capital One generally aims to process claims within a reasonable time frame.

Learn about more about the process of Submitting Your Claim for the Capital One Settlement in the field.

For example, simple credit card claims for unauthorized charges might be processed within a few days, while more complex claims involving fraud investigations or insurance claims could take several weeks or even months.

Claim Review Stages

The claim review process involves several stages:

- Initial Assessment:Capital One’s claim team will first review the documentation you submitted to ensure it’s complete and meets the necessary requirements.

- Investigation:If the claim requires further investigation, Capital One may contact you for additional information or documentation. They may also conduct their own investigation, such as contacting merchants or reviewing security footage.

- Decision:After completing the review and investigation, Capital One will make a decision on your claim.

Claim Decision Outcomes, What Happens After You Submit a Capital One Claim?

The outcome of your claim can be one of the following:

- Claim Approved:If your claim is approved, Capital One will process the payment according to the terms of your policy or account agreement.

- Claim Denied:If your claim is denied, Capital One will provide you with a written explanation of the reasons for the denial. You may have the option to appeal the decision.

- Partial Approval:In some cases, Capital One may partially approve your claim, meaning they will only pay a portion of the requested amount. This could happen if they determine that some of the charges or expenses are not covered under your policy or agreement.

Final Review

Submitting a claim to Capital One can be a complex process, but with a clear understanding of the steps involved and effective communication, you can navigate it with confidence. By following the Artikeld steps, staying informed about the claim status, and addressing any questions or concerns promptly, you can increase the likelihood of a successful resolution and receive the compensation you deserve.

Questions Often Asked: What Happens After You Submit A Capital One Claim?

How long does it typically take for Capital One to process a claim?

The processing time for a Capital One claim can vary depending on the complexity of the claim and the required documentation. However, Capital One generally aims to process claims within a reasonable timeframe, often within a few weeks.

What happens if my claim is denied?

If your claim is denied, Capital One will provide a written explanation outlining the reasons for the denial. You have the right to appeal the decision, and Capital One will provide instructions on how to do so.

Can I track the status of my claim online?

Yes, you can often track the status of your claim online through your Capital One account. You may also receive updates and notifications via email or text message.

What are the different payment methods for claim payouts?

Capital One offers various payment methods for claim payouts, including direct deposit, check, or debit card credit. The available options may vary depending on the claim type and your preferred method.