What is the highest tax bracket in 2024? This question is on the minds of many high-income earners, especially as they plan for their financial future. The tax system in the United States uses a progressive structure, meaning those who earn more pay a higher percentage of their income in taxes.

Understanding how tax brackets work is crucial for making informed financial decisions and minimizing tax liability.

This article will delve into the highest tax bracket in 2024, exploring the different filing statuses and corresponding income thresholds. We’ll also discuss factors that influence the effective tax rate, including deductions, exemptions, and credits. Ultimately, this guide aims to equip you with the knowledge needed to navigate the complexities of the tax system and make strategic financial choices.

Contents List

Highest Tax Bracket in 2024

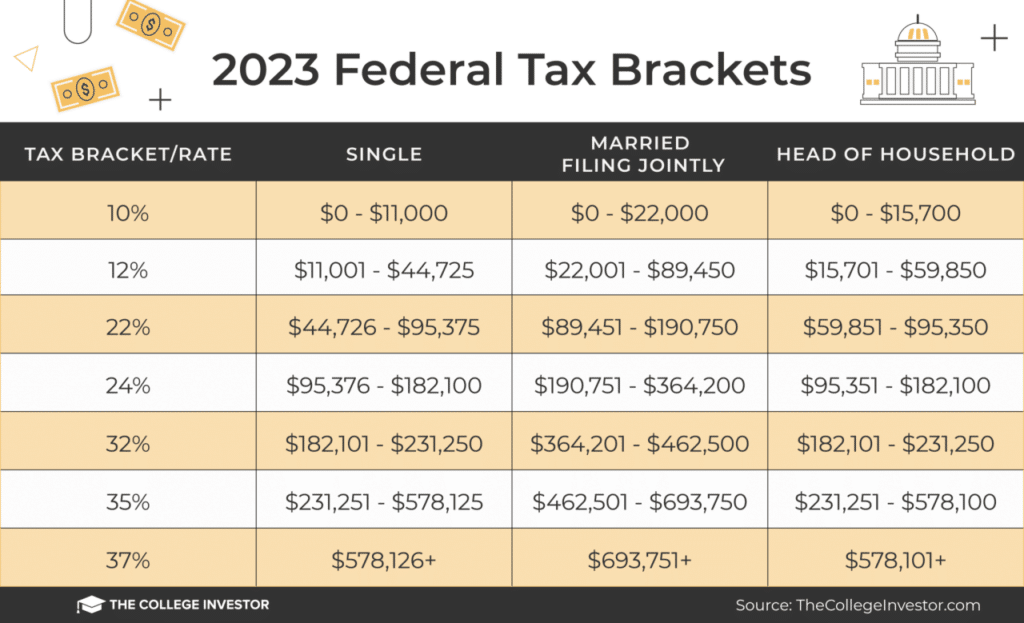

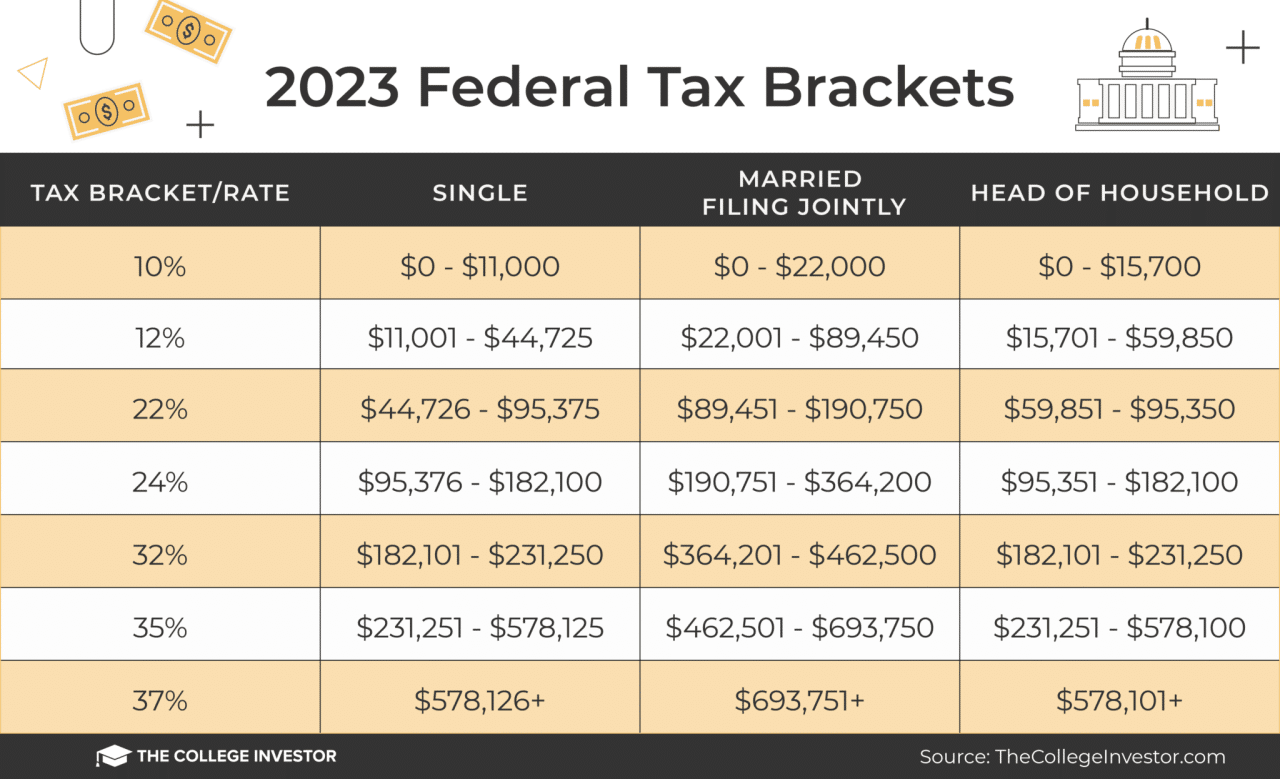

The highest tax bracket in 2024 is the top marginal tax rate, which applies to the portion of your income exceeding a certain threshold. This rate is different for single filers, married couples filing jointly, and heads of household.

The Las Vegas Raiders are set to face off against the Denver Broncos this weekend, and you can catch all the action live on TV. Find out how to watch the game and get ready for some exciting football.

Tax Brackets for 2024

The highest tax bracket for each filing status in 2024 is:

- Single Filers:The highest tax bracket for single filers in 2024 is 37%, which applies to taxable income exceeding $578,125.

- Married Filing Jointly:The highest tax bracket for married couples filing jointly in 2024 is 37%, which applies to taxable income exceeding $693,750.

- Head of Household:The highest tax bracket for heads of household in 2024 is 37%, which applies to taxable income exceeding $578,125.

Note: These tax brackets and income thresholds are subject to change based on potential tax legislation or economic conditions. It is recommended to consult with a tax professional for the most up-to-date information.

With the new year approaching, it’s important to be aware of any changes to the tax brackets. You can find a comprehensive overview of the changes for 2024 here.

Factors Influencing Tax Brackets

While the tax brackets themselves are set by law, various factors can significantly influence the effective tax rate an individual or household pays. These factors include deductions, exemptions, and credits, all of which can reduce taxable income and ultimately lower the overall tax liability.

If you’re filing as head of household, you’ll want to know the tax brackets for your filing status in 2024. This link provides the information you need to calculate your tax liability.

Deductions and Exemptions

Deductions and exemptions are specific expenses or allowances that can be subtracted from your gross income to determine your taxable income. They reduce the amount of income subject to taxation, lowering your tax liability.

If you’re a fan of Arkansas football, you won’t want to miss this recruiting report from Otis Kirk. The report covers all the latest news and insights on the Razorbacks’ recruiting efforts.

- Standard Deduction:This is a fixed amount that most taxpayers can choose to take instead of itemizing deductions. The standard deduction amount varies based on filing status (single, married filing jointly, etc.).

- Itemized Deductions:These are specific expenses that can be deducted if you choose to itemize rather than taking the standard deduction. Some common itemized deductions include mortgage interest, state and local taxes, charitable contributions, and medical expenses exceeding a certain percentage of your adjusted gross income.

The Miami Dolphins had a lot to say after their recent game, and you can read their postgame quotes here. The quotes offer a glimpse into the team’s thoughts and emotions after the game.

- Exemptions:Exemptions are fixed amounts that can be deducted for each dependent claimed on your tax return. These exemptions can reduce your taxable income and lower your tax liability.

Tax Policy Changes, What is the highest tax bracket in 2024?

Changes in tax policy, such as adjustments to tax brackets, deductions, or credits, can significantly impact the effective tax rate. For instance, increasing the standard deduction or expanding eligibility for certain credits can lower tax burdens for individuals and families.

The tax brackets for single filers in 2024 are outlined here. Make sure you’re aware of the brackets to accurately calculate your taxes.

Conversely, reducing deductions or raising tax rates can lead to higher tax liabilities.

The Green Bay Packers were able to pull off a victory against the Los Angeles Rams, winning 24-19. The game was decided by the Packers’ ability to capitalize on Rams turnovers.

Credits

Tax credits are direct reductions in your tax liability. They are often designed to encourage specific behaviors or support particular groups.

- Child Tax Credit:This credit provides a tax break for families with children. The amount of the credit can vary depending on the child’s age and income.

- Earned Income Tax Credit (EITC):This credit is available to low-to-moderate income working individuals and families. The credit amount is based on income, filing status, and the number of qualifying children.

- American Opportunity Tax Credit:This credit helps pay for the first four years of college. The credit is available for eligible students, and the amount can vary based on the student’s income and the amount of tuition and fees paid.

Final Conclusion: What Is The Highest Tax Bracket In 2024?

As you navigate the highest tax bracket in 2024, remember that proactive tax planning can significantly reduce your overall tax liability. Consult with a qualified tax professional to explore strategies tailored to your specific circumstances. By understanding the intricacies of the tax system and taking advantage of available deductions and credits, you can optimize your financial position and achieve your financial goals.

FAQ Insights

How do I know which tax bracket I fall into?

To determine your tax bracket, you need to consider your filing status and taxable income. The IRS provides specific income ranges for each tax bracket and filing status. You can find this information on the IRS website or consult a tax professional.

Does the highest tax bracket mean I pay the highest percentage of my income in taxes?

No, while the highest tax bracket has the highest marginal tax rate, it only applies to the portion of your income that falls within that bracket. Your effective tax rate, which is the percentage of your total income paid in taxes, will be lower than the marginal tax rate.

What are some common deductions for high-income earners?

Common deductions for high-income earners include mortgage interest, charitable contributions, state and local taxes (SALT), and medical expenses. The deductibility of these expenses may vary depending on your individual circumstances and current tax laws.

Can I avoid paying taxes on my entire income if I’m in the highest tax bracket?

No, even if you are in the highest tax bracket, you will still pay taxes on all of your income. However, the tax rate applied to each portion of your income will vary depending on the tax bracket it falls within.

Need help figuring out your tax bracket for 2024? This tax bracket calculator can help you determine your tax liability based on your income.

The world is mourning the loss of TikTok star Taylor Rousseau Grigg, who passed away at the young age of 25. Read more about her life and legacy.

The tax brackets for those filing as married filing separately in 2024 are available here. This information is crucial for accurate tax calculations.

The Jaguars pulled off a thrilling victory over the Colts in Week 5 of the 2024 season, winning 37-34. Check out the full game report for all the details.

If you’re a qualifying widow(er), you’ll want to know the tax brackets that apply to your filing status in 2024. Find the tax brackets here.

Wondering what the new tax brackets are for 2024? This article provides a detailed explanation of the changes.

Alabama’s fall from grace in the College Football Rankings has opened the door for Big Ten teams to dominate the top spots. See how the rankings have shifted this week.

As the new year approaches, it’s important to stay informed about the tax brackets in the United States. Find the tax brackets for 2024 here.