What is the Ibond rate in November 2024? This question is on the minds of many investors, as I Bonds offer a unique blend of security and potential for growth. I Bonds, short for inflation-indexed bonds, are a type of savings bond issued by the U.S.

Treasury that are designed to protect your investment from inflation. Unlike traditional bonds, which pay a fixed interest rate, I Bonds adjust their interest rate based on the rate of inflation. This means that your investment can grow at a faster pace than traditional bonds, especially during periods of high inflation.

Understanding I Bond rates is crucial for investors seeking to preserve their wealth and potentially increase their returns. The rate for I Bonds fluctuates every six months, reflecting changes in the Consumer Price Index (CPI). The rate for November 2024 is currently unknown, as it will be determined based on the CPI for the six months leading up to that date.

However, by analyzing historical rates and current economic conditions, we can gain insights into potential factors that might influence the rate.

Contents List

I Bond Rates and How They Work

I Bonds are a type of savings bond issued by the U.S. Treasury that offer a fixed rate of return plus an inflation adjustment. This unique combination makes them an attractive investment option for investors seeking to protect their savings from inflation.

For frequent flyers, there are several best credit cards available in October 2024 that offer valuable perks and rewards. These cards can help you save money on flights, hotels, and other travel expenses.

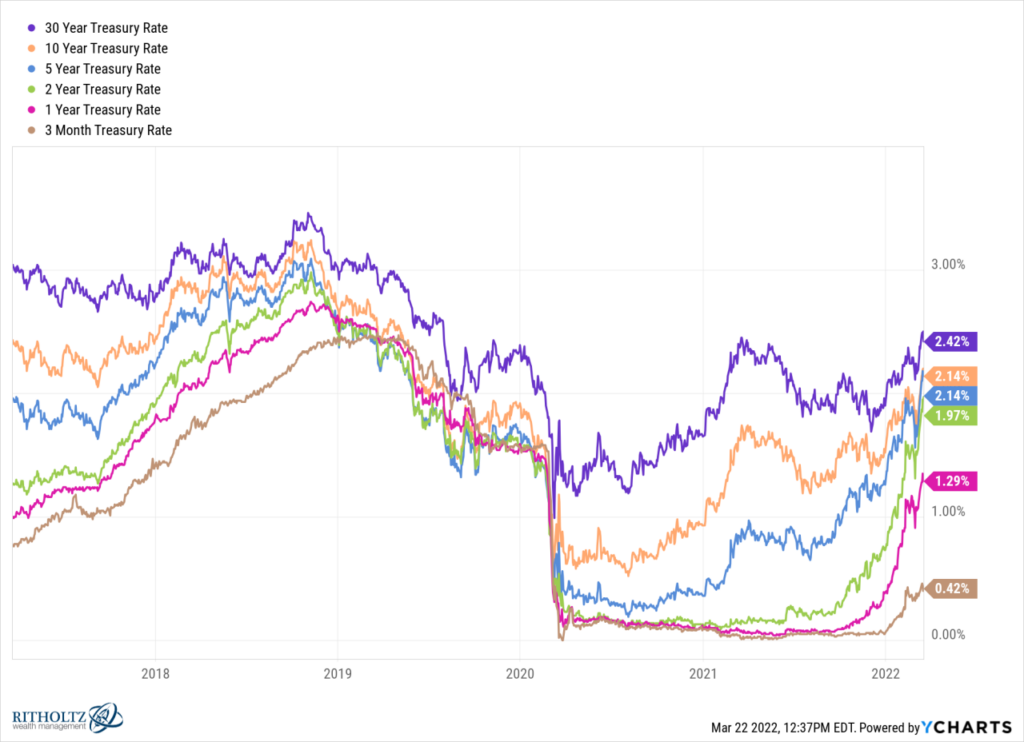

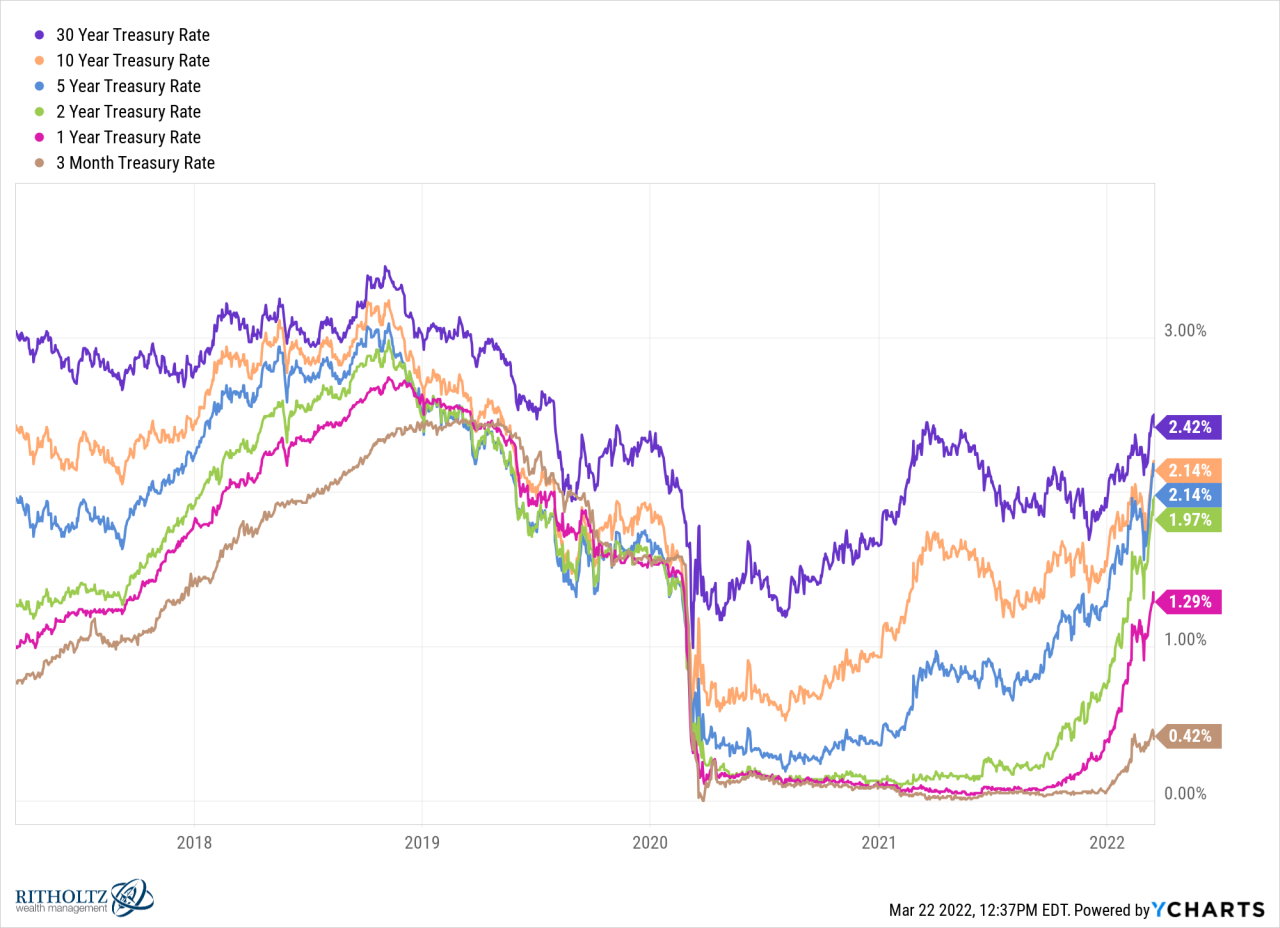

I Bond Rate History

I Bond rates have fluctuated over time, reflecting changes in inflation and interest rates. Since their inception in 1998, I Bond rates have ranged from as low as 0% to as high as 7.12%.

If you’re considering contributing to a Roth IRA, you’ll want to be aware of the Roth IRA contribution limits for 2024. These limits can help you determine how much you can contribute and maximize your tax benefits.

For example, in 2023, the I Bond rate was initially set at 0% but was later adjusted to 4.30% in May and then to 6.89% in November.

The Cigna layoffs announcement in October 2024 has raised concerns about the future of the healthcare industry. It’s important to stay informed about these developments and their potential impact.

Calculating I Bond Rates

The I Bond rate is calculated using a combination of a fixed rate and a variable inflation rate.

Freelancers often have unique tax situations. A tax calculator specifically designed for freelancers can be a valuable tool to help you estimate your tax liability and make informed financial decisions.

The formula for calculating the I Bond rate is: I Bond Rate = Fixed Rate + (Inflation Rate x 2)

Students may have a different tax deadline than other taxpayers. The October 2024 tax deadline for students can vary depending on their individual circumstances, so it’s important to stay informed.

The fixed rate is determined twice a year, in May and November. The inflation rate is based on the Consumer Price Index for Urban Consumers (CPI-U) for the preceding six months.

For sole proprietorships, the tax extension deadline in October 2024 provides a bit of extra time to file your taxes. However, it’s important to remember that this only extends the filing deadline, not the payment deadline.

Factors Influencing I Bond Rates

Several factors influence I Bond rates, including:

- Inflation:The most significant factor affecting I Bond rates is inflation. As inflation rises, the variable inflation rate component of the I Bond rate also increases, resulting in a higher overall rate.

- Interest Rates:Interest rates set by the Federal Reserve can also indirectly influence I Bond rates. When interest rates rise, the fixed rate component of the I Bond rate may increase to remain competitive with other investment options.

- Government Fiscal Policy:Government fiscal policy, such as tax cuts or spending increases, can also influence inflation and, consequently, I Bond rates.

Investing in I Bonds: What Is The Ibond Rate In November 2024

Investing in I Bonds is a straightforward process, and they offer a unique combination of guaranteed returns and inflation protection. Let’s explore how to invest in I Bonds and the associated tax implications.

If you’re looking to maximize your retirement savings, you’ll want to know what is the maximum 401k contribution for 2024. This limit can change annually, so it’s important to stay up-to-date on the latest figures.

Purchasing I Bonds

I Bonds can be purchased directly from the U.S. Treasury. You can purchase I Bonds electronically through TreasuryDirect or in paper form through a tax preparation service or financial institution.

If you’re over 50, you can contribute more to your Roth IRA in 2024. Check out the Roth IRA contribution limits for 2024 over 50 to see how much you can contribute.

Purchasing I Bonds Through TreasuryDirect

- Create a TreasuryDirect account.

- Verify your identity.

- Select the amount you wish to invest.

- Choose the purchase method (electronic or paper).

- Confirm the purchase.

Purchasing I Bonds Through a Tax Preparation Service or Financial Institution

- Contact a tax preparation service or financial institution.

- Provide the necessary information and purchase details.

- Complete the transaction.

Minimum Investment Amount and Maximum Investment Limits

The minimum investment amount for I Bonds is $25, and the maximum annual investment limit is $10,000 per person. You can purchase an additional $5,000 in I Bonds using your tax refund.

Many individuals are interested in maximizing their 401k contributions, but it’s also important to understand how much can be contributed after taxes. This can help you plan your contributions effectively.

Tax Implications of I Bond Investments

I Bonds are not subject to state or local taxes. However, you are required to pay federal income tax on the interest earned when you redeem the bonds.

For those with a SEP IRA, you’ll need to know the IRA contribution limits for SEP IRA in 2024. These limits can help you plan your retirement savings effectively.

The interest earned on I Bonds is considered taxable income and is reported on your federal tax return.

October 2024 brings a variety of tax credits available , so it’s worth taking a look at what you might qualify for. These credits can help offset your tax liability and save you money.

The interest earned on I Bonds is generally taxed as ordinary income, but you can choose to defer paying taxes until you redeem the bonds.

If you’re a tennis enthusiast, you won’t want to miss the Erste Bank Open 2024. Check out the schedule and ticket information to secure your spot at this exciting event.

Tips for Investing in I Bonds

I Bonds offer a unique combination of safety and potential for growth, making them an attractive investment option for many individuals. However, maximizing returns and managing risk requires a thoughtful approach. Here are some tips to help you make the most of your I Bond investments.

The IRA contribution limits for 2024 are subject to change each year. It’s essential to know the latest limits to ensure you’re maximizing your contributions and building a strong retirement nest egg.

Maximizing Returns, What is the Ibond rate in November 2024

I Bonds earn interest based on a fixed rate and an inflation rate that adjusts every six months. To maximize returns, consider these strategies:

- Invest the maximum amount:You can invest up to $10,000 per year in I Bonds per person, per Social Security number. Investing the maximum amount allows you to take advantage of the full potential growth offered by I Bonds.

- Invest early in the year:The inflation rate for I Bonds is set at the beginning of each six-month period. Investing early in the year can help you capture the higher inflation rate for the entire period.

- Hold I Bonds for at least a year:I Bonds have a one-year holding period. If you redeem them before a year, you forfeit the last three months of interest earned. Holding I Bonds for at least a year allows you to maximize your returns.

Managing Risk

I Bonds offer a relatively safe investment, but it’s important to understand the potential risks involved:

- Interest rate risk:The interest rate on I Bonds can fluctuate, and you may not earn the same rate you received when you first invested. However, the fixed rate component of the interest rate remains the same for the life of the bond.

With the tax changes impacting the October 2024 deadline , it’s crucial to stay informed about the new rules and regulations. This includes understanding the new deductions, credits, and income thresholds that may apply to your individual circumstances.

The inflation rate component adjusts every six months, providing some protection against inflation.

- Liquidity risk:I Bonds have a one-year holding period, and you may not be able to access your funds immediately if you need them. However, you can redeem them after one year, but you will forfeit the last three months of interest earned.

The recent Geico layoffs in October 2024 have sparked concerns about the long-term effects on the insurance industry. These layoffs are likely to impact customer service, policy processing, and overall efficiency.

- Inflation risk:While I Bonds offer protection against inflation, the rate may not always keep pace with rising inflation. However, I Bonds have historically provided a decent return during periods of high inflation.

Potential Downsides

While I Bonds offer several advantages, it’s important to consider the potential downsides:

- Limited return potential:I Bonds typically offer lower returns than other investments, such as stocks or bonds. However, they provide a relatively safe and predictable return, making them a good option for risk-averse investors.

- Tax implications:Interest earned on I Bonds is taxable as ordinary income in the year it is earned. However, you can defer paying taxes on the interest until you redeem the bond.

- Limited investment options:I Bonds are only available through TreasuryDirect, and you can only purchase them electronically. This can limit your investment options and may not be suitable for all investors.

Epilogue

In conclusion, I Bonds are a valuable investment tool for those seeking to protect their savings from inflation and potentially earn a competitive return. While the exact rate for November 2024 is yet to be determined, by understanding the factors that influence I Bond rates and the potential benefits of investing in them, investors can make informed decisions about their financial future.

With the ability to adjust their interest rates based on inflation, I Bonds offer a unique opportunity to navigate the challenges of a fluctuating economy and potentially achieve their financial goals.

Q&A

How do I purchase I Bonds?

You can purchase I Bonds through TreasuryDirect, the U.S. Treasury’s online system for buying and managing government securities.

What is the minimum investment amount for I Bonds?

The minimum investment amount for I Bonds is $25. You can purchase up to $10,000 in I Bonds per year.

Are there any tax implications for I Bond investments?

Interest earned on I Bonds is taxable as ordinary income, but you can defer paying taxes on the interest until you redeem the bonds. This can be beneficial if you expect to be in a lower tax bracket in the future.

How long can I hold an I Bond?

I Bonds have a minimum holding period of one year. After that, you can redeem them at any time, but you will incur a three-month interest penalty if you redeem them before five years.