What is the IRS mileage rate for October 2024? This question is important for anyone who drives for business, medical, or moving purposes. The IRS mileage rate is a standard rate that taxpayers can use to deduct their vehicle expenses on their tax returns.

The rate is adjusted periodically to reflect changes in fuel prices and other costs associated with driving. This rate can be a valuable tool for saving money on taxes, but it’s important to understand how it works and how to use it correctly.

The IRS mileage rate is based on the average cost of operating a vehicle, including fuel, maintenance, depreciation, and insurance. The rate is set by the IRS each year and is typically announced in the fall. The rate is divided into three categories: business, medical, and moving.

The business mileage rate is the highest, followed by the medical mileage rate, and then the moving mileage rate. The rate is typically lower for medical and moving purposes because the IRS assumes that these trips are shorter and less frequent than business trips.

Contents List

IRS Mileage Rate for October 2024

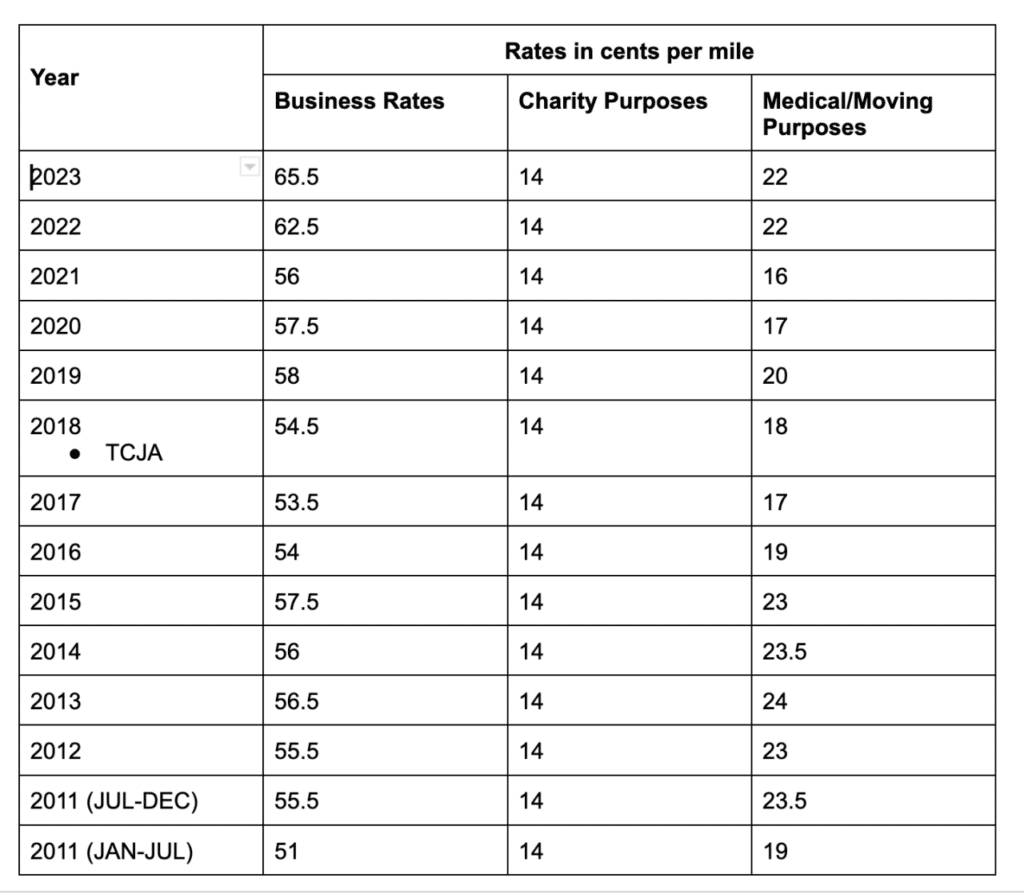

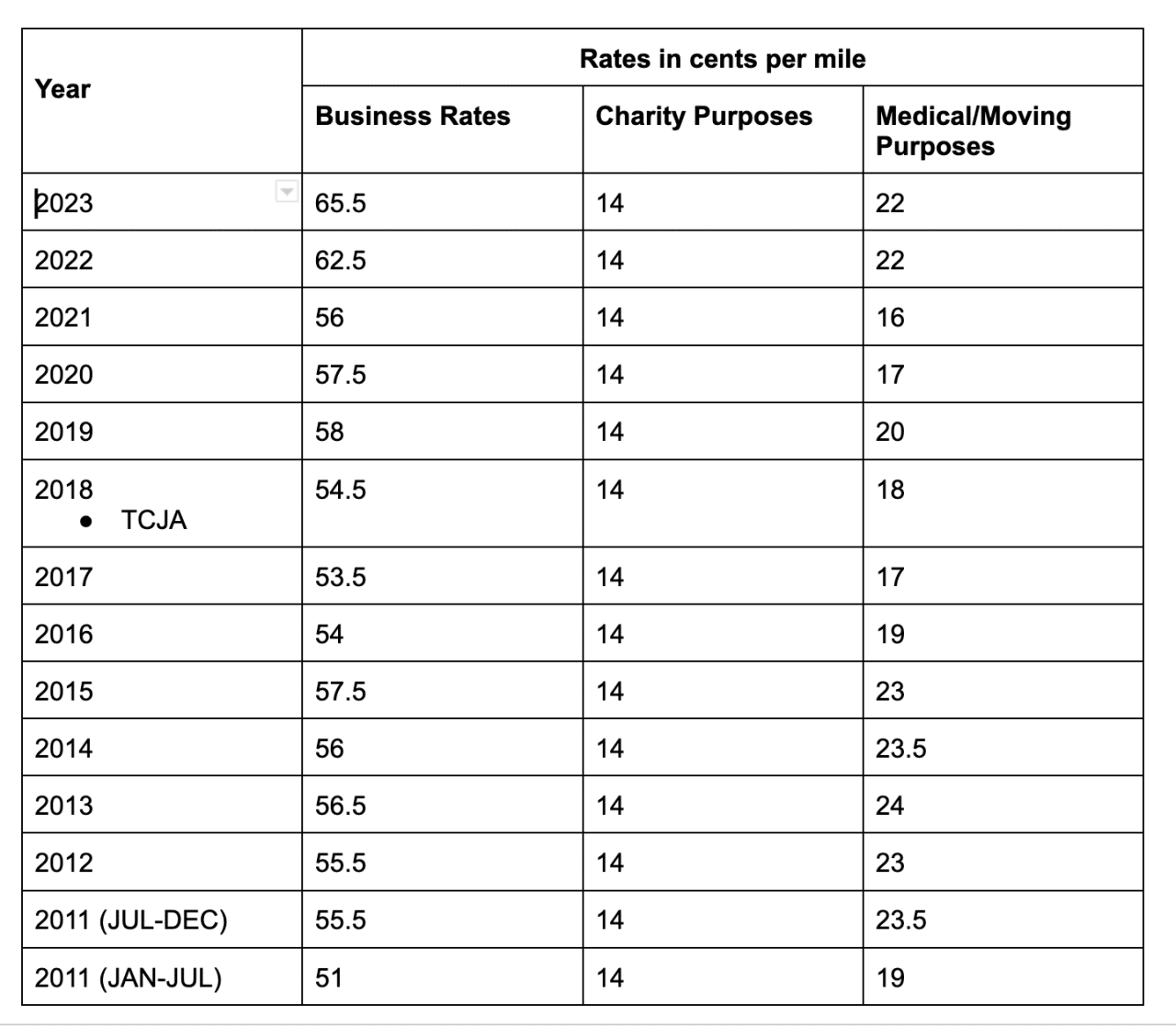

The IRS mileage rate is used to calculate the deductible expenses for business, medical, and moving purposes. It is updated annually by the IRS and is effective for the entire calendar year. The rates for October 2024 are as follows:

Standard Mileage Rates for October 2024, What is the IRS mileage rate for October 2024?

The standard mileage rate for business use in October 2024 is 65.5 cents per mile. This rate is used to deduct the costs of operating a vehicle for business purposes. The standard mileage rate for medical and moving purposes in October 2024 is 22 cents per mile.

Students often have a different tax deadline, and for 2024, it’s October 15th. This gives you a bit more time to file, but don’t forget that the deadline still applies to you! You can find more information about the October 2024 tax deadline for students at this link.

This rate is used to deduct the costs of operating a vehicle for medical or moving purposes. Here is a table that summarizes the mileage rates for different purposes in October 2024:

| Purpose | Rate per Mile | Date Range | Notes |

|---|---|---|---|

| Business | $0.655 | October 1, 2024

Understanding the tax rates for each bracket is crucial for planning your finances. The tax rates for each tax bracket in 2024 vary depending on your income level, so it’s essential to check the details to see how much of your hard-earned money will be going towards taxes.

|

This rate is used to deduct the costs of operating a vehicle for business purposes. |

| Medical | $0.22 | October 1, 2024

There have been some changes to the tax brackets for 2024 compared to 2023. It’s always good to stay up-to-date on these changes, as they can impact your tax liability. You can see a breakdown of the tax bracket changes for 2024 vs 2023 at this link.

|

This rate is used to deduct the costs of operating a vehicle for medical purposes. |

| Moving | $0.22 | October 1, 2024

The tax brackets for qualifying widow(er)s in 2024 are similar to those for married filing jointly, offering a bit of a break for those who have recently lost a spouse. You can find more information about these brackets, including specific income thresholds, at this link.

|

This rate is used to deduct the costs of operating a vehicle for moving purposes. |

Summary

Understanding the IRS mileage rate and how it works is essential for anyone who drives for business, medical, or moving purposes. By using the IRS mileage rate, taxpayers can deduct their vehicle expenses and save money on their taxes.

However, it’s important to keep accurate records and follow the IRS guidelines to ensure that you are eligible for the deduction. With the right information and planning, you can maximize your tax savings and make the most of the IRS mileage rate.

Answers to Common Questions: What Is The IRS Mileage Rate For October 2024?

What happens if the IRS mileage rate changes during the year?

You can use the mileage rate in effect for the date you incurred the expenses. For example, if you had a business trip in July and the mileage rate changed in October, you would use the July rate for your business trip.

Can I use the IRS mileage rate for personal trips?

No, the IRS mileage rate is only for business, medical, or moving purposes. You cannot use it for personal trips.

How do I keep track of my mileage?

You can keep track of your mileage using a mileage log, a smartphone app, or a GPS device. Be sure to record the date, starting and ending odometer readings, and the purpose of each trip.

What if I use my vehicle for both business and personal use?

You can only deduct the mileage for business, medical, or moving purposes. You cannot deduct mileage for personal trips.

Filing separately as a married couple can have its own unique set of tax brackets. It’s important to understand how these brackets work to make informed decisions about your filing status. You can find more information about the tax brackets for married filing separately in 2024 at this link.

The tax brackets for single filers in 2024 are designed to reflect the different income levels of individuals. Understanding these brackets is essential for accurate tax planning. You can find more information about the tax brackets for single filers in 2024 at this link.

Tax brackets directly influence how much of your income is taxed at different rates. It’s important to understand how these brackets work to make informed financial decisions. You can find more information about how tax brackets will affect your 2024 income at this link.

Want to quickly see how your income fits into the tax brackets for 2024? There are online calculators that can help you figure this out. Check out this link to find a tax bracket calculator for 2024 and get a better understanding of your tax situation.

Freelancers often have a different tax deadline than traditional employees. For 2024, the deadline for freelancers is October 15th. Make sure you’re aware of this deadline and have your taxes filed on time. You can find more information about the October 2024 tax deadline for freelancers at this link.

There have been some changes to the tax laws that might impact the October 2024 deadline. It’s important to stay up-to-date on these changes to ensure you’re filing correctly. You can find more information about the tax changes impacting the October 2024 deadline at this link.

Retirees often have different tax rules and deadlines than those still working. For 2024, the October 15th deadline applies to retirees. Make sure you’re aware of the specific deadlines and rules for your situation. You can find more information about the October 2024 tax deadline for retirees at this link.

The tax brackets for 2024 in the United States have been adjusted to reflect changes in the economy and tax policy. It’s important to understand these brackets to accurately calculate your tax liability. You can find more information about the tax brackets for 2024 in the United States at this link.

There are new tax brackets for 2024, and it’s important to be aware of how they might impact your taxes. These changes can affect your tax liability, so it’s essential to stay informed. You can find more information about the new tax brackets for 2024 at this link.

When filing your taxes for the October 2024 deadline, it’s important to consider any deductions you may be eligible for. These deductions can help reduce your tax liability and save you money. You can find more information about tax deductions for the October 2024 deadline at this link.

Tax credits can offer significant tax savings, and there are various credits available for the October 2024 deadline. Taking advantage of these credits can help you reduce your tax burden. You can find more information about tax credits for the October 2024 deadline at this link.