What is the maximum 401k contribution for 2024? This question is top of mind for many individuals looking to maximize their retirement savings. The answer depends on several factors, including your age and income level. Understanding the contribution limits and strategies for maximizing your 401(k) is crucial for building a secure financial future.

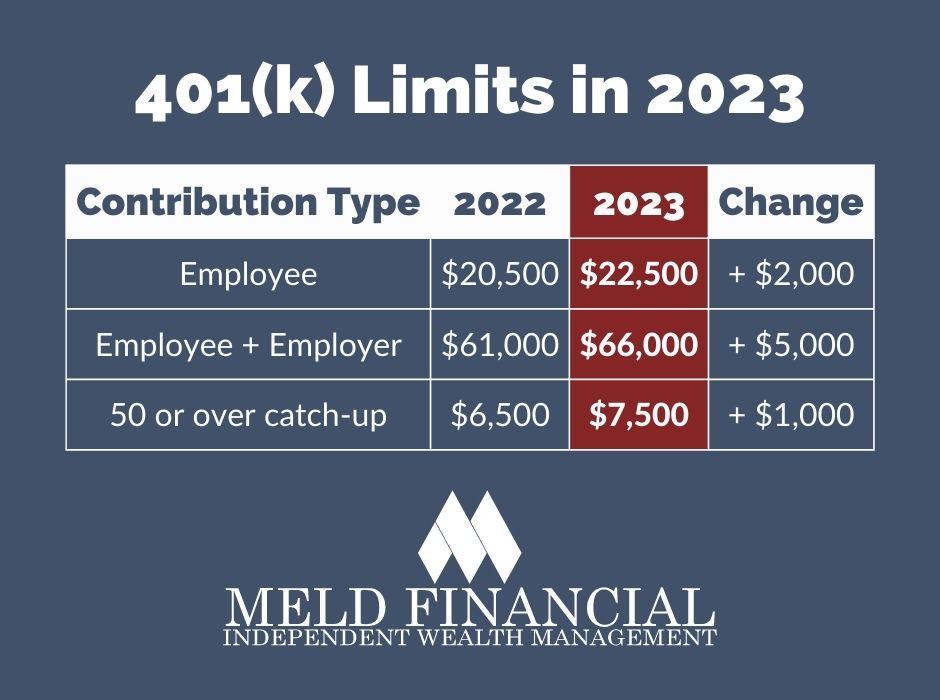

In 2024, the maximum contribution limit for 401(k) plans is $22,500. If you’re 50 or older, you can contribute an additional $7,500 as a catch-up contribution, bringing the total to $30,000. These limits apply to both traditional and Roth 401(k) plans.

Contents List

2024 401(k) Contribution Limits

The 401(k) plan is a retirement savings plan that allows employees to contribute pre-tax dollars to a retirement account. Contributions grow tax-deferred and withdrawals are taxed in retirement. The maximum contribution limit for 2024 is determined by the IRS and may change annually.

As the October 2024 tax deadline approaches, it’s a good idea to review tax preparation tips. You can find some helpful guidance here. These tips can help you ensure your taxes are filed correctly and on time.

2024 401(k) Contribution Limits for Employees

The maximum amount that an employee can contribute to a 401(k) plan in 2024 is $22,500. This is an increase from the 2023 limit of $22,500.

The IRS has set contribution limits for traditional and Roth IRAs in 2024 and beyond, which you can find here. These limits can change annually, so it’s good to check the latest information to ensure you’re contributing the maximum amount allowed.

Catch-Up Contributions for Individuals Aged 50 and Older

Individuals aged 50 and older can make additional catch-up contributions to their 401(k) plans. This allows them to save more for retirement. The catch-up contribution limit for 2024 is $7,500.

The tax bracket thresholds for 2024 are available here. Understanding these thresholds can help you plan your finances and make informed decisions about your tax obligations.

Tax Benefits of 401(k) Contributions

Contributions to a 401(k) plan are made with pre-tax dollars, which means that you will not have to pay taxes on the money until you withdraw it in retirement. This can significantly reduce your tax liability in the present and help you accumulate more wealth for retirement.

Wondering if the mileage rate is changing in October 2024? You can find the latest information on mileage rate changes here. This information is crucial for accurate deductions when filing your taxes.

Impact of 401(k) Contributions on Retirement Savings

Maximizing your 401(k) contributions can have a significant impact on your retirement savings, setting you up for a comfortable and secure future. By consistently contributing the maximum amount allowed, you can harness the power of compound interest and accumulate a substantial nest egg over time.

The October 2024 tax deadline is approaching! The IRS provides helpful resources to guide you through the process, which you can find here. These resources can help you file your taxes accurately and on time.

Retirement Income Projections with Different Contribution Amounts

The amount you contribute to your 401(k) directly affects your retirement income projections. Let’s consider a hypothetical scenario:

- Scenario 1:You contribute $22,500 annually (the maximum for 2024) for 30 years, assuming an average annual return of 7%. You could accumulate approximately $1.6 million by retirement.

- Scenario 2:You contribute $10,000 annually for 30 years, assuming the same 7% return.

Thinking about contributing to a Roth IRA in 2024? You can find the contribution limits for Roth IRAs here. This information can help you maximize your retirement savings while taking advantage of tax benefits.

You could accumulate approximately $720,000 by retirement.

This simple example highlights the substantial difference in potential retirement income based on your contribution amount. Even a seemingly small difference in contributions can lead to a significant difference in your retirement savings.

Thinking about a SIMPLE IRA for your retirement savings? The contribution limits for SIMPLE IRAs in 2024 are available here. These limits are designed to help you make the most of this retirement savings option.

Benefits of Early Contributions and Compound Interest

Starting early with your 401(k) contributions offers a significant advantage due to the power of compound interest. Compound interest works by earning interest on your initial investment, and then earning interest on the interest earned. This snowball effect can dramatically increase your savings over time.

Planning to contribute to a SEP IRA in 2024? You can find the maximum contribution limits for SEP IRAs here. This information is important for maximizing your retirement savings and taking advantage of tax benefits.

“The earlier you start, the more time your money has to grow.”

If you’re self-employed, you might be considering a Solo 401(k). Find out the contribution limits for Solo 401(k)s in 2024 here. These limits can help you determine how much you can save for retirement through this type of account.

For instance, let’s consider two individuals:

- Individual A:Starts saving at age 25 and contributes $10,000 annually for 30 years.

- Individual B:Starts saving at age 35 and contributes $10,000 annually for 20 years.

Assuming a 7% annual return, Individual A could accumulate approximately $1.1 million by retirement, while Individual B would accumulate approximately $540,000. This illustrates the significant advantage of starting early and allowing your savings to grow over a longer period.

Need to know the mileage rate for medical expenses in October 2024? You can find this information here. This rate can be used to deduct certain medical expenses when you file your taxes.

Additional Resources and Considerations: What Is The Maximum 401k Contribution For 2024

Understanding 401(k) contributions and retirement planning is crucial for securing your financial future. While we’ve covered the basics, there are many other resources and considerations that can help you maximize your savings.

Want to know the highest tax bracket in 2024? You can find the answer, along with details about other tax brackets, here. This information can be helpful for planning your finances and understanding your tax obligations.

Accessing Additional Resources

To gain a deeper understanding of 401(k) contributions and retirement planning, it’s beneficial to explore various resources. Here are some reputable sources of information:

- The Internal Revenue Service (IRS):The IRS website provides comprehensive information on 401(k) plans, contribution limits, and tax implications. You can find publications, FAQs, and other valuable resources.

- The U.S. Department of Labor:The Department of Labor’s website offers information on retirement plans, including 401(k)s, and provides guidance on protecting your retirement savings.

- Financial Planning Organizations:Organizations like the Financial Planning Association (FPA) and the Certified Financial Planner Board of Standards (CFP Board) can provide information on finding qualified financial advisors.

- Your Employer’s Human Resources Department:Your employer’s HR department can provide specific details about your company’s 401(k) plan, including matching contributions, vesting schedules, and investment options.

Consulting with Financial Advisors

Seeking professional advice from a qualified financial advisor can be invaluable in navigating the complexities of retirement planning. Here’s how a financial advisor can help:

- Personalized Retirement Plan:A financial advisor can help you develop a personalized retirement plan based on your individual circumstances, goals, and risk tolerance.

- Investment Strategy:They can guide you in choosing appropriate investments for your 401(k) plan, ensuring your portfolio aligns with your retirement objectives.

- Tax Optimization:Financial advisors can help you understand the tax implications of your 401(k) contributions and withdrawals, maximizing your after-tax returns.

- Retirement Projections:They can provide realistic retirement projections based on your current savings, estimated expenses, and anticipated investment growth.

Understanding Employer Matching Contributions, What is the maximum 401k contribution for 2024

Many employers offer matching contributions to their employees’ 401(k) plans. This means that for every dollar you contribute, your employer will contribute a certain percentage, often up to a specified limit.

- Maximizing Employer Match:It’s crucial to understand your employer’s matching contribution policy and ensure you contribute enough to receive the full match. This is essentially free money, significantly boosting your retirement savings.

- Vesting Schedule:Be aware of your employer’s vesting schedule, which Artikels how long you need to work for the company to fully own the employer’s matching contributions.

Exploring Other Retirement Plan Options

Besides 401(k)s, there are other retirement plan options available, each with its own advantages and disadvantages:

- Individual Retirement Accounts (IRAs):IRAs are individual retirement accounts that offer tax advantages. There are two main types: Traditional IRAs, where contributions are tax-deductible, and Roth IRAs, where withdrawals are tax-free in retirement.

- 403(b) Plans:403(b) plans are similar to 401(k)s but are specifically for employees of non-profit organizations, public schools, and certain other organizations.

- 457 Plans:457 plans are available to employees of state and local governments and certain non-profit organizations. They offer tax-deferred growth and can be a valuable option for those working in the public sector.

Final Wrap-Up

Taking advantage of the maximum 401(k) contribution limit can significantly boost your retirement savings. Remember to consider your individual financial situation and consult with a financial advisor to develop a personalized retirement plan that meets your goals. By understanding the contribution limits, exploring different strategies, and maximizing your contributions, you can pave the way for a comfortable and secure retirement.

FAQ Overview

What are the tax benefits of contributing to a 401(k)?

Traditional 401(k) contributions are tax-deductible, meaning you can reduce your taxable income and potentially lower your tax bill. Roth 401(k) contributions are made with after-tax dollars, but your withdrawals in retirement are tax-free.

Can I withdraw money from my 401(k) before retirement?

You can withdraw money from your 401(k) before retirement, but you may be subject to penalties and taxes. Early withdrawals are generally allowed in cases of hardship, such as medical expenses or a first-time home purchase. Consult with a financial advisor to understand the potential consequences of early withdrawals.

How do employer matching contributions work?

Employer matching contributions are a valuable benefit offered by many companies. Your employer will match a portion of your 401(k) contributions, effectively increasing your retirement savings. Be sure to take full advantage of any employer matching contributions available to you.

Need to know the mileage rate for moving expenses in October 2024? You can find the latest information on this rate here. This rate can be used to deduct moving expenses when you file your taxes.

Want to know the current mileage rate for October 2024? You can find the latest information on the mileage rate here. This rate is used to deduct business and medical expenses when filing your taxes.

The October 2024 tax deadline is quickly approaching. If you need to file your taxes, you can find helpful information on how to do so here. These resources can guide you through the process and help you file your taxes on time.

Need to fill out a W9 Form for October 2024? You can find instructions and guidance on how to complete this form here. This information is essential for accurate reporting and tax filing.