What is the maximum 401k contribution for 2024 for over 50? If you’re over 50, you have the opportunity to boost your retirement savings with catch-up contributions. This extra contribution allows you to put away more money each year, potentially accelerating your path to financial security.

Let’s delve into the details of these valuable contributions and how they can benefit your retirement planning.

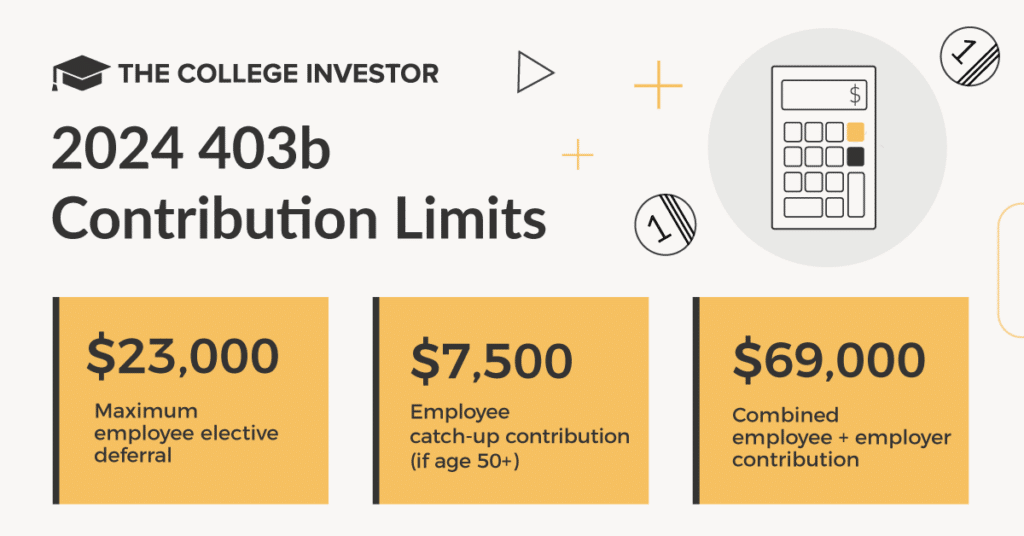

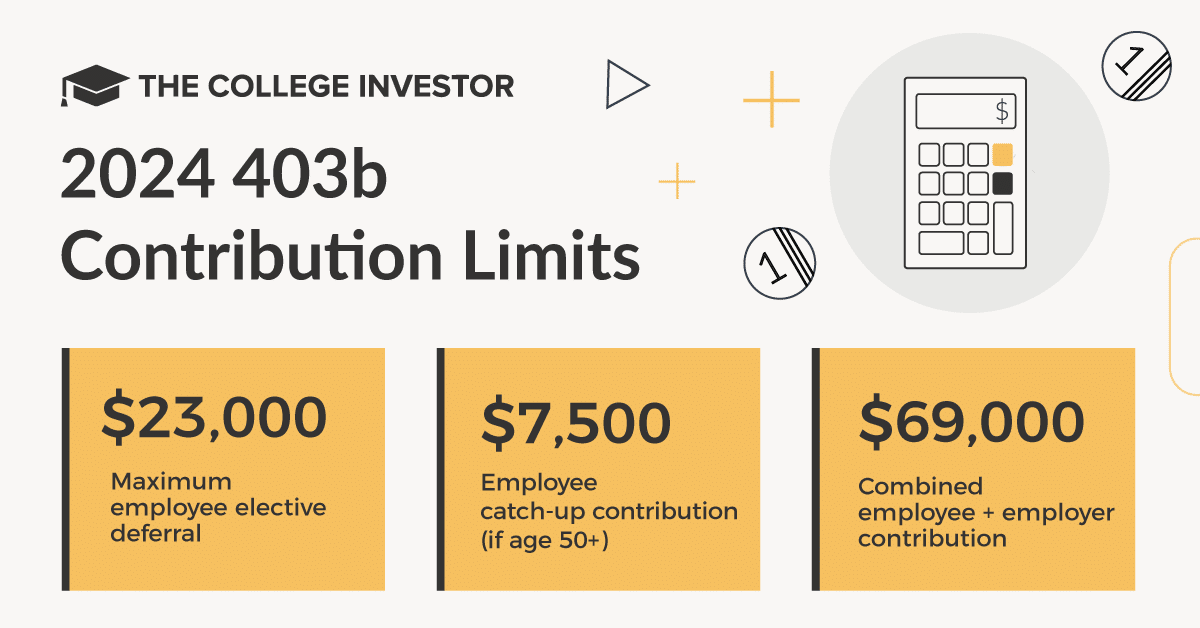

In 2024, individuals over 50 can contribute an additional $7,500 to their 401(k) plans, on top of the standard contribution limit of $22,500. This means that you can contribute up to $30,000 to your 401(k) in 2024. These catch-up contributions are designed to help older workers make up for lost time and reach their retirement savings goals.

Contents List

Factors Influencing Contribution Decisions: What Is The Maximum 401k Contribution For 2024 For Over 50

Deciding how much to contribute to your 401(k) is a significant financial decision that involves careful consideration of various factors. Your individual circumstances, financial goals, and risk tolerance all play a crucial role in shaping your contribution strategy.

The tax bracket changes for 2024 could impact your tax liability. It’s a good idea to stay informed about any adjustments that might affect your taxes.

Personal Financial Situation, What is the maximum 401k contribution for 2024 for over 50

Your personal financial situation significantly influences your 401(k) contribution decisions.

Saving for retirement? You might be interested in the IRA contribution limits for married couples in 2024. These limits can help you maximize your contributions and potentially boost your retirement savings.

- Current Income and Expenses:Your current income and expenses determine your disposable income, which is the amount available for saving and investing. If you have high expenses or a low income, you may have limited funds available for 401(k) contributions.

- Existing Debt:If you have substantial debt, such as student loans or credit card debt, you might prioritize paying down that debt before maximizing 401(k) contributions.

Have the IRA contribution limits for 2024 vs 2023 changed? It’s always a good idea to stay informed about any adjustments that might affect your retirement savings.

- Emergency Fund:Having an emergency fund is crucial for financial stability. It’s advisable to have 3-6 months’ worth of living expenses saved before aggressively contributing to your 401(k).

Retirement Goals

Your retirement goals are a primary driver of your 401(k) contribution decisions.

Are you part of a partnership? You’ll likely need to fill out the W9 Form for October 2024 for partnerships. This form is used to report your tax information to the partnership.

- Retirement Age:The earlier you plan to retire, the more you’ll need to save. If you plan to retire early, you’ll need to contribute more to reach your desired retirement savings goal.

- Desired Retirement Lifestyle:Your desired retirement lifestyle influences how much you need to save.

Planning to contribute to a Roth IRA? The IRA contribution limits for Roth IRA in 2024 can help you determine how much you can contribute to your retirement savings.

If you envision a lavish retirement, you’ll need a larger nest egg than someone who desires a modest lifestyle.

- Expected Retirement Expenses:Estimating your future expenses, such as housing, healthcare, and travel, helps determine your retirement savings needs.

Risk Tolerance

Your risk tolerance plays a crucial role in determining your 401(k) investment strategy and contribution decisions.

If you’re working with government agencies, you’ll need to complete the W9 Form for October 2024 for government agencies. This form provides your tax information to the agency.

- Investment Choices:A higher risk tolerance may lead you to invest in a more aggressive portfolio with a higher potential for growth but also higher risk. Conversely, a lower risk tolerance might lead you to invest in a more conservative portfolio with lower potential returns but also lower risk.

If you’re driving for business, you’ll need to know the mileage rate for October 2024. This rate is used to calculate your business deductions for vehicle expenses.

- Contribution Strategy:If you have a high risk tolerance, you might be more inclined to contribute the maximum amount to your 401(k) to maximize potential growth. Conversely, if you have a low risk tolerance, you might contribute a smaller amount to prioritize financial security.

Planning to contribute to your 401(k)? The 401(k) contribution limits for 2024 by age can help you determine how much you can contribute based on your age.

Benefits of Maximum Contribution

Contributing the maximum amount to your 401(k) offers several advantages, including:

- Tax Advantages:401(k) contributions are pre-tax, meaning you reduce your taxable income, leading to lower tax liability.

- Compounding Growth:The earlier you start contributing, the more time your money has to grow through compounding.

- Employer Match:Many employers offer a matching contribution, which is free money for your retirement savings.

Want to get an idea of what tax bracket you might fall into? The tax bracket calculator for 2024 can help you estimate your tax liability based on your income.

- Potential for Early Retirement:Maximizing your contributions can help you reach your retirement goals faster and potentially retire earlier.

Other Financial Goals

While maximizing your 401(k) contributions is important, it’s essential to consider other financial goals as well.

Are you self-employed? Don’t forget the October 2024 tax deadline for self-employed individuals. Make sure to file your taxes on time to avoid any penalties.

- Paying Down Debt:If you have high-interest debt, such as credit card debt, it might be more beneficial to prioritize paying it down before maximizing your 401(k) contributions.

- Saving for a Down Payment:If you’re saving for a down payment on a house, you might allocate a portion of your savings to that goal.

If you’re self-employed, you might be interested in the IRA contribution limits for solo 401(k) in 2024. These limits can help you maximize your contributions and potentially boost your retirement savings.

- Funding Education:If you have children or plan to pursue further education, you might need to prioritize saving for those expenses.

Planning for Retirement with 401(k) Contributions

Planning for retirement is a crucial aspect of financial well-being, and 401(k) contributions play a significant role in accumulating wealth over time. Understanding the impact of different contribution levels and strategies can help individuals make informed decisions to secure their financial future.

Wondering if the mileage rate is changing in October 2024 ? It’s a good idea to stay updated on any changes that might affect your business deductions.

Illustrative Scenarios of 401(k) Contributions

This table illustrates the potential impact of different 401(k) contribution levels on retirement savings, assuming a consistent annual rate of return:| Contribution Level | Annual Contribution | Estimated Account Balance at Age 65 ||—|—|—|| Low | $5,000 | $350,000 || Moderate | $10,000 | $700,000 || High | $15,000 | $1,050,000 |These figures are for illustrative purposes only and do not reflect individual circumstances or market fluctuations.

Need help filling out the W9 Form for October 2024 ? There are resources available to guide you through the process and ensure you complete it correctly.

However, they highlight the significant potential for growth when consistent contributions are made over an extended period.

Have there been any W9 Form changes and updates for October 2024 ? It’s important to stay up-to-date on any revisions to ensure you’re completing the form correctly.

Steps to Maximize 401(k) Contributions for Retirement

Maximizing 401(k) contributions can greatly enhance retirement savings. Here are some steps individuals can take:

- Contribute the Maximum Allowed:Utilize the full annual contribution limit, which is $22,500 for 2024. This maximizes the potential for tax-deferred growth.

- Take Advantage of Employer Matching:If your employer offers a matching contribution, make sure to contribute enough to receive the full match. This is essentially free money that boosts your retirement savings.

- Increase Contributions Gradually:If increasing contributions all at once is challenging, gradually increase them over time. This helps adjust to higher contributions and allows for greater flexibility.

- Review Asset Allocation Regularly:Ensure your investment portfolio aligns with your risk tolerance and time horizon. Periodically review and adjust your asset allocation as needed.

- Consider Roth 401(k) Contributions:If you anticipate being in a higher tax bracket in retirement, Roth 401(k) contributions may be beneficial, as withdrawals in retirement are tax-free.

Visual Representation of 401(k) Growth

The following graphic illustrates the potential growth of a 401(k) account over time, considering different contribution levels and assuming an average annual rate of return:

[Insert image of a line graph showing the growth of a 401(k) account over time, with different lines representing different contribution levels. The x-axis should represent time, and the y-axis should represent account balance. The graph should show that higher contribution levels result in significantly higher account balances over time.]

If you’re driving for business, you’ll want to know the standard mileage rate for October 2024. This rate is used to calculate your business deductions for vehicle expenses.

This visual representation demonstrates the power of compounding and the importance of starting early and contributing consistently. Even small increases in contributions can have a substantial impact on retirement savings over time.

End of Discussion

Taking advantage of the catch-up contribution limit for individuals over 50 can be a smart move to bolster your retirement savings. Remember to consider your individual financial situation, retirement goals, and risk tolerance when making your contribution decisions. It’s never too late to start saving for retirement, and every dollar you contribute can make a difference in the long run.

By maximizing your 401(k) contributions, you’re taking a proactive step towards a comfortable and secure retirement.

FAQ Resource

Can I contribute the catch-up amount even if I haven’t reached the standard contribution limit?

Yes, you can contribute the catch-up amount even if you haven’t reached the standard contribution limit. However, you cannot exceed the total combined contribution limit of $30,000 for 2024.

Are catch-up contributions subject to the same tax benefits as regular 401(k) contributions?

Yes, catch-up contributions receive the same tax advantages as regular 401(k) contributions. They are pre-tax contributions, meaning you won’t pay taxes on them until you withdraw the money in retirement.

Does the catch-up contribution limit apply to other retirement accounts like Roth 401(k)s?

The catch-up contribution limit only applies to traditional 401(k) plans. There is no separate catch-up contribution limit for Roth 401(k)s.

How do I know if my employer offers catch-up contributions?

You should contact your employer’s human resources department to find out if they offer catch-up contributions. Not all employers offer this option.