What is the maximum Roth IRA contribution in 2024? This question is on the minds of many individuals looking to secure their financial future. A Roth IRA allows you to contribute after-tax dollars, which grow tax-free and can be withdrawn tax-free in retirement.

Understanding the contribution limits is crucial for maximizing your retirement savings potential.

The maximum contribution limit for 2024 is set at $6,500 for individuals and $13,000 for married couples filing jointly. This limit applies to those under the age of 50. Those aged 50 and older can contribute an additional “catch-up” amount of $1,000, bringing their total contribution limit to $7,500 for individuals and $14,000 for couples.

It’s important to note that these limits are subject to change, so it’s always advisable to consult with a financial advisor or refer to the IRS website for the most up-to-date information.

Contents List

Roth IRA Contribution Limits for 2024: What Is The Maximum Roth IRA Contribution In 2024

The maximum amount you can contribute to a Roth IRA in 2024 depends on your age and whether you’re filing as single or married filing jointly. These contribution limits are set by the IRS and can change from year to year.

If you’re self-employed, it’s important to stay on top of your tax obligations. The October 2024 tax deadline for self-employed individuals is different from the deadline for regular employees, so make sure you know when you need to file.

Contribution Limits for 2024

The maximum Roth IRA contribution limit for 2024 is $7,000 for individuals and $14,000 for married couples filing jointly.

Note:If you’re 50 or older in 2024, you can contribute an additional $1,000 on top of the regular contribution limit, bringing the total to $8,000 for individuals and $15,000 for married couples filing jointly.

Potential Changes to Contribution Limits

While the contribution limits are set for 2024, they could change in future years. The IRS typically adjusts the contribution limits for inflation, so you can expect to see increases in the future. However, the exact amount of any increase will depend on the rate of inflation.

Example:If inflation is 3% in 2025, the contribution limit could increase to $7,210 for individuals and $14,420 for married couples filing jointly.

Eligibility for Roth IRA Contributions

Not everyone is eligible to contribute to a Roth IRA. Your eligibility depends on your income, and you may be able to contribute a portion of your income even if you exceed the income limits.

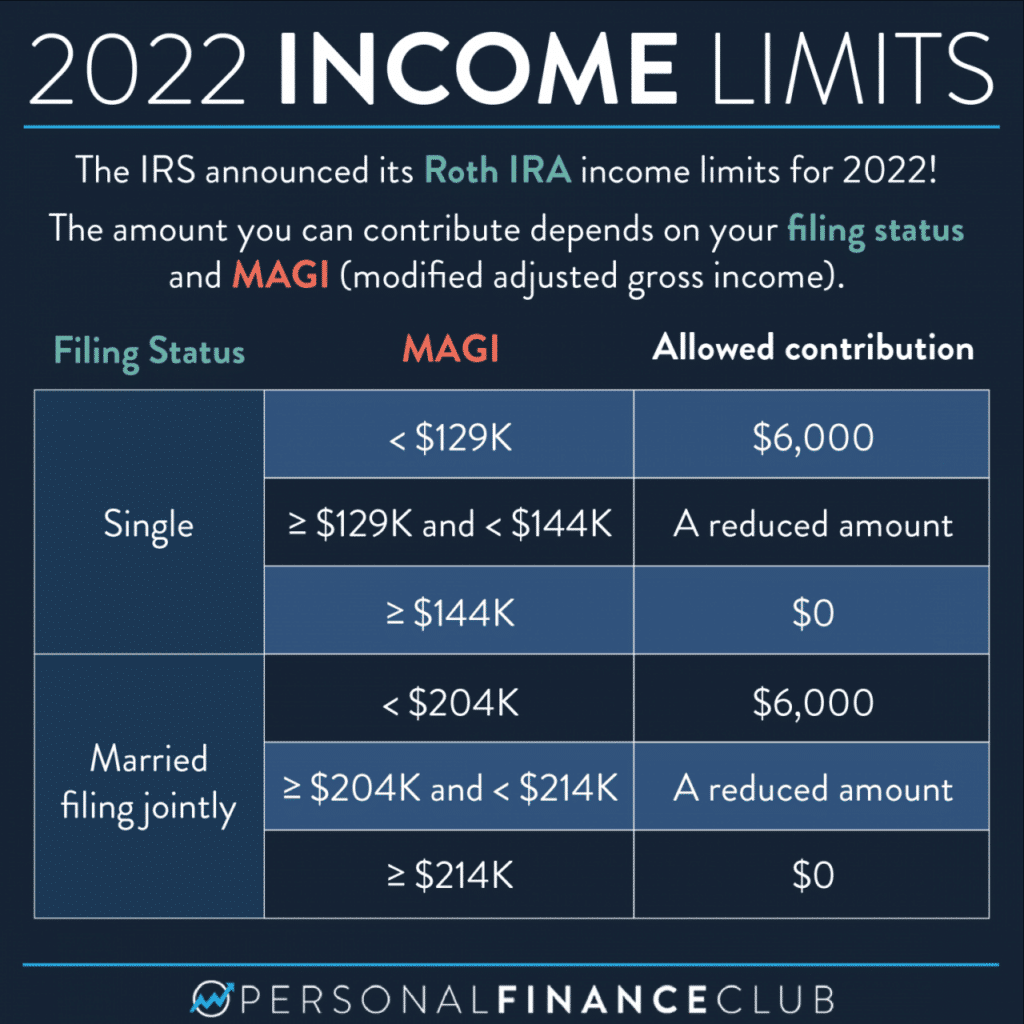

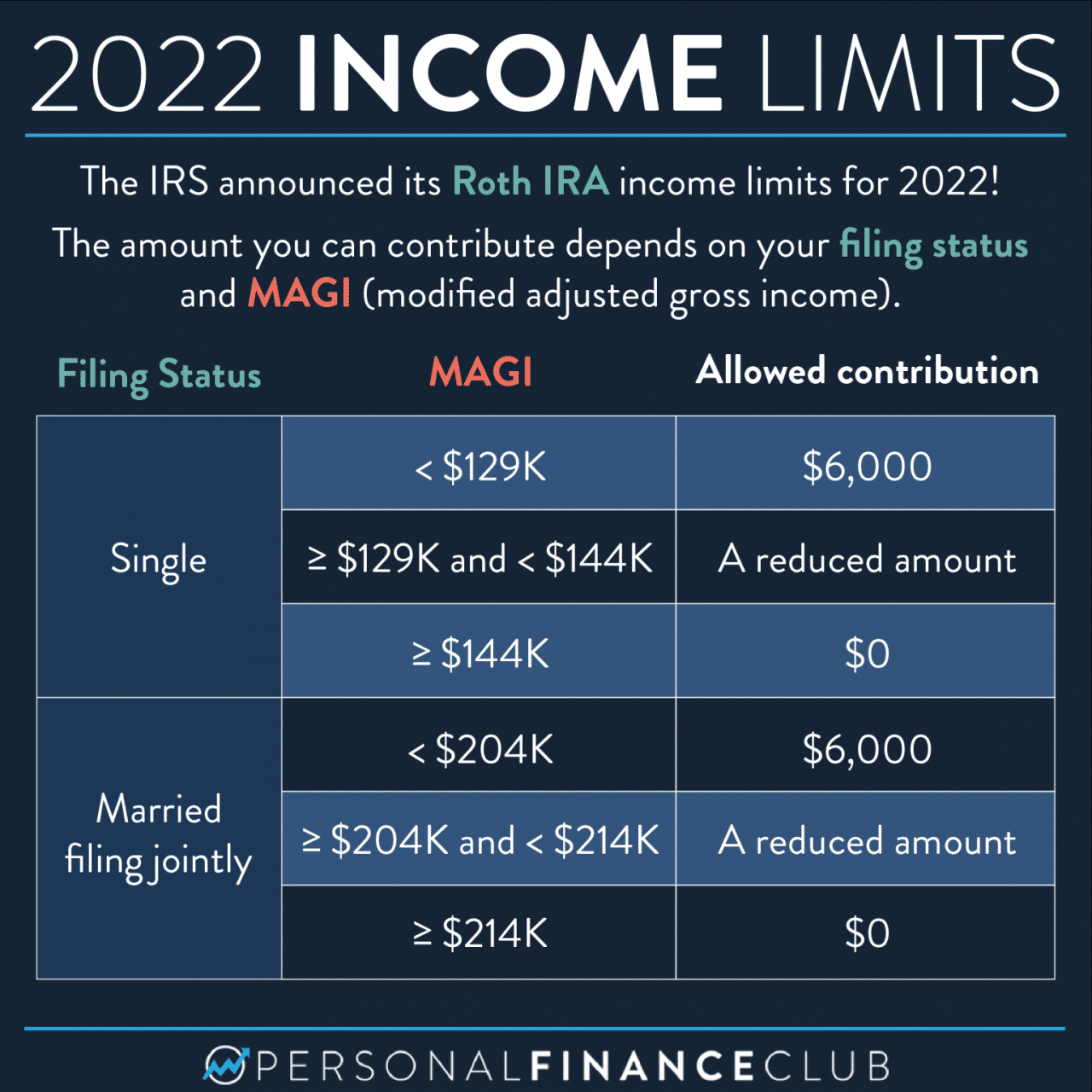

Modified Adjusted Gross Income (MAGI) Limits

The amount you can contribute to a Roth IRA depends on your modified adjusted gross income (MAGI). For 2024, the MAGI limits are:

If your MAGI is: | You can contribute:

——————–|———————–

If you’re a high earner, you might have a higher 401k contribution limit. You can find the 401k contribution limits for 2024 for high earners on our website. This can help you make the most of your retirement savings and reach your financial goals.

$153,000 or less | The full amount$153,001 to $168,000 | A reduced amount$168,001 or more | Nothing

You might be thinking about maxing out your 401k contributions this year, but you might be wondering if you can go over the limit. While it’s generally not possible to contribute more than the annual limit, there are some exceptions.

Check out our article on whether you can contribute more than the 401k limit in 2024 to see if you qualify.

Consequences of Exceeding the MAGI Limits

If your MAGI exceeds the limits, you will not be able to contribute to a Roth IRA. You can still contribute to a traditional IRA, but you will have to pay taxes on the withdrawals in retirement.

Saving for retirement is important, and an IRA is a great way to do it. You might be wondering how much you can contribute to your IRA in 2024. You can find the IRA contribution limits for 2024 on our website.

This can help you plan your retirement savings and reach your financial goals.

Advantages of Roth IRA Contributions

The Roth IRA offers several advantages, making it a popular retirement savings option for many individuals. The most significant advantage is the potential for tax-free withdrawals in retirement, which can significantly enhance your financial well-being during your golden years.

Owning rental property can be a good investment, but it also comes with tax implications. You’ll need to report your income and expenses from your rental property, and you can use a tax calculator for income from rental properties in October 2024 to help you figure out your tax liability.

Tax-Free Withdrawals in Retirement

Roth IRA contributions grow tax-deferred, and qualified withdrawals in retirement are tax-free. This means you won’t have to pay any federal income tax on the money you withdraw from your Roth IRA after you reach age 59 1/2 and have held the account for at least five years.

Credit cards can be useful, but it’s important to choose one that works for you. If you’re looking for a credit card with no annual fee, there are plenty of options available. You can find the best credit cards with no annual fee in October 2024 on our website.

This can save you a substantial amount of money in taxes, especially if your income is higher in retirement.

Saving for retirement is important, and knowing how much you can contribute to your 401k can help you reach your goals. The contribution limit for 2024 might be different than what you’re used to, so it’s good to check.

And if you’re over 50, you might be able to make extra “catch-up” contributions, which can be a real boost to your retirement savings.

Impact on Overall Tax Liability, What is the maximum Roth IRA contribution in 2024

Contributing to a Roth IRA can also impact your overall tax liability. Because Roth IRA contributions are made with after-tax dollars, they don’t reduce your taxable income in the year you contribute. This can be beneficial if you expect to be in a lower tax bracket in retirement.

For example, if you are currently in a higher tax bracket but anticipate being in a lower tax bracket in retirement, contributing to a Roth IRA could be a smart strategy.

Roth IRA vs. Traditional IRA

Both Roth IRAs and Traditional IRAs are popular retirement savings vehicles, offering tax advantages to help you save for your golden years. However, they differ in how they handle taxes, which can impact your financial strategy.

Tax Treatment

The main difference between Roth IRAs and Traditional IRAs lies in when you pay taxes.

If you’re thinking about making the maximum contribution to your 401k in 2024, it’s good to know the limits. You can find the maximum 401k contribution for 2024, including catch-up contributions , online. Keep in mind that these limits can change, so it’s always best to check the most up-to-date information.

- Roth IRA:You contribute after-tax dollars, meaning you don’t receive a tax deduction for contributions. However, your withdrawals in retirement are tax-free.

- Traditional IRA:You contribute pre-tax dollars, which means you receive a tax deduction for your contributions. But, your withdrawals in retirement are taxed as ordinary income.

Withdrawal Options

The tax treatment of withdrawals also varies between Roth IRAs and Traditional IRAs.

If you’re a freelancer, you’ll need to file your taxes differently than someone who works for an employer. The October 2024 tax deadline for freelancers is different than the deadline for regular employees, so make sure you know when you need to file.

- Roth IRA:Withdrawals of contributions (not earnings) are always tax-free and penalty-free. Withdrawals of earnings are also tax-free and penalty-free after age 59 1/2, provided you’ve held the account for at least five years.

- Traditional IRA:Withdrawals before age 59 1/2 are generally subject to a 10% penalty, plus your usual income tax rate. However, there are exceptions, such as for first-time homebuyers, certain medical expenses, and disability. After age 59 1/2, withdrawals are taxed as ordinary income.

The 401k contribution limit can vary depending on your employer. You can find the 401k contribution limits for 2024 for different employers on our website. This can help you figure out how much you can contribute and plan your retirement savings.

Factors to Consider When Choosing

When deciding between a Roth IRA and a Traditional IRA, consider the following factors:

- Your current tax bracket:If you expect to be in a higher tax bracket in retirement, a Roth IRA might be more beneficial. This is because your withdrawals will be tax-free, regardless of your future income.

- Your anticipated future income:If you expect your income to be lower in retirement, a Traditional IRA might be a better choice. This is because you’ll receive a tax deduction for contributions now, when your income is higher.

- Your risk tolerance:Roth IRAs are generally considered more flexible, as you can withdraw your contributions at any time without penalty. This can be advantageous if you need access to your savings before retirement.

- Your long-term financial goals:Consider your long-term financial goals and how you expect your tax situation to evolve over time. This will help you determine which type of IRA is right for you.

Example: Choosing Between Roth IRA and Traditional IRA

Let’s say you’re in your early 20s and earning a modest income. You expect your income to increase significantly over the next few decades. You also anticipate being in a higher tax bracket in retirement. In this case, a Roth IRA might be a better choice.

You’ll pay taxes on your contributions now, when your income is lower. But, your withdrawals in retirement will be tax-free, even if your income is significantly higher.On the other hand, if you’re nearing retirement and expect your income to be lower in the future, a Traditional IRA might be more beneficial.

Your age can affect how much you can contribute to your 401k. You can find the 401k contribution limits for 2024 by age on our website. This can help you understand the limits for your age group and make the most of your retirement savings.

You’ll receive a tax deduction for your contributions now, when your income is higher. This can help reduce your current tax liability. However, you’ll need to pay taxes on your withdrawals in retirement.Ultimately, the best choice for you depends on your individual circumstances.

A SIMPLE IRA is a type of retirement account that’s available to small businesses and self-employed individuals. If you have a SIMPLE IRA, you might be wondering about the contribution limits. You can find the IRA contribution limits for SIMPLE IRAs in 2024 on our website.

It’s essential to consider your current and future tax situation, your risk tolerance, and your long-term financial goals. Consulting with a financial advisor can help you make an informed decision.

Strategies for Maximizing Roth IRA Contributions

The Roth IRA offers a powerful way to save for retirement, but it’s important to maximize your contributions to fully reap the benefits. This section Artikels strategies to make the most of your Roth IRA contributions.

Figuring out your taxes can be a bit of a headache, but luckily there are tools to help! You can use a tax calculator for deductions and credits in October 2024 to see how much you might owe or get back.

This can be especially helpful if you’re self-employed, as you’ll need to pay estimated taxes throughout the year.

Income Limits and Contribution Strategies

Understanding income limits is crucial when maximizing your Roth IRA contributions. There are income limits for Roth IRA contributions, and exceeding these limits can restrict your ability to contribute fully. For instance, in 2024, if your modified adjusted gross income (MAGI) is above a certain threshold, you may not be eligible to contribute to a Roth IRA or may only be able to contribute a reduced amount.

Here are some strategies to consider:

- Contribute Early and Often:Start contributing as early as possible, even if you can only afford a small amount. This allows you to take advantage of the power of compounding and lets your money grow over time. This is a key strategy, especially for those who expect to reach the income limits in the future.

- Consider a Backdoor Roth IRA:If your income exceeds the Roth IRA contribution limits, you may consider a backdoor Roth IRA. This involves contributing to a traditional IRA and then converting the funds to a Roth IRA. This strategy allows you to potentially contribute to a Roth IRA even if you exceed the income limits.

Saving for retirement is important, and a 401k is a great way to do it. You might be wondering how much you can contribute to your 401k after taxes. You can find the answer to that question on our website, where we cover how much you can contribute to your 401k in 2024 after taxes.

- Contribute the Maximum:If you are eligible, aim to contribute the maximum amount allowed for your age. This maximizes your tax-free growth potential and helps you reach your retirement savings goals faster.

- Adjust Your Contribution Strategy Based on Income:Monitor your income throughout the year. If your income is approaching the limits, adjust your contribution strategy accordingly. You may want to reduce your contributions or consider other retirement savings options.

Catch-Up Contributions

Individuals aged 50 and older have the option of making “catch-up” contributions to their Roth IRA. This allows them to contribute an additional amount on top of the regular contribution limit. For 2024, the catch-up contribution limit is $1,000.

Catch-up contributions can be a valuable tool for older individuals who want to boost their retirement savings. They can help make up for lost time and ensure a more comfortable retirement.

Online shopping is so convenient, but it can be easy to overspend. Having a credit card with rewards for online purchases can help you get something back for your spending. Check out our list of the best credit cards for online shopping in October 2024 and find the one that fits your needs.

Step-by-Step Guide to Contributing to a Roth IRA

Contributing to a Roth IRA is a straightforward process. Here’s a step-by-step guide:

- Choose a Roth IRA provider:You can open a Roth IRA with a variety of financial institutions, including banks, brokerage firms, and mutual fund companies. Compare fees, investment options, and customer service when selecting a provider.

- Determine your contribution amount:Decide how much you can contribute each year. Keep in mind the annual contribution limits and your income level.

- Fund your Roth IRA:Transfer funds from your bank account or other investment accounts to your Roth IRA.

- Invest your contributions:Choose investments that align with your risk tolerance and financial goals. Options include stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

- Monitor your Roth IRA:Review your Roth IRA regularly to ensure it’s on track to meet your retirement goals. Adjust your investment strategy as needed.

Closure

A Roth IRA can be a powerful tool for building wealth and securing your financial future. By understanding the contribution limits, eligibility requirements, and tax advantages, you can make informed decisions about your retirement savings strategy. Remember to consider your individual financial circumstances and consult with a qualified professional to determine the best approach for your unique situation.

FAQ Overview

What happens if I contribute more than the maximum Roth IRA limit?

If you contribute more than the maximum allowed, the IRS will consider the excess contribution as a taxable distribution, and you may be subject to penalties. It’s crucial to stay within the limits to avoid any unwanted tax consequences.

Can I contribute to a Roth IRA and a Traditional IRA simultaneously?

Yes, you can contribute to both a Roth IRA and a Traditional IRA in the same year, but there are income limits that apply. Make sure to check the IRS guidelines to ensure you meet the eligibility requirements for both types of accounts.

Is there a minimum age requirement to contribute to a Roth IRA?

There is no minimum age requirement to contribute to a Roth IRA. As long as you have earned income, you can contribute to a Roth IRA, regardless of your age.