What is the mileage rate for October 2024? This question is top of mind for many individuals and businesses who rely on mileage reimbursements for work or medical expenses. Understanding the current mileage rate is crucial for accurate financial planning and tax reporting.

This guide delves into the intricacies of mileage rates, providing a comprehensive overview of how they work, the factors influencing them, and best practices for utilizing them effectively.

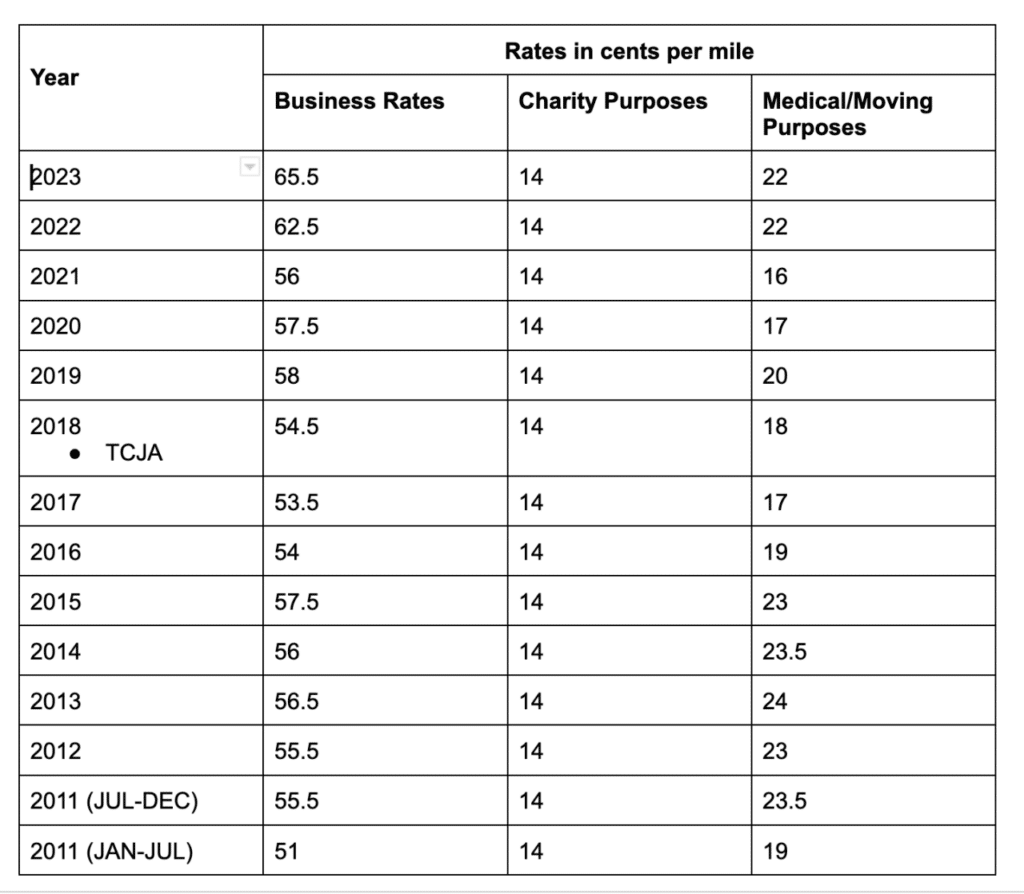

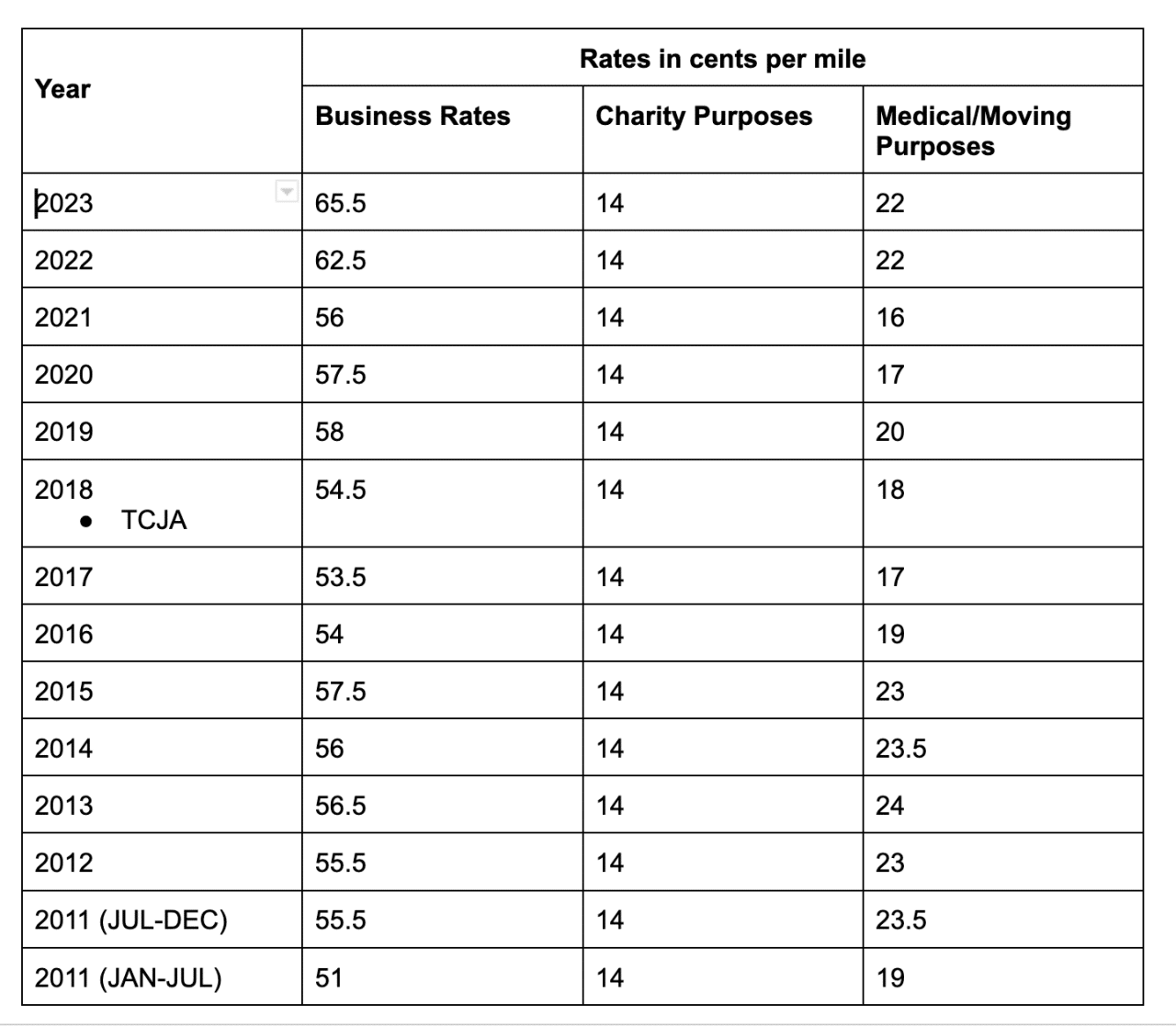

The Internal Revenue Service (IRS) sets standard mileage rates for both business and medical expenses, which are updated annually. These rates are based on an average cost of operating a vehicle, considering factors like depreciation, insurance, repairs, and fuel. For October 2024, the IRS has announced specific rates for both business and medical mileage, offering a clear framework for reimbursement calculations.

Contents List

Using Mileage Rates Effectively

Maximizing your mileage deductions requires accurate tracking and proper documentation. By understanding the IRS guidelines and employing effective strategies, you can ensure you receive the maximum allowable reimbursement for your business and medical expenses.

The highest tax bracket in 2024 is 37%, which applies to incomes over $578,125 for single filers. Find out more about the highest tax bracket here: What is the highest tax bracket in 2024?.

Tracking Mileage for Business and Medical Expenses, What is the mileage rate for October 2024?

Maintaining accurate records of your mileage is crucial for claiming deductions. This involves diligently logging every trip you take for business or medical purposes.

Tax brackets can affect your income, and understanding how they work is important for financial planning. This article will help you understand how tax brackets affect your income in 2024: How will tax brackets affect my 2024 income?.

- Use a Mileage Tracking App:Many apps are available to automatically track your mileage using GPS technology. These apps can record your starting and ending points, date, time, and total distance traveled. This eliminates the need for manual logging, making the process more efficient.

Retirees have the same tax deadline as everyone else, October 15, 2024. Learn more about the tax deadline for retirees here: October 2024 tax deadline for retirees.

- Maintain a Mileage Log:If you prefer a more traditional approach, you can manually track your mileage using a notebook or spreadsheet. This method requires you to record the date, starting and ending points, purpose of the trip, and total distance traveled.

- Keep Detailed Records:Ensure your records include the date, time, starting and ending points, purpose of the trip, and the total distance traveled. This information will be essential when filing your taxes or requesting reimbursements.

Documentation for Mileage Reimbursements

When requesting reimbursement for mileage, it’s crucial to provide supporting documentation to validate your claims.

The Seahawks fought hard in Week 5, but ultimately fell short in a close game. Read more about the comeback that almost was in this article: Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss.

- Mileage Log:Your mileage log is the primary document used to substantiate your claims. It should be detailed and accurate, reflecting all the information mentioned earlier.

- Business Receipts:If your mileage is related to business expenses, you should also provide receipts for any other expenses incurred during the trip, such as tolls, parking fees, and fuel.

- Medical Documentation:For medical-related mileage, you may need to provide documentation from your healthcare provider confirming the purpose of the trip.

IRS Guidelines for Mileage Deductions

The IRS provides specific guidelines for claiming mileage deductions. Adhering to these guidelines is essential to ensure your claims are legitimate and accepted.

The tax deadline for October 2024 is October 15, 2024. Get more information about the tax deadline here: What is the tax deadline for October 2024.

The IRS mileage rate is updated annually and is available on the IRS website.

Freelancers have a bit more time to file their taxes, with the deadline being October 15, 2024. Learn more about the tax deadline for freelancers here: October 2024 tax deadline for freelancers.

- Standard Mileage Rate:The IRS offers a standard mileage rate for business, medical, and charitable purposes. This rate is updated annually and is available on the IRS website. For example, the standard mileage rate for business use in 2024 was 65.5 cents per mile.

If you miss the tax deadline, you may face penalties. Find out more about tax penalties for missing the deadline here: Tax penalties for missing the October 2024 deadline.

This means you can deduct 65.5 cents for every mile driven for business purposes.

- Actual Expenses:You can also choose to deduct your actual expenses related to your vehicle, such as gas, repairs, and depreciation. This option may be beneficial if your actual expenses are higher than the standard mileage rate.

- Recordkeeping Requirements:The IRS requires you to maintain detailed records of your mileage, including the date, starting and ending points, purpose of the trip, and total distance traveled. These records should be readily available for IRS review if requested.

Alternatives to Standard Mileage Rate

While the standard mileage rate provides a convenient way to calculate mileage reimbursements, it may not always be the most accurate or beneficial method. There are alternative methods that may offer greater flexibility and potentially higher reimbursements.

If you need more time to file your taxes, you can apply for an extension. Check out this article for more information on filing extensions: Tax filing extensions for October 2024.

Actual Expense Method

The actual expense method allows you to track and document all expenses related to your vehicle usage, including gas, oil changes, repairs, insurance, and depreciation. This method provides a more detailed and potentially higher reimbursement than the standard mileage rate.

The IRS offers a variety of resources to help you file your taxes on time. Check out these resources for help with the October 2024 tax deadline: IRS resources for the October 2024 tax deadline.

Tracking and Documenting Actual Expenses

To utilize the actual expense method, meticulous record-keeping is crucial. You need to maintain detailed records of all vehicle-related expenses. This includes:

- Gas receipts:Keep all gas receipts, noting the date, location, and amount of fuel purchased.

- Maintenance records:Maintain records of all vehicle maintenance, including oil changes, tire rotations, and repairs. Include the date, description of the service, and cost.

- Insurance premiums:Keep records of your vehicle insurance premiums, including the policy dates and coverage details.

- Depreciation:Calculate the depreciation of your vehicle based on its age, mileage, and market value. You can use online tools or consult with a tax professional for guidance.

Comparing the Standard Mileage Rate and Actual Expense Method

The standard mileage rate and actual expense method offer different advantages and disadvantages.

Understanding tax brackets is essential for planning your finances. This article will guide you through the different tax brackets in 2024: Understanding tax brackets for 2024.

| Method | Advantages | Disadvantages |

|---|---|---|

| Standard Mileage Rate |

|

|

| Actual Expense Method |

|

|

Example:Let’s say you drove 10,000 miles for business purposes in a year. Using the standard mileage rate, your reimbursement would be $10,000 x $0.655 (2024 standard mileage rate) = $6,550. However, if you used the actual expense method and tracked all your expenses, your reimbursement could be higher, depending on your actual expenses.

Tax season is coming up, and the deadline for filing your taxes is October 15, 2024. You can find more information about how to file your taxes by the deadline here: How to file taxes by the October 2024 deadline.

Final Wrap-Up: What Is The Mileage Rate For October 2024?

Navigating the world of mileage rates can seem complex, but understanding the fundamentals is essential for accurate financial management. By familiarizing yourself with the current mileage rates, factors influencing them, and best practices for tracking and documentation, you can ensure proper reimbursement and compliance with IRS regulations.

Remember, accurate record-keeping is crucial for maximizing your mileage deductions and minimizing potential tax liabilities.

Answers to Common Questions

What is the difference between the standard mileage rate and the actual expense method?

The standard mileage rate is a fixed amount per mile that the IRS allows for business and medical expenses. The actual expense method, on the other hand, allows you to deduct your actual costs, such as gas, repairs, insurance, and depreciation.

You can choose whichever method best suits your situation.

Can I use the standard mileage rate for both business and medical expenses?

Yes, the IRS offers separate standard mileage rates for both business and medical expenses. You can use the appropriate rate depending on the purpose of your travel.

How often are mileage rates updated?

The IRS typically updates standard mileage rates annually, usually at the beginning of the calendar year. However, it’s always best to check the IRS website for the most up-to-date information.

The United States has seven tax brackets for 2024. Learn more about the tax brackets for 2024 here: Tax brackets for 2024 in the United States.

Each tax bracket has a different tax rate. Learn more about the tax rates for each tax bracket in 2024: Tax rates for each tax bracket in 2024.

There have been some changes to the tax brackets for 2024 compared to 2023. Find out more about the changes here: Tax bracket changes for 2024 vs 2023.

The tax brackets for 2024 have changed slightly from previous years. Get more information about the changes here: Tax bracket changes for 2024.