What is the standard deduction for 2024? It’s a question many taxpayers ask as they prepare to file their taxes. The standard deduction is a valuable tax break that allows taxpayers to reduce their taxable income. It’s a fixed amount that can be claimed instead of itemizing deductions, which involve listing individual expenses.

The standard deduction amount varies depending on your filing status. For example, if you’re single, you might be eligible for a higher standard deduction than if you’re married filing jointly. This amount can change annually, so it’s important to check the latest guidelines.

Contents List

Understanding the Standard Deduction

The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) to reduce your taxable income. It is a valuable tool for taxpayers, allowing them to lower their tax liability without having to itemize their deductions.

It’s always a good idea to stay informed about the latest changes to the mileage rate, especially if you use your car for business or charitable purposes. The mileage rate changing in October 2024? could affect your tax deductions, so make sure to check for any updates.

What is the Standard Deduction?

The standard deduction is a set amount that you can claim on your tax return to reduce your taxable income. It is based on your filing status, which is determined by your marital status and whether you are claimed as a dependent on someone else’s return.

It’s crucial for businesses to be aware of the October 2024 tax deadline for businesses to ensure timely filing and avoid penalties. Make sure you’re prepared and have all the necessary information ready.

The standard deduction is a simplified way to account for certain common expenses that most taxpayers incur, such as medical expenses, charitable contributions, and state and local taxes.

The contribution limit for a Roth IRA in 2024 is a great way to save for retirement while potentially reducing your tax burden. Make sure you understand the rules and eligibility requirements.

The Significance of the Standard Deduction

The standard deduction is significant because it allows you to reduce your taxable income without having to itemize your deductions. This can be particularly beneficial for taxpayers who do not have significant deductible expenses. For example, if you are a single filer with a modest income and no major medical expenses or charitable contributions, you may find that claiming the standard deduction results in a lower tax liability than itemizing your deductions.

Understanding the tax bracket thresholds for 2024 is crucial for planning your finances. These thresholds determine how much you’ll pay in taxes, so it’s important to be aware of them.

Standard Deduction Amounts for 2024

The standard deduction is a fixed amount that taxpayers can choose to deduct from their taxable income instead of itemizing their deductions. This amount is adjusted annually for inflation.

Standard Deduction Amounts by Filing Status

The standard deduction amounts for 2024 vary depending on your filing status. Here’s a breakdown of the standard deduction amounts for each filing status:

| Filing Status | Standard Deduction Amount |

|---|---|

| Single | $13,850 |

| Married Filing Jointly | $27,700 |

| Married Filing Separately | $13,850 |

| Head of Household | $20,800 |

| Qualifying Widow(er) | $27,700 |

Factors Affecting Standard Deduction: What Is The Standard Deduction For 2024

While the standard deduction is a fixed amount, certain factors can influence its value for individual taxpayers. Understanding these factors is crucial for accurately calculating your tax liability and maximizing your deductions.

It’s important to understand tax brackets for 2024 to make informed financial decisions. These brackets can affect your tax liability, so knowing how they work is crucial.

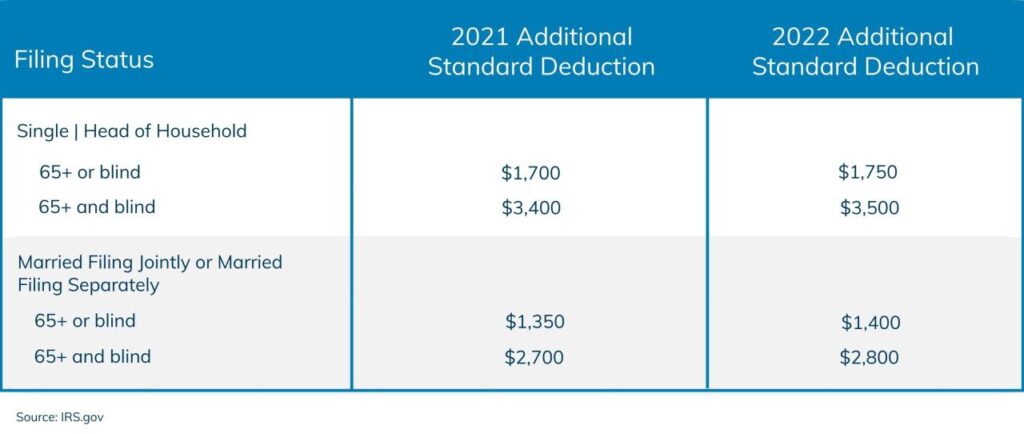

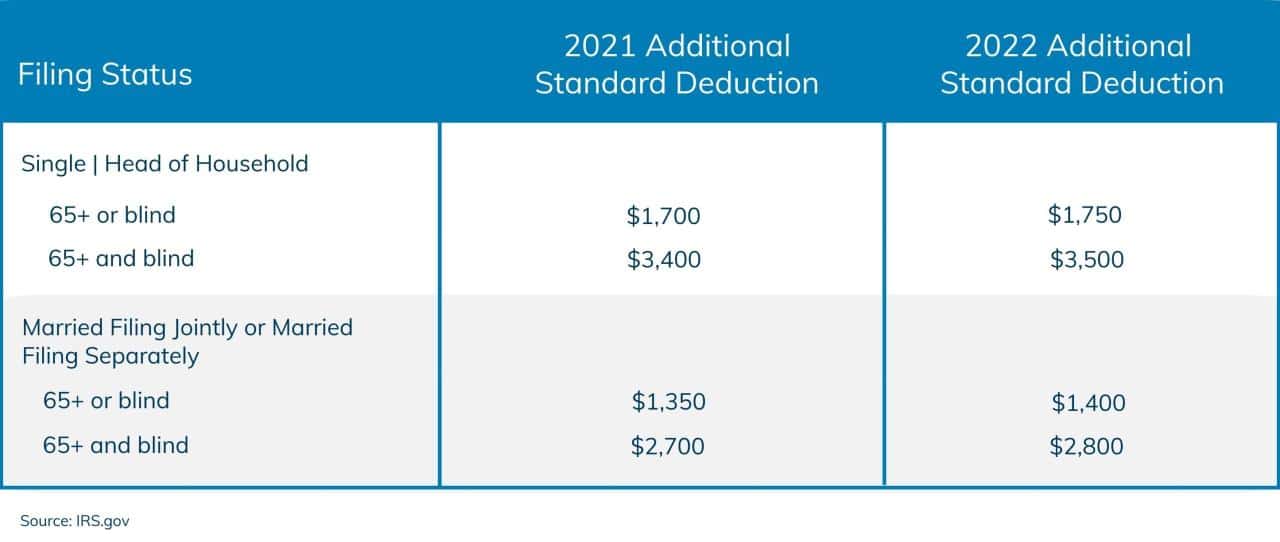

Age and Blindness, What is the standard deduction for 2024

The standard deduction amount can be increased for taxpayers who are 65 years of age or older or blind. These additional standard deduction amounts are added to the regular standard deduction. For 2024, the additional standard deduction for age or blindness is:

- Age:$1,850

- Blindness:$1,850

For example, if a taxpayer is 70 years old and blind, they would receive an additional $3,700 ($1,850 for age + $1,850 for blindness) to their standard deduction.

There are tax changes impacting the October 2024 deadline that could affect your tax obligations. Stay informed about these changes to ensure you’re prepared for the filing season.

Being Claimed as a Dependent

The standard deduction for a taxpayer who is claimed as a dependent on someone else’s return is limited. In 2024, the standard deduction for a dependent is the greater of:

- $1,200or

- The taxpayer’s earned income plus $400,up to the regular standard deduction amount.

For example, if a 17-year-old student has earned income of $3,000, their standard deduction would be $3,400 ($3,000 + $400), as this is greater than the $1,200 minimum.

The IRA contribution limits for 2024 are important for anyone looking to save for retirement. These limits can help you plan your contributions and maximize your savings potential.

Filing Status

The standard deduction amount varies depending on your filing status. For 2024, the standard deduction amounts for each filing status are:

- Single:$14,000

- Married Filing Separately:$14,000

- Married Filing Jointly:$28,000

- Qualifying Widow(er):$28,000

- Head of Household:$21,000

For instance, a married couple filing jointly will have a higher standard deduction than two individuals filing separately, even if they have the same income.

Independent contractors need to be aware of the W9 Form October 2024 for independent contractors changes and updates. These changes can impact how you report your income and taxes, so it’s important to stay informed.

Choosing Between Standard Deduction and Itemized Deductions

When filing your federal income tax return, you have the option of claiming either the standard deduction or itemized deductions. The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) to reduce your taxable income.

The tax brackets for single filers in 2024 can help you understand how much you’ll owe in taxes based on your income. It’s important to stay informed about these brackets to plan your finances effectively.

Itemized deductions, on the other hand, are specific expenses that you can deduct, such as medical expenses, charitable contributions, and state and local taxes. Choosing the right deduction method can significantly impact your tax liability.

If you’re self-employed, you’ll want to be aware of the 401k contribution limits for 2024 for self-employed. These limits can help you plan for your retirement and maximize your tax savings.

Comparing Standard Deduction and Itemized Deductions

The standard deduction and itemized deductions offer different ways to reduce your taxable income.

The W9 Form October 2024 changes and updates are essential for businesses and independent contractors. These changes ensure accurate reporting of tax information, making it crucial to stay updated.

- Standard Deduction:This is a fixed amount set by the IRS, and it varies based on your filing status. It’s a simplified way to deduct expenses without having to itemize them.

- Itemized Deductions:These are specific expenses that you can deduct if they meet certain criteria. Common itemized deductions include medical expenses, charitable contributions, home mortgage interest, and state and local taxes.

Decision-Making Process

The decision of whether to take the standard deduction or itemize depends on your individual circumstances. Here’s a flowchart that illustrates the decision-making process:[Insert flowchart here You would need to create a flowchart that illustrates the decision-making process. The flowchart should start with “Calculate your AGI.” Then, it should branch out to “Calculate your itemized deductions” and “Calculate your standard deduction.” The next step should be “Compare the two amounts.” If the itemized deductions are greater, then you should itemize.

The IRA contribution limits for SEP IRA in 2024 are a great way to save for retirement if you’re self-employed. These limits are designed to help you maximize your contributions and grow your savings.

If the standard deduction is greater, then you should take the standard deduction.]

If you’re making charitable donations, be sure to check the October 2024 mileage rate for charitable donations. This rate can affect your tax deductions, so it’s important to stay informed.

Advantages and Disadvantages

Standard Deduction

- Advantages:

- Simplicity: It’s easier to calculate and claim than itemized deductions.

- Guaranteed Reduction: You’re guaranteed to reduce your taxable income by the standard deduction amount.

- No Documentation: You don’t need to gather and keep records of your expenses.

- Disadvantages:

- Limited Deductions: You may miss out on deductions if your itemized deductions exceed the standard deduction.

- No Flexibility: You can’t choose which expenses to deduct, as you’re limited to the standard deduction amount.

Itemized Deductions

- Advantages:

- Higher Deductions: You can potentially deduct more if your itemized deductions exceed the standard deduction.

- Customization: You can choose which expenses to deduct, allowing you to maximize your tax savings.

- Disadvantages:

- Complexity: It can be more complex to calculate and claim itemized deductions.

- Documentation: You need to keep detailed records of your expenses to support your deductions.

- Uncertainty: Your deductions may be subject to audit by the IRS.

Standard Deduction and Tax Liability

The standard deduction directly impacts your tax liability, which is the amount of income tax you owe to the government. It’s a crucial element in determining your taxable income, the portion of your earnings subject to taxation. The standard deduction acts as a threshold, allowing you to reduce your taxable income before calculating your tax obligations.

The higher the standard deduction, the lower your taxable income, potentially leading to a lower tax liability.

If you’re over 50, you can contribute a little extra to your retirement savings. The IRA contribution limits for 2024 for those over 50 allow you to catch up on your retirement savings.

Impact of the Standard Deduction on Tax Liability

The standard deduction is a significant factor in determining your tax liability. It lowers your taxable income, potentially reducing your tax bill. Let’s explore how this works:

Taxable Income = Gross Income

The IRA contribution limits for SIMPLE IRA in 2024 are a great way to save for retirement if you’re self-employed. These limits are designed to help you maximize your contributions and grow your savings.

Deductions

For example, if your gross income is $50,000 and the standard deduction for your filing status is $13,850, your taxable income would be $36,150 ($50,000$13,850). You would then calculate your tax liability based on this reduced taxable income.

Practical Scenarios

Let’s illustrate the standard deduction’s impact with some practical scenarios:

- Scenario 1: Single Filers– Single filer with gross income of $40,000 and a standard deduction of $13,850. – Taxable income: $26,150 ($40,000 – $13,850). – Based on the 2024 tax brackets, this individual might owe less tax compared to someone with a lower standard deduction.

- Scenario 2: Married Filing Jointly– Married couple filing jointly with a gross income of $80,000 and a standard deduction of $27,700. – Taxable income: $52,300 ($80,000 – $27,700). – The higher standard deduction for married couples filing jointly can significantly reduce their tax liability.

These scenarios highlight how the standard deduction directly impacts your tax liability. It acts as a significant reduction in your taxable income, potentially lowering your tax bill.

Summary

Understanding the standard deduction is crucial for maximizing your tax savings. By carefully considering your options and utilizing the standard deduction when applicable, you can ensure you’re taking advantage of all available tax benefits. Remember to consult with a tax professional for personalized advice and to stay updated on the latest tax laws and regulations.

Essential FAQs

What is the difference between the standard deduction and itemized deductions?

The standard deduction is a fixed amount that you can claim instead of itemizing your deductions. Itemized deductions allow you to list specific expenses, such as medical expenses, charitable contributions, and mortgage interest, which can reduce your taxable income. You can choose whichever option results in a lower tax liability.

How do I know if I should use the standard deduction or itemize?

It’s best to calculate both the standard deduction and itemized deductions to see which option provides a larger deduction. You can use tax software or consult a tax professional to help you determine the best course of action.

Can I change my mind about using the standard deduction or itemizing after I’ve filed my taxes?

Generally, you can’t change your mind about using the standard deduction or itemizing after you’ve filed your taxes. However, there may be exceptions in certain situations, such as if you made a mistake on your return or if there was a change in the law.

It’s best to consult with a tax professional if you have any questions or concerns.