What is the standard mileage rate for October 2024? This question is on the minds of many individuals and businesses who rely on vehicle use for work, medical appointments, or charitable activities. The standard mileage rate, set by the IRS, provides a convenient way to deduct vehicle expenses without meticulously tracking every gallon of gas and oil change.

But how is this rate determined, and what factors influence its fluctuation?

The standard mileage rate is a crucial figure for taxpayers, offering a simplified approach to claiming deductions for vehicle-related expenses. This rate, updated annually, reflects the average cost of operating a vehicle, considering factors such as fuel prices, maintenance, depreciation, and insurance.

Understanding how this rate is calculated and how it can benefit you is essential for maximizing your tax savings.

Contents List

Understanding the Standard Mileage Rate

The standard mileage rate is a rate set by the Internal Revenue Service (IRS) that allows taxpayers to deduct a certain amount for each mile driven for business, charitable, or medical purposes. It provides a simplified way to calculate expenses related to vehicle use without having to track detailed costs like gas, maintenance, and depreciation.

Freelancers have a specific deadline to file their taxes, so it’s crucial to be aware of the October 2024 tax deadline for freelancers. This deadline is different from the standard tax filing deadline.

History of the Standard Mileage Rate, What is the standard mileage rate for October 2024?

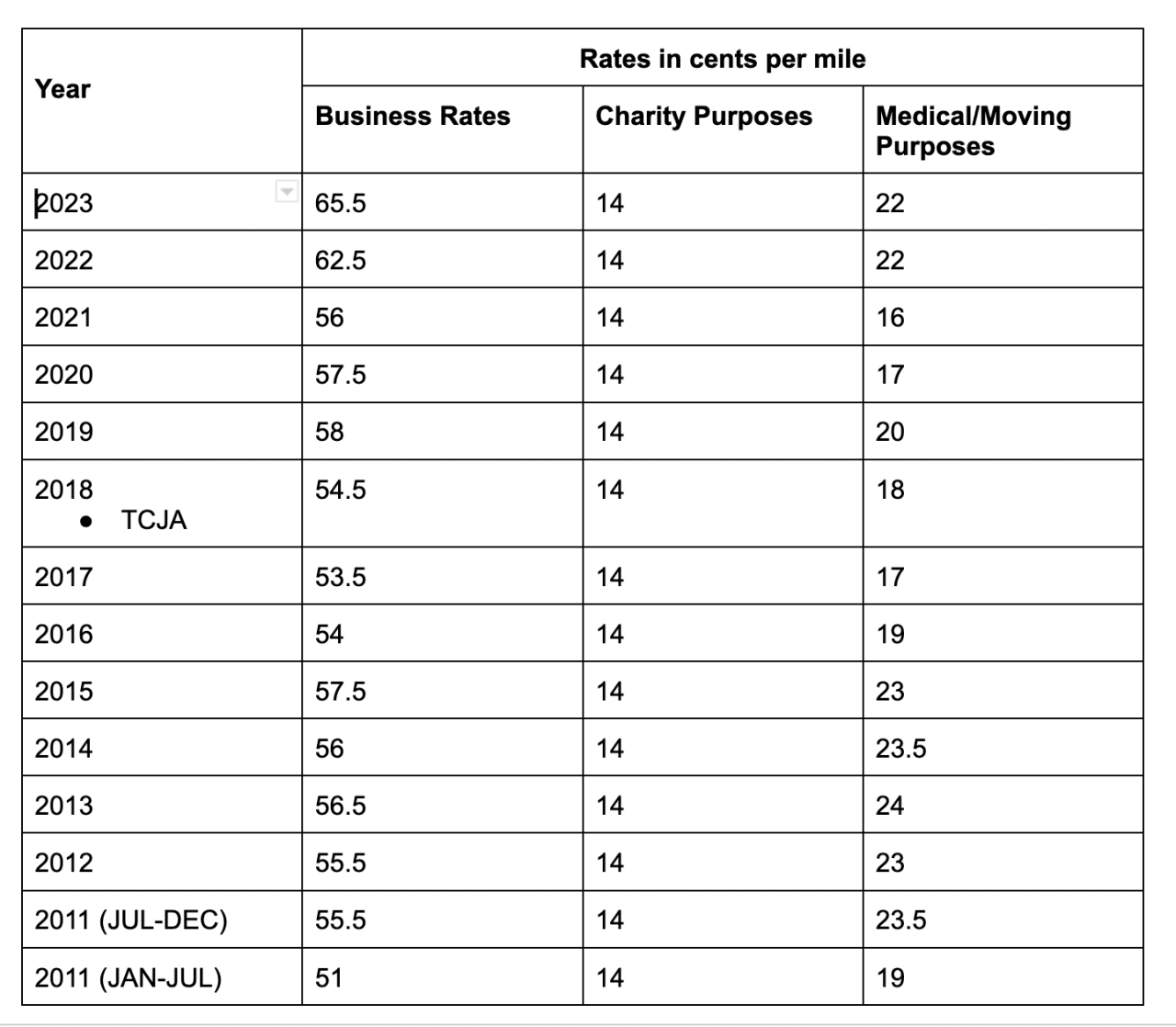

The standard mileage rate has fluctuated over time, reflecting changes in fuel prices, vehicle maintenance costs, and inflation. The IRS adjusts the rate annually to keep it in line with these factors. Here’s a glimpse of how the rate has changed in recent years:

- 2023:65.5 cents per mile for business use, 22 cents per mile for medical and moving expenses.

- 2022:62.5 cents per mile for business use, 22 cents per mile for medical and moving expenses.

- 2021:58.5 cents per mile for business use, 17 cents per mile for medical and moving expenses.

Sources for the Standard Mileage Rate

The standard mileage rate is published annually by the IRS. The official source for the rate is the IRS website, where you can find the current rate as well as historical rates. The IRS also publishes the rate in various publications, such as Publication 463, “Travel, Entertainment, Gift, and Car Expenses.”

There are various tax credits for the October 2024 deadline that you may be eligible for. Make sure you explore these options to potentially reduce your tax liability.

Using the Standard Mileage Rate

The standard mileage rate is a convenient way to calculate the cost of using your vehicle for business, medical, or charitable purposes. This rate is determined by the IRS and changes annually. It can be a simpler alternative to keeping detailed records of your actual expenses.

Getting your taxes done right is essential, so it’s a good idea to familiarize yourself with tax preparation tips for the October 2024 deadline. This can help ensure you’re maximizing your deductions and avoiding any potential issues.

When is the Standard Mileage Rate Applicable?

The standard mileage rate is applicable in various scenarios. You can use it to calculate deductions for:

- Business use:When you use your vehicle for business purposes, such as driving to client meetings, attending conferences, or delivering goods.

- Medical use:When you use your vehicle to travel for medical care, such as visiting a doctor, hospital, or therapist.

- Charitable use:When you use your vehicle to volunteer for a charitable organization, such as driving to a soup kitchen or delivering meals to seniors.

Standard Mileage Rates for Different Purposes

The standard mileage rate varies depending on the purpose of your vehicle use. Here is a table showing the rates for different purposes:

| Purpose | Standard Mileage Rate (October 2024) |

|---|---|

| Business | $0.655 per mile (estimated) |

| Medical | $0.22 per mile (estimated) |

| Charitable | $0.14 per mile (estimated) |

Deductions Claimable Using the Standard Mileage Rate

The standard mileage rate can be used to claim various deductions, including:

- Business expenses:You can deduct the cost of using your vehicle for business purposes, including travel to client meetings, job site visits, and deliveries.

- Medical expenses:You can deduct the cost of using your vehicle to travel for medical care, including visits to doctors, hospitals, and therapists. This deduction can help offset the cost of medical bills.

- Charitable expenses:You can deduct the cost of using your vehicle for charitable purposes, including volunteering for a charitable organization, driving to a soup kitchen, or delivering meals to seniors.

Note:The standard mileage rate is subject to change annually. It’s crucial to consult the IRS website or a tax professional for the most up-to-date information.

The tax bracket thresholds for 2024 are important to know as they determine how much you’ll pay in taxes. You can find out more about the tax bracket thresholds for 2024 to see how your income will be affected.

Alternative Methods for Tracking Vehicle Expenses

When determining the cost of using your vehicle for business purposes, you have the option of using the standard mileage rate or tracking your actual expenses. Each method has its advantages and disadvantages, and the best choice depends on your individual circumstances.

Missing the October 2024 tax deadline can lead to penalties, so it’s important to file on time. Learn about the tax penalties for missing the October 2024 deadline to avoid any unexpected costs.

Comparing the Standard Mileage Rate and Actual Expense Tracking

The standard mileage rate is a fixed amount per mile that the IRS allows you to deduct for business use of your vehicle. It is a simplified method that eliminates the need to track every expense. However, the standard mileage rate may not always accurately reflect your actual expenses, especially if your vehicle is older or if you have high fuel costs.Tracking actual expenses involves keeping detailed records of all expenses related to your vehicle, including fuel, repairs, maintenance, insurance, and depreciation.

The tax deadline for October 2024 is important to keep in mind to avoid penalties. You can find out the exact tax deadline for October 2024 to ensure you’re filing on time.

This method can be more time-consuming, but it can result in a larger deduction than the standard mileage rate if your actual expenses are higher.

If you need more time to file your taxes, you can request a tax filing extension for October 2024. This will give you additional time to gather all the necessary documents and complete your return.

| Method | Advantages | Disadvantages |

|---|---|---|

| Standard Mileage Rate |

|

|

| Actual Expense Tracking |

|

|

Tracking Actual Vehicle Expenses

Tracking actual vehicle expenses involves keeping detailed records of all costs associated with your vehicle. Here are some key expenses to track:

- Fuel:Keep receipts for all fuel purchases and record the date, mileage, and amount spent.

- Repairs and Maintenance:Track all repairs and maintenance expenses, including oil changes, tire replacements, and engine repairs. Keep receipts and invoices for all services.

- Insurance:Record the amount you pay for vehicle insurance premiums.

- Registration and Licensing:Keep records of all vehicle registration and licensing fees.

- Depreciation:Depreciation is the decrease in value of your vehicle over time. You can calculate depreciation using various methods, such as the straight-line method or the declining balance method.

The IRS allows you to deduct depreciation using the Modified Accelerated Cost Recovery System (MACRS).

Last Recap

The standard mileage rate is a valuable tool for individuals and businesses seeking to simplify their tax deductions for vehicle expenses. While it offers convenience, understanding its limitations and exploring alternative methods like actual expense tracking is crucial for making informed financial decisions.

By staying informed about the latest rate updates and utilizing the available resources, you can ensure accurate and efficient tax reporting for your vehicle-related expenses.

Question & Answer Hub: What Is The Standard Mileage Rate For October 2024?

How often does the standard mileage rate change?

The standard mileage rate is updated annually by the IRS, typically at the beginning of each calendar year.

What if I use my vehicle for both business and personal use?

You can only claim the standard mileage rate for business miles. For personal miles, you cannot deduct expenses.

Can I use the standard mileage rate for all types of vehicles?

The standard mileage rate applies to most vehicles, including cars, trucks, vans, and motorcycles.

Where can I find the most up-to-date standard mileage rate?

You can find the latest standard mileage rate on the IRS website or by contacting the IRS directly.

Understanding the highest tax bracket is essential for tax planning. You can find out more about what is the highest tax bracket in 2024 and how it might affect your income.

The United States has a progressive tax system with different tax brackets. Learn about the tax brackets for 2024 in the United States to understand how your income will be taxed.

Knowing the tax rates for each tax bracket is important for tax planning. You can find out the tax rates for each tax bracket in 2024 to see how much you’ll pay in taxes.

Self-employed individuals have a specific deadline for filing their taxes. Make sure you’re aware of the October 2024 tax deadline for self-employed individuals to avoid any penalties.

Tax laws can change, so it’s important to stay informed about any tax changes impacting the October 2024 deadline that might affect your tax filing.

If you’re filing as head of household, you have specific tax brackets to consider. Learn about the tax brackets for head of household in 2024 to understand your tax liability.

The Seahawks had a tough loss in Week 5, but they’re still a competitive team. Read about the Seahawks comeback falling short in Week 5 loss and what it means for their season.

Businesses also have a deadline for filing their taxes. Make sure you’re aware of the October 2024 tax deadline for businesses to avoid any penalties.