Will Roth IRA contribution limits increase in 2024? This question is on the minds of many Americans looking to maximize their retirement savings. Understanding the factors that influence these limits and potential scenarios for the future can help individuals make informed decisions about their financial planning.

The Roth IRA offers a unique opportunity to save for retirement while potentially enjoying tax-free withdrawals in the future. The annual contribution limit, however, can significantly impact how much you can save each year. As the economy evolves, the government may adjust these limits to reflect changes in inflation and other economic factors.

Contents List

- 1 Current Roth IRA Contribution Limits

- 2 Historical Trends in Contribution Limits

- 3 Economic Factors Influencing 2024 Limits

- 4 Potential Scenarios for 2024 Limits

- 5 Impact of Increased Limits on Individuals

- 6 Considerations for Planning: Will Roth IRA Contribution Limits Increase In 2024

- 7 Final Conclusion

- 8 Commonly Asked Questions

Current Roth IRA Contribution Limits

The Roth IRA is a popular retirement savings plan that allows you to contribute after-tax dollars, and your earnings grow tax-free. This means that you can withdraw your contributions and earnings tax-free in retirement. The contribution limit for Roth IRAs is set by the IRS each year, and it can change from year to year.

If you’re self-employed, you might need to file for a tax extension. The deadline for tax extensions in October 2024 is outlined in this article: Tax extension deadline October 2024 for self-employed individuals. Staying on top of these deadlines is crucial for avoiding penalties.

Let’s explore the current contribution limits for 2023.

If you’re an independent contractor, you’ll likely need to provide a W9 form to your clients. The W9 form for independent contractors in October 2024 can be found here: W9 Form October 2024 for independent contractors. Having the right W9 form can help you avoid any tax issues.

Roth IRA Contribution Limits for 2023

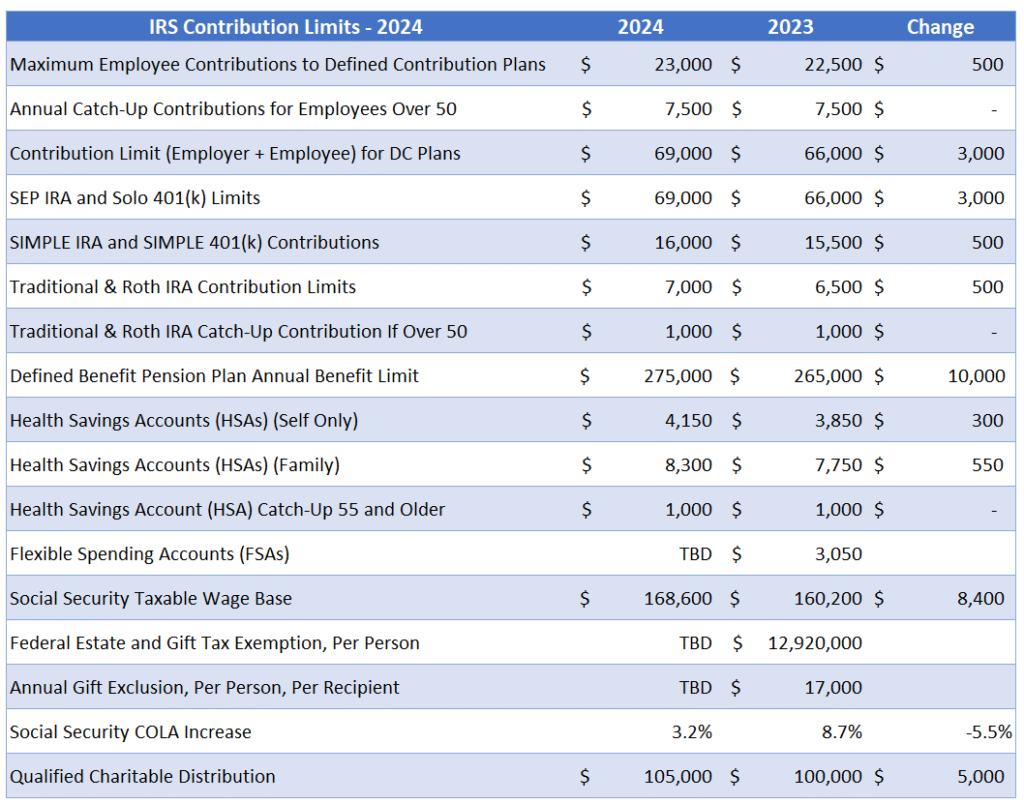

The contribution limit for Roth IRAs in 2023 is $6,500 for individuals under age Individuals who are 50 years or older can contribute an additional $1,000, bringing their total contribution limit to $7,

Saving for retirement is important, and an IRA can be a valuable tool. But how much can you contribute to your IRA in 2024? You can find the answer here: How much can I contribute to my IRA in 2024.

Understanding the contribution limits can help you maximize your retirement savings.

500. Here’s a table summarizing the contribution limits for different age groups in 2023

Figuring out your tax bracket can be a little confusing. A tax bracket calculator can help you determine what your tax bracket is based on your income level. Check out this calculator for different income levels in 2024: 2024 tax bracket calculator for different income levels.

Understanding your tax bracket can help you plan your finances.

| Age | Contribution Limit |

|---|---|

| Under 50 | $6,500 |

| 50 and over | $7,500 |

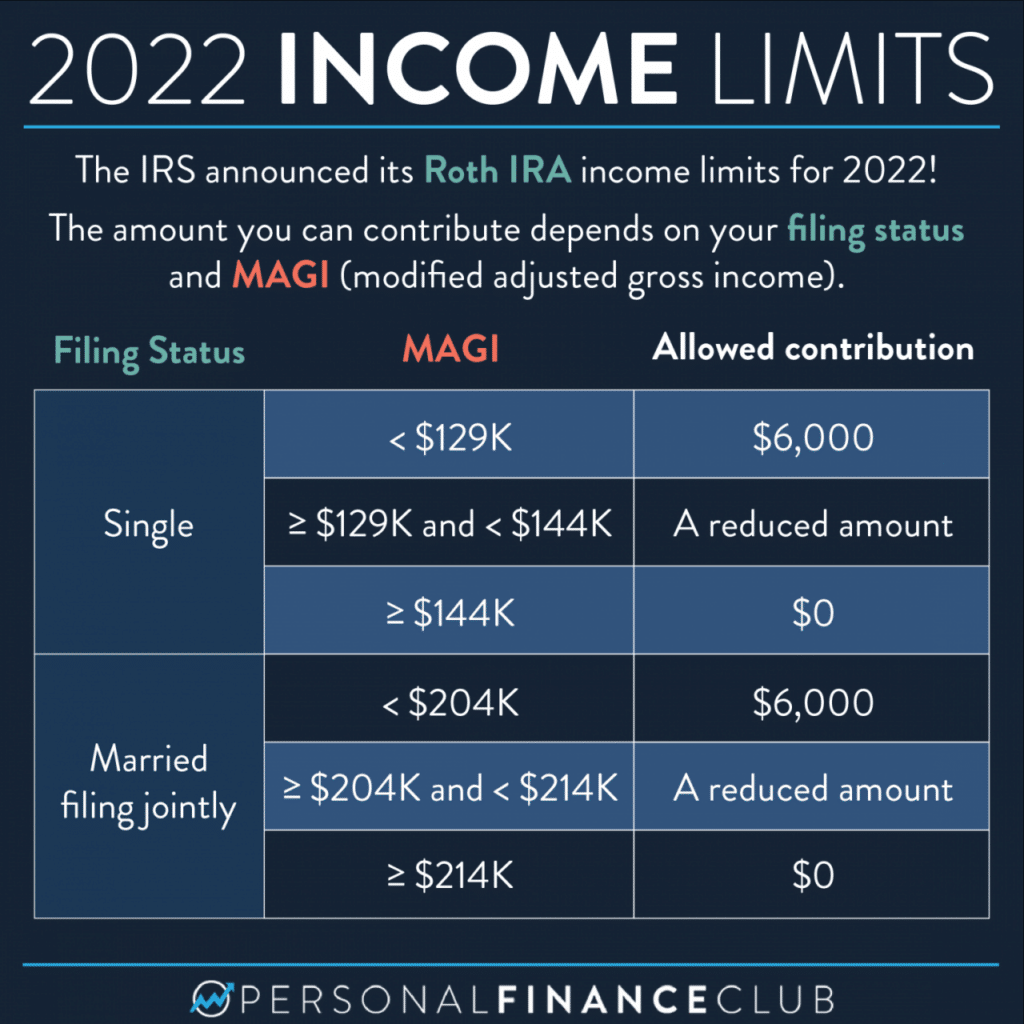

Note:The contribution limit for Roth IRAs is based on your modified adjusted gross income (MAGI). If your MAGI exceeds a certain threshold, you may not be able to contribute to a Roth IRA or your contributions may be limited.

Historical Trends in Contribution Limits

The Roth IRA contribution limit has steadily increased over the past few years, reflecting the rising cost of living and the need to encourage retirement savings. Understanding this historical trend helps us to better predict potential future changes and make informed decisions about our retirement planning.

If you’re a qualifying widow(er), you might have a different standard deduction than other taxpayers. To find out what the standard deduction is for qualifying widow(er)s in 2024, check out this article: Standard deduction for qualifying widow(er) in 2024.

Knowing your specific deduction can help you file your taxes accurately.

Historical Trends in Contribution Limits

The following table Artikels the Roth IRA contribution limits over the past five years:

| Year | Contribution Limit |

|---|---|

| 2019 | $6,000 |

| 2020 | $6,000 |

| 2021 | $6,000 |

| 2022 | $6,500 |

| 2023 | $6,500 |

Factors Influencing Contribution Limit Changes

Several factors influence the annual adjustments to Roth IRA contribution limits. These include:

- Inflation:The most significant factor driving contribution limit adjustments is inflation. The Consumer Price Index (CPI) is a key indicator used to measure inflation. If the CPI rises, the contribution limits are typically adjusted upward to maintain the purchasing power of contributions.

If you’ve donated items to charity, you might be able to deduct your mileage expenses. The mileage rate for charitable donations in October 2024 is outlined in this article: October 2024 mileage rate for charitable donations. Knowing this rate can help you claim the correct deduction on your taxes.

- Economic Growth:When the economy is performing well, contribution limits may be adjusted upward to encourage retirement savings and support economic growth.

- Political Considerations:Political factors can also play a role in contribution limit adjustments. For instance, lawmakers may adjust limits to address concerns about retirement security or to promote specific economic policies.

Economic Factors Influencing 2024 Limits

The contribution limits for Roth IRAs are adjusted annually to account for inflation. Several economic factors can influence these adjustments, including inflation, economic growth, and government policy. Understanding these factors can provide insights into how the 2024 contribution limits might be affected.

Inflation

Inflation is a significant factor in determining Roth IRA contribution limits. The Internal Revenue Service (IRS) uses the Consumer Price Index (CPI) to adjust these limits for inflation. The CPI measures the average change in prices paid by urban consumers for a basket of consumer goods and services.

Figuring out your standard deduction can be a bit confusing, especially if you’re a senior. The good news is that there’s a specific standard deduction for seniors in 2024, which you can find out more about here: Standard deduction for seniors in 2024.

Knowing this deduction can help you determine how much you’ll owe in taxes this year.

When inflation is high, the CPI increases, leading to higher contribution limits. For example, if the CPI increases by 3%, the contribution limit for Roth IRAs could also increase by approximately 3%.

Tax season is coming up, and it’s always helpful to use a tax calculator to get an idea of what you might owe. Want to know which tax calculators are best for October 2024? This comparison article can help you choose the right one: Best tax calculator for October 2024: A comparison.

Finding the right calculator can make tax time a little less stressful.

Economic Growth

Economic growth can also play a role in setting contribution limits. A robust economy with strong job growth and rising wages could lead to higher contribution limits. This is because a healthy economy allows individuals to save more for retirement.

If you’re an estate, you’ll need to file a W9 form to provide your tax identification number. The W9 form for estates in October 2024 can be found here: W9 Form October 2024 for estates. Understanding the requirements for W9 forms is important for proper tax filing.

However, the impact of economic growth on contribution limits is less direct than inflation.

Government Policy

Government policy can also influence contribution limits. For example, Congress could decide to increase or decrease the contribution limits as part of a broader tax reform package. Additionally, the government might introduce new policies aimed at encouraging retirement savings, which could impact contribution limits.

Potential Scenarios for 2024 Limits

Predicting the exact Roth IRA contribution limits for 2024 is impossible, as they depend on various economic factors that can fluctuate significantly. However, by considering different economic scenarios, we can explore potential ranges for the contribution limits.The contribution limits are typically adjusted annually to account for inflation.

If you’re driving for business or charitable purposes, you might be able to deduct your mileage expenses. To find out what the mileage rate is for October 2024, you can check out this article: What is the mileage rate for October 2024?

. Staying up-to-date on the latest mileage rates can help you maximize your deductions.

This adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of living for urban wage earners and clerical workers.

Potential Scenarios for 2024 Limits

The following table Artikels different potential scenarios for 2024 contribution limits, considering optimistic, pessimistic, and neutral outlooks:

| Scenario | CPI-W Inflation Rate | Potential Contribution Limit |

|---|---|---|

| Optimistic | 3.0% or higher | $7,000 or higher |

| Neutral | 2.0%

If you’re married and filing separately, your standard deduction might be different than if you were filing jointly. To find out exactly what the standard deduction for married filing separately is in 2024, check out this helpful article: Standard deduction for married filing separately in 2024. This information can be essential for accurate tax filing.

|

$6,750

If you’re self-employed, you might be considering a Solo 401k to save for retirement. But how much can you contribute? The IRA contribution limits for Solo 401ks in 2024 are outlined in this article: Ira contribution limits for solo 401k in 2024. Understanding these limits can help you make the most of your retirement savings.

|

| Pessimistic | Below 2.0% | $6,500 or lower |

Hypothetical Scenario: Contribution Limits Remain Unchanged in 2024

In this scenario, the Roth IRA contribution limit would remain at $6,500 for 2024. This would occur if inflation remains low, and the government decides not to increase the limit. This scenario is less likely, given the historical trend of increasing contribution limits.

The 401k contribution limit is subject to change each year. If you’re wondering whether the limit will change in 2024, you can find the answer here: Will the 401k contribution limit change in 2024. Staying informed about these changes can help you maximize your retirement savings.

Hypothetical Scenario: Contribution Limits Increase in 2024

In this scenario, the Roth IRA contribution limit would increase to $7,000 or higher for 2024. This would occur if inflation is higher than expected, and the government decides to adjust the limit accordingly. This scenario is more likely, given the recent inflation rates and the historical trend of increasing contribution limits.

Students often have different tax situations than other taxpayers. If you’re a student, it’s important to know what your standard deduction is in 2024. You can find that information here: Standard deduction for students in 2024. Understanding your deductions can help you save money on your taxes.

Impact of Increased Limits on Individuals

Higher Roth IRA contribution limits can be a boon for many individuals, offering them the opportunity to save more for retirement and potentially reduce their tax burden. However, there are also considerations and challenges that individuals need to be aware of.

Potential Benefits of Increased Contribution Limits

Increased contribution limits can benefit individuals in several ways:

- Greater Retirement Savings:Higher contribution limits allow individuals to save more for retirement, potentially increasing their overall retirement nest egg. This can be particularly beneficial for those who are early in their careers and have more time to benefit from compound interest.

Saving for retirement is important, and your 401k contribution limit can play a big role in how much you can save. Wondering what the limit is for 2024? You can find the answer here: What is the 401k contribution limit for 2024.

Understanding this limit can help you make smart decisions about your retirement planning.

- Tax Advantages:Contributions to a Roth IRA are made with after-tax dollars, meaning that withdrawals in retirement are tax-free. Increased contribution limits can lead to greater tax-free retirement income.

- Financial Security:A larger Roth IRA balance can provide a sense of financial security in retirement, allowing individuals to cover their expenses and maintain their desired lifestyle.

- Flexibility:Roth IRA withdrawals are tax-free, offering flexibility in retirement. Individuals can use the money for any purpose, whether it’s covering essential expenses, pursuing hobbies, or leaving an inheritance.

Potential Challenges and Considerations

While increased contribution limits offer potential benefits, individuals should also consider the following challenges and considerations:

- Increased Out-of-Pocket Expenses:Higher contribution limits mean individuals need to contribute more out-of-pocket, which can be challenging for those with limited disposable income.

- Income Limits:Roth IRA contributions are subject to income limits. Individuals exceeding these limits may not be eligible to contribute the full amount, or they may be ineligible to contribute at all.

- Opportunity Cost:Contributing to a Roth IRA means tying up funds that could be used for other financial goals, such as paying down debt or investing in other assets.

- Investment Risk:Roth IRA contributions are invested in the market, which carries inherent risk. Individuals need to consider their risk tolerance and investment strategy.

Impact of Increased Contribution Limits on Different Income Levels

The impact of increased contribution limits can vary depending on an individual’s income level:

| Income Level | Potential Benefits | Potential Challenges |

|---|---|---|

| Low-income individuals | Greater opportunity to save for retirement, potentially leading to a larger nest egg and greater financial security. | May still face challenges in contributing the full amount due to limited disposable income. |

| Middle-income individuals | Increased potential for tax-free retirement income and greater financial flexibility. | May need to adjust their budgets to accommodate higher contributions, especially if they are already contributing the maximum amount. |

| High-income individuals | Potential for significant tax savings in retirement, but may be subject to income limits that restrict their ability to contribute the full amount. | May face higher opportunity costs, as they may have other investment opportunities available to them. |

Considerations for Planning: Will Roth IRA Contribution Limits Increase In 2024

Planning for Roth IRA contributions in 2024 requires a thoughtful approach, considering various factors that influence your financial well-being. Understanding your individual financial goals and circumstances is crucial for making informed contribution decisions.

Factors to Consider, Will Roth IRA contribution limits increase in 2024

When planning for Roth IRA contributions in 2024, individuals should consider several key factors:

- Current Income and Tax Bracket:Your current income level determines your eligibility for Roth IRA contributions and influences your tax savings. If your income exceeds certain thresholds, you may not be able to contribute to a Roth IRA or your contribution may be phased out.

For 2023, the income limits for single filers are $153,000 for contributions and $168,000 for phase-out. For married couples filing jointly, the limits are $228,000 and $248,000, respectively. These limits may change in 2024.

- Expected Future Income and Tax Bracket:Your future income and tax bracket are important considerations, as Roth IRA contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. If you anticipate a higher tax bracket in retirement, a Roth IRA can provide significant tax advantages.

For example, if you expect to be in a higher tax bracket in retirement, you’ll pay less in taxes if you withdraw funds from a Roth IRA rather than a traditional IRA, where withdrawals are taxed.

- Retirement Goals and Time Horizon:Your retirement goals and time horizon influence your investment strategy and the amount you need to save. If you have a longer time horizon, you can take on more risk with your investments. If you are closer to retirement, you may want to invest more conservatively.

A Roth IRA allows you to potentially grow your investments tax-free, which can be beneficial for long-term savings goals.

- Other Retirement Savings:You should consider your other retirement savings accounts, such as 401(k)s or traditional IRAs, when planning for Roth IRA contributions. If you have other retirement accounts, you may not need to contribute the maximum amount to a Roth IRA.

For example, if you have a 401(k) with a company match, you may want to prioritize maximizing that contribution before contributing to a Roth IRA.

- Emergency Savings:Before contributing to a Roth IRA, ensure you have sufficient emergency savings to cover unexpected expenses. Having a healthy emergency fund provides financial security and helps avoid dipping into your retirement savings for unexpected events.

Final Conclusion

The future of Roth IRA contribution limits is uncertain, but by staying informed about potential scenarios and economic trends, individuals can make strategic decisions to maximize their retirement savings. Whether limits increase or remain the same, understanding your financial goals and utilizing the full potential of your Roth IRA is crucial for building a secure future.

Commonly Asked Questions

What is a Roth IRA?

A Roth IRA is a retirement savings account that allows individuals to contribute after-tax dollars and potentially withdraw earnings tax-free in retirement.

Who is eligible for a Roth IRA?

Most working individuals are eligible for a Roth IRA, regardless of their income level. However, there are income limitations for contributing to a Roth IRA.

What are the tax benefits of a Roth IRA?

The primary tax benefit of a Roth IRA is the potential for tax-free withdrawals in retirement. You pay taxes on your contributions upfront, but your earnings and withdrawals are tax-free.

How do I open a Roth IRA?

You can open a Roth IRA through a variety of financial institutions, including banks, brokerage firms, and mutual fund companies.